Chart Image: Global Shipping Stock Index and Valuation Indicator

The trade war has wreaked havoc on global markets and indeed the global economy.

In many ways the direct effects (tariffs etc) and indirect effects (uncertainty and disruption) have basically engineered an artificial slowdown in global trade and economic activity. But like all good crises, there’s also opportunity…

The chart in focus today comes from a recent edition of the Weekly Macro Themes report where we looked at what’s really going on with global trade and shipping stocks.

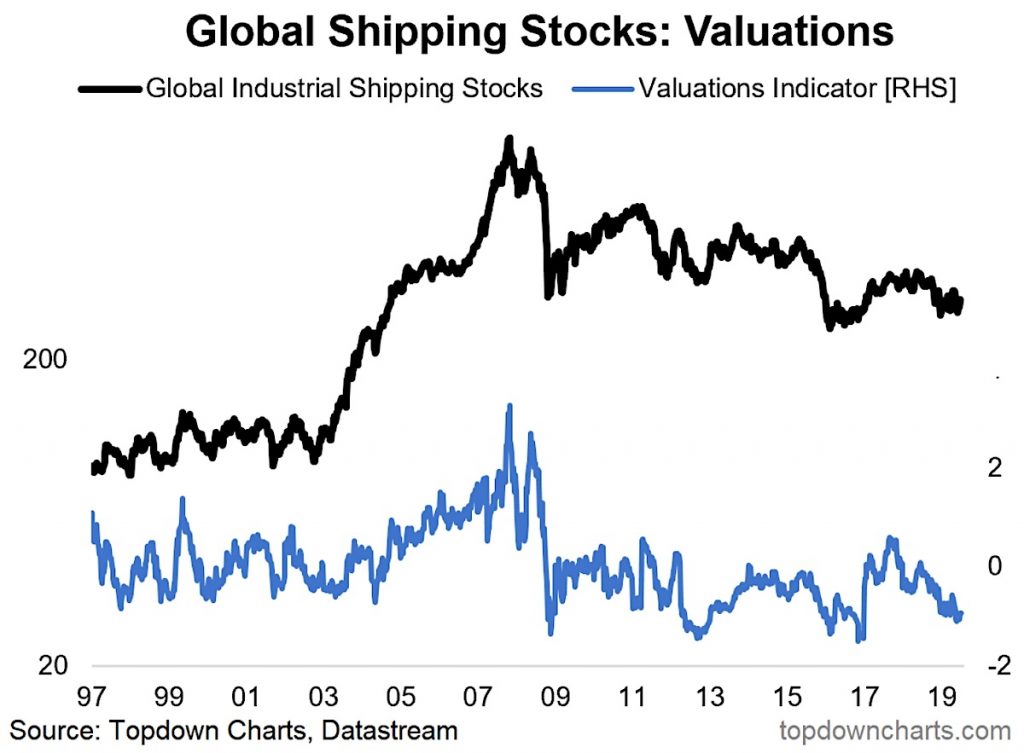

The chart shows our global shipping stocks index and the valuation indicator for this group of stocks. As you might expect, shipping stocks are trading on cheap valuations relative to history, thanks to both the direct and indirect effects of the trade wars.

The valuations indicator is a combined historical z-score of price to book and price to cash flow metrics for the sector (we take a median so as to provide a generalization of valuations in this sector). The global shipping stock index is an equal weighted index of 13 stocks.

In my view a lot of great investment ideas start with a valuation story (either too high or too low). In this case, with valuations trading at the low end of the historical range it’s something worth paying attention to. It’s true that cheap valuations can get even cheaper, but over the longer term valuations tend to speak for themselves.

In the immediate term, the sector is unfortunately tied closely to the ebbs and flows of sentiment and headlines around whether or not a trade deal is going to be done with China. Notably though, that presents 2-way risk (i.e. while it has been negative to date, there is scope for upside surprise).

The other big aspect is the softening global economy, which along with the trade war has dampened global trade growth. You probably need to see the global economy start to turn the corner and re-accelerate as a prime catalyst for such a growth-linked sector like this. The policy pivot (one of my big themes for H2 and beyond) may well be a key part of this.

So while there is plenty of 2-way risk for global shipping stocks in the immediate term, further out at least, the valuations picture looks good.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.