A Logical Comparison

Before we compare 2017 to 1929 and 1987, it is helpful to understand our frame of reference in the context of sound decision making. From the Harvard Business Review:

Bad decisions can damage a business and a career, sometimes irreparably. So where do bad decisions come from? In many cases, they can be traced back to the way the decisions were made—the alternatives were not clearly defined, the right information was not collected, the costs and benefits were not accurately weighed. But sometimes the fault lies not in the decision-making process but rather in the mind of the decision maker. The way the human brain works can sabotage our decisions.

Emotional Scars Remain

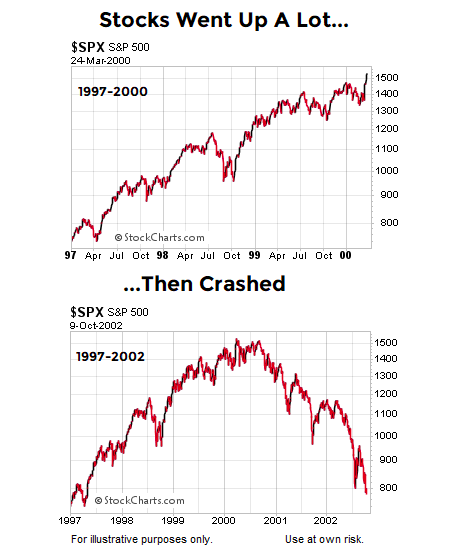

We all know the human mind tends to mark emotional events for easy retrieval relative to more mundane day-to-day events. One dramatic series of events was the 2000 dot-com bust and stock market crash. As shown in the S&P 500 (INDEXSP:.INX) charts below, stocks went up a lot and then crashed.

When stocks drop over 50%, it causes a significant amount of stress and can bring out extreme emotions. According to the Harvard Business Review, a traumatic event can be weighted heavily down the road when it is time to assess probabilities:

Because we frequently base our predictions about future events on our memory of past events, we can be overly influenced by dramatic events—those that leave a strong impression on our memory… A dramatic or traumatic event in your own life can distort your thinking.

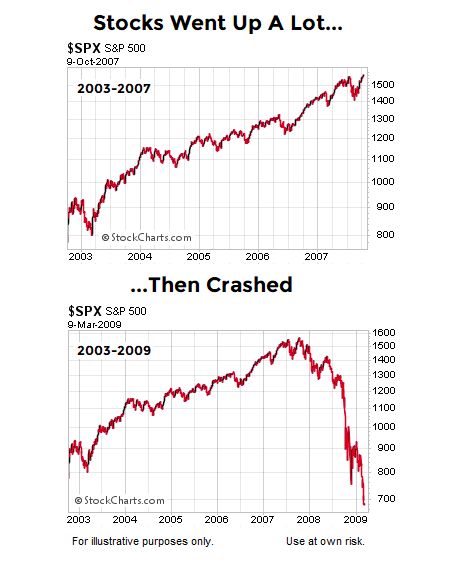

Many investors have two sets of traumatic events related to their investment portfolios. As shown in the charts below, between 2003 and 2007 stocks went up a lot and then crashed.

2017: A Crash Must Be Coming

In 2017, stocks have gone up a lot. Therefore, like 2000 and 2007, a stock market crash must be just around the corner in 2017…right? Given the emotional scars from 2000 and 2007, it is easy to understand why numerous articles have been written about the possibility of a 1929 or 1987-style crash occurring in 2017. There is always an emotional side to every story. There is also a factual side.

Is 2017 Similar To 1929 and/or 1987?

According to the Harvard Business Review, one way to offset painful-memory bias is to examine facts:

To minimize the distortion caused by variations in recallability, carefully examine all your assumptions to ensure they’re not unduly influenced by your memory. Get actual statistics whenever possible. Try not to be guided by impressions.

Facts allow us to strip out emotions and personal bias. This week’s video will review hard data to help us answer the question, how likely is a 1929 or 1987-style crash in 2017?

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode.

Hit Esc to exit full-screen mode.

Taking It Day By Day

As noted in a detailed September 8 analysis, under our approach, it is important to remain open to all outcomes. If the data begins to shift, we will adjust as needed. As of this writing, the data remains constructive. As noted in the Harvard Business Review, it is important for us to stick to the facts:

Researchers have identified a whole series of flaws in the way we think in making decisions. Some, like the heuristic for clarity, are sensory misperceptions. Others take the form of biases. Others appear simply as irrational anomalies in our thinking. What makes all these traps so dangerous is their invisibility. Because they are hardwired into our thinking process, we fail to recognize them—even as we fall right into them.

Twitter: @CiovaccoCapital

The author or his clients may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.