With the dramatic drop in stocks over the past two weeks, followed by an equally rapid snapback rally, many in the financial blogosphere are wondering whether we will see more market volatility in the coming weeks. And further, whether the lows will be retested and whether it’s safe to get long yet.

Calling market tops and bottoms are notoriously difficult and there are a myriad of stock market indicators and measures that can be used to support either side of the argument. Rather than making any of those calls, this is a great opportunity to explore relative strength within the equities asset class: small caps vs large caps stocks.

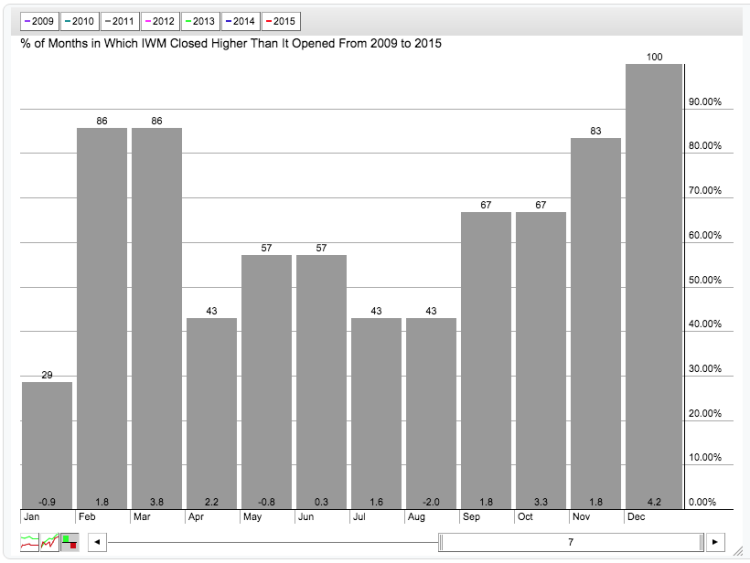

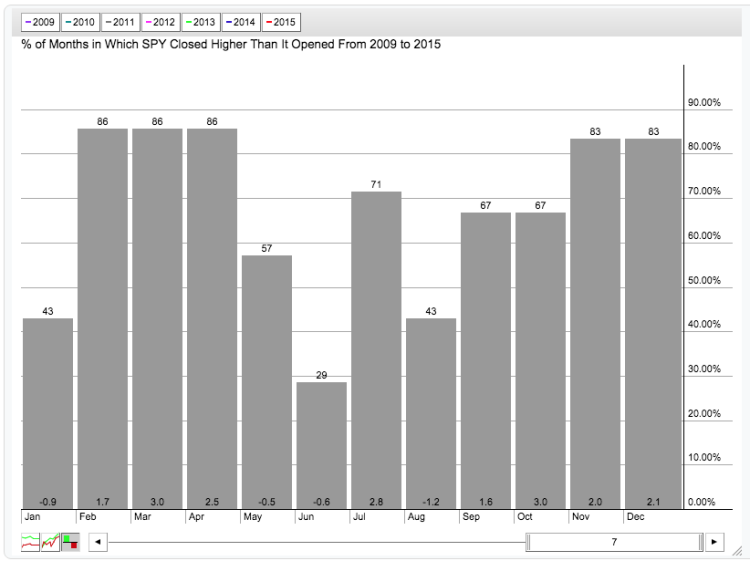

Since the inception of the bull market in US equities (2009), both the Russell 2000 ETF (IWM) and the S&P 500 ETF (SPY) have finished August in the green only 40% of the time. Looking ahead, the picture changes. Despite the reputation for autumn market swoons, IWM and SPY have both finished positively in September and October 67% of the time.

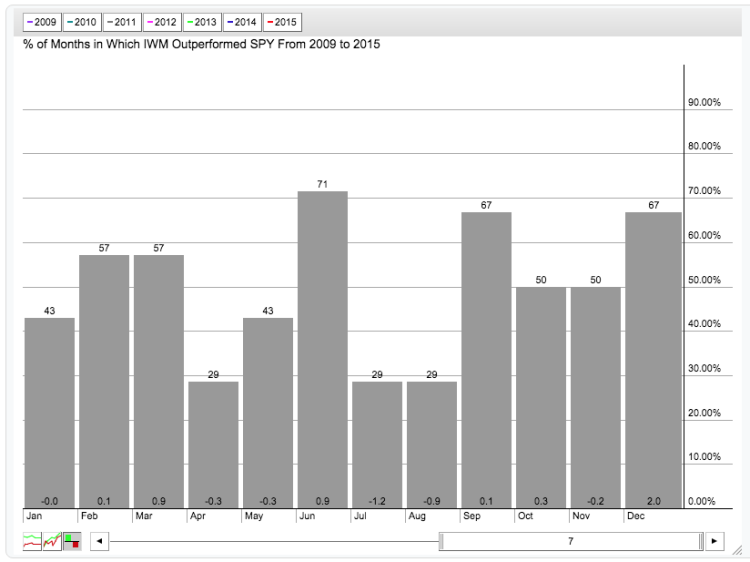

In terms of relative strength between the market indexes, the small caps (IWM) have outperformed large caps (SPY) over the past six years in September, while October has been an even split.

If your models say get long but you’re struggling with the signal in light of the past two weeks, a pairs trade with IWM long and SPY short may offer some hedged exposure on the long side. And if the market does leave the recent lows in the rearview mirror, correlation between the two indexes may decrease, thereby improving the chances for outperformance of the higher beta small caps over lower beta large caps.

Please note that this in not a trade recommendation and that smart trade structure is the key to an effective pairs trade. But certainly something to explore further if the recent market volatility has left you adrift.

Have a great week and thanks for reading.

The author does not have a position in the mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.