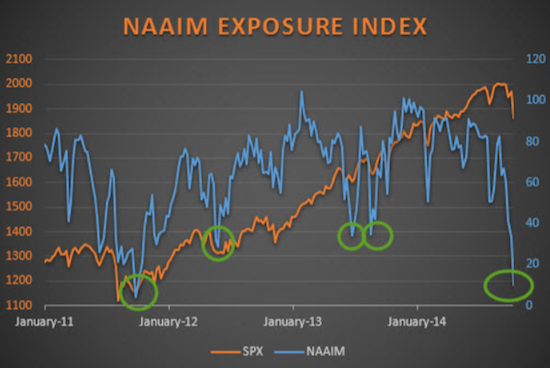

Various sentiment measures are flashing previous levels of fear we’ve seen at recent major lows. Andrew Nyquist went over a few here, but one more that I’d like to mention is the National Association of Active Investment Managers (NAAIM) Exposure Index. This measures the overall equity exposure for active managers.

Various sentiment measures are flashing previous levels of fear we’ve seen at recent major lows. Andrew Nyquist went over a few here, but one more that I’d like to mention is the National Association of Active Investment Managers (NAAIM) Exposure Index. This measures the overall equity exposure for active managers.

Although NAAIM’s website claims the Exposure Index is “… of little value in attempting to determine what the stock market will do in the future,” I think the chart below is very powerful and could be a clue as to what could happen next.

NAAIM Exposure Index v. S&P 500 Index (SPX)

As you can see, active managers just outright panicked, with equity exposure coming in at its lowest level since September 2011. Since then we’ve seen three other moves down below 40, with each marking a market capitulation and major buying opportunity soon afterwards. Could it happen again this time?

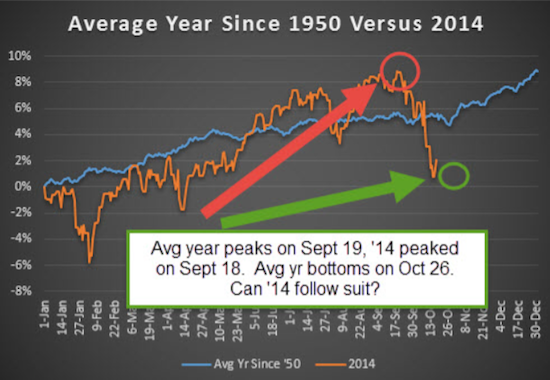

Andrew Kassen noted why the overall breadth backdrop still suggests more weakness and purely based on seasonality we might not be out of the woods quite yet. Here’s a chart I’ve been using that shows the average year usually bottoms closer to the end of October, so maybe one more surge lower is needed to truly flush out the weak hands.

S&P 500 Index (SPX): Average Year Since 1950 v. 2014 Year-To-Date

Blue line represents the average day for each year since 1950

All in all, the NAAIM Exposure Index is a definite step in the right direction. Plus, unlike other polls, this one looks at what actual money is doing, not just some random guy’s opinion – I like that. Now it doesn’t mean we have to bottom this week or even bottomed last week, but it means we are getting much closer to a tradeable low.

Follow Ryan on Twitter: @RyanDetrick

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.