Okay everyone, it’s time to take off your tin foil hats and climb out of the bomb shelter.

Simply put, sellers are more aggressive than the buyers. But frankly, it doesn’t matter. Understanding “why” has nothing to do with controlling risk, managing positions, and respecting the possibility that, at times, your position might just be wrong.

Trading is about trading. Trading is not about being right. The market is not here to validate our opinions or make us look smart for our buddies in the bomb shelter. However, if we can stick around long enough, the market will humble us (hopefully) and teach us an incredible amount about our psychology and how we can protect ourselves (and even benefit) from increased market volatility.

As we move into the year we need to remember that any assumptions we had about the market need to be questioned. Over the past few years, the market has responded to down moves by rallying sharply. That type of price action makes sense given the context of a Bull market. That sentiment has shifted and we need to be prepared and accepting of the Bear market we’re entering. In this environment, we can expect the rallies to fail and the declines to be faster with fewer pauses.

If you’ve developed trading habits and systems that rely on the behavior of a Bull Market, now is the time to recognize and change your assumptions. Market volatility presents opportunity, but that opportunity is not without risk.

So, what is Volatility telling us?

Most traders like to look at price charts in a decline and wonder where the drop stops. Unfortunately, you won’t find the answer in a chart and nobody (short of maybe the Plunge Protection Team) knows. Price levels only tell us areas where the possibility for change exists. There are no guarantees.

One of the interesting things to note about the move lower this week is that every day felt very measured and controlled. Sure the market was off several percent, but it didn’t fall out of bed like it sometimes does. It’s just the number of consecutive declines that’s causing pain. When compared to the collapse in August 2015, they felt almost slow.

Due to the controlled nature of the declines, there’s also a divergence occurring within the market volatility complex. But if your go-to market volatility indexes are the VIX and RVX to measure panic, then you’re missing a big part of the picture.

Understanding Market Volatility

In order to understand what’s going on with Implied Volatility, we should also consider both the VIX:VXV ratio and the volatility of volatility (VVIX).

One of the things we know about VIX:VXV is that in a panic, short dated options explode in value more than longer dated options. VIX, which measures 30 day implied volatility, will become elevated relative to the implied volatility of longer dated options. We use VXV to measure the implied volatility of 3 month options. Normally VIX:VXV is a ratio below one and in a bull market it’s usually below .90. When things get rocky, the ratio will increase above one and that’s exactly what we’re seeing right now.

The image below illustrates the divergence in VIX:VXV ratio. Despite the big decline this week, the implied volatility of 30 day options has not exploded relative to 3 month implied volatility. From an implied volatility standpoint, we’re not seeing total panic and mayhem.

In addition to what we’re seeing with the VIX:VXV ratio, the Volatility of Volatility (VVIX) isn’t in panic mode either. In the chart below we’re looking at VVIX and what we’re seeing is that the VIX has made a controlled move higher in the face of the decline.

The obvious question is what the divergence in Implied Volatility means for the market. The lack of panic suggests that participants either anticipated the decline or they haven’t seen reason to panic yet. The open and trading we see next week is going to hold some critical clues for what’s next.

If we see a large gap lower on Monday, things are going to get ugly much faster than people were expecting. In that scenario, we can expect to see VVIX and VIX make panic type moves. All the short options that seemed “juicy” to sell this week will seem cheap very quickly. On the other hand, if the market finds some stability, it means that implied volatility was “right” going into the weekend.

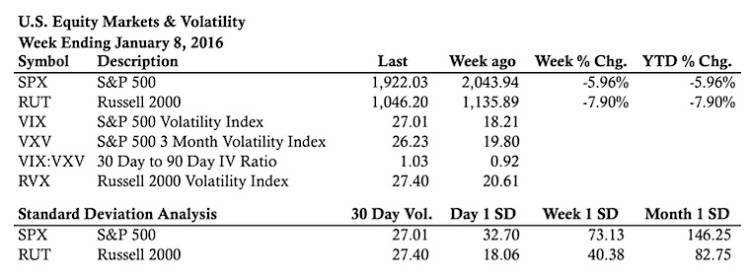

We need to wait and see what Monday holds. Below are stats for last week.

Thanks for reading.

Twitter: @ThetaTrend

Author holds positions in SPY and IWM at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.