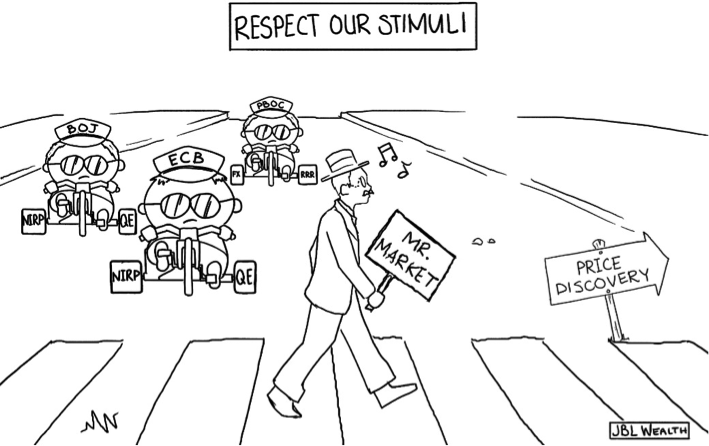

January may go down as the month Mr. Market refused to “Respect Our Stimuli” and started the stroll towards price discovery. Efforts by the three main central banks still engaged in the Big Wheels of stimulus had tough months.

The European Central Bank’s (ECB) two main “stimulus” programs are a $800 billion per year QE program and Negative Interest Rate Policy (NIRP) on excess reserves. On January 21st, with collapsing oil, a shaking China and markets probing multi-year lows, Mario Draghi emphatically stated that “there are no limits to our action”, intimating that stimulus will be expanded at the March ECB meeting. The verbal stimulus pushed markets higher for a few days, but the S&P 500 and Euro Stoxx 600 are both virtually unchanged from the day of his comments (unusually short half-life for “whatever it takes” Draghi).

Not to be outdone in the battle of central banks …

The Bank of Japan is pursuing a $660 billion per year quantitative easing program and on January 29th, the BOJ surprisingly adopted Negative Interest Rate Policy (NIRP) on excess bank reserves like the Europeans. The Nikkei surged over 4.5% on the day of the announcement, but five trading days later it is down 3.3% from pre-announcement levels. And, in the past month, the People’s Bank of China continued its selling of foreign reserves to prevent rapid devaluation of the Yuan, raised offshore reserve requirement ratios (RRR) to prevent Yuan devaluation, employed the “national team” (which has purchased north of $275 billion in stock since Summer 2015 to support crashing markets) and injected over $200 billion in liquidity into banks in January 2016 alone, the most money in over three years. The Shanghai Composite fell 10% the first week of January, and despite PBOC actions (and the actions of global central banks around the world), the index is down 20% in the first five weeks of the year.

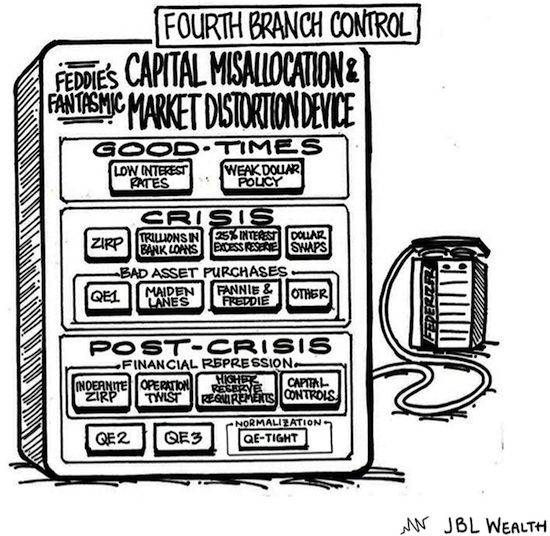

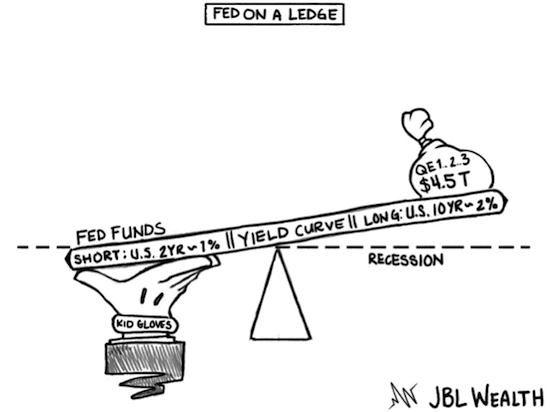

January was also the first full month of the Fed’s “QE-Tight” (my term), whereby the Fed is raising short term rates while keeping its QE laden $4.5 trillion balance sheet intact by reinvesting interest and principal payments on maturing bonds to assuage markets – thus tightening but maintaining a QE balance sheet. The Fed’s divergence from the other officers of global monetary policy is no doubt contributing to the markets’ lack of respect for the remaining central banks’ stimuli. With Friday’s strong wage growth numbers in the jobs report, and the possible transmission to inflation, the Fed is more likely to consider a rate hike in March, which was inconceivable a week ago – like attempting a land war in Asia.

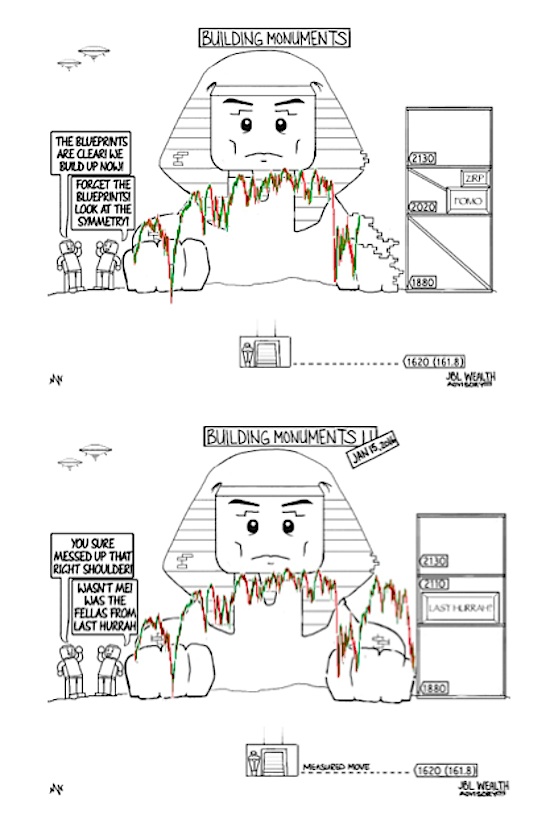

Technical Considerations

With respect to charts I am watching, we are back at the 1880 neckline from Building Monuments – a 1+ year old potential bearish head and shoulders pattern in the S&P 500 (the first image is from October 13, 2015 and the second is from January 15th, 2016). The measured or implied move, should it play out, is to around 1620-1630. The 1630 level also roughly corresponds with the 161.8 Fibonacci retracement level from the October 2014 lows to the May 2015 highs. Note: it is where the mummy is buried.

continue reading on the next page…