A few months ago I wrote an article here on how yearly pivots tend track the major market reversals each year. So far in 2016 many stocks, commodities and indices have bottomed on their Yearly Support pivots.

It’s been a wild year, so it pays to know where your pivots are. Here are some great examples.

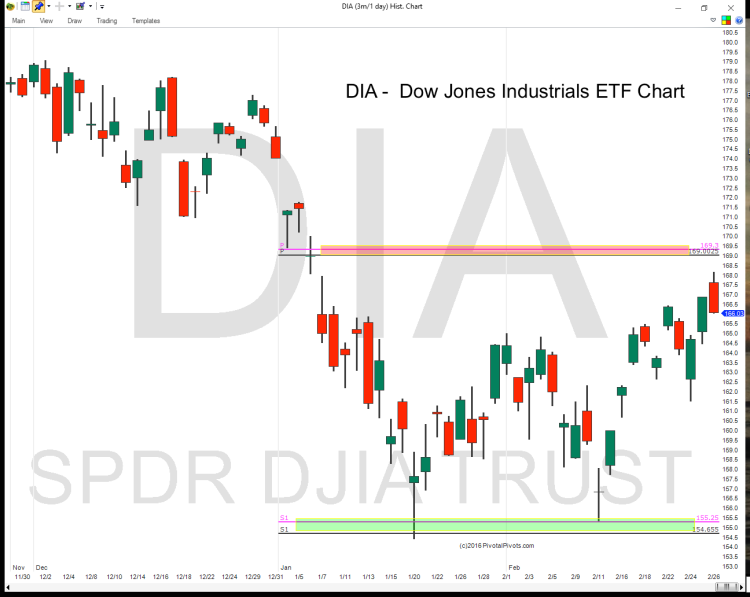

The Dow Jones Industrial Average ($DJIA & $DIA) did a double bottom on the YearlyS1 pivot. Look for next resistance at Yearly(P) pivots at $169.30 on $DIA and 17,000 on DJIA.

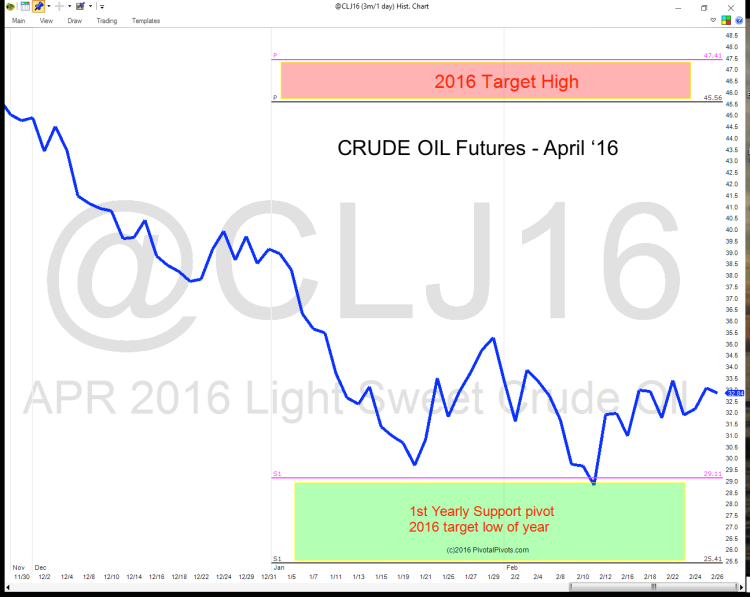

WTI Crude Oil futures found support on the YearlyS1 pivot. This is my target low for 2016 and I don’t feel oil will go lower. I see crude oil prices going back to $45 in 2016… especially after a cluster of key market reversals across asset classes.

The Financial Sector ETF $XLF found support on the YearlyS1 pivot. Market bulls need the banks/financials stocks to bottom if they wan to see a real rally. $XLF should rally back up to the Yearly(P) Pivots at $22.70 in 2016 (timing TBD).

The Russell 2000 Index and the Russell 2000 ETF ($IWM) both found strong support on the YearlyS2 pivots. The small caps stock market index could rally back up to the Yearly(P) at 1170 sometime in 2016.

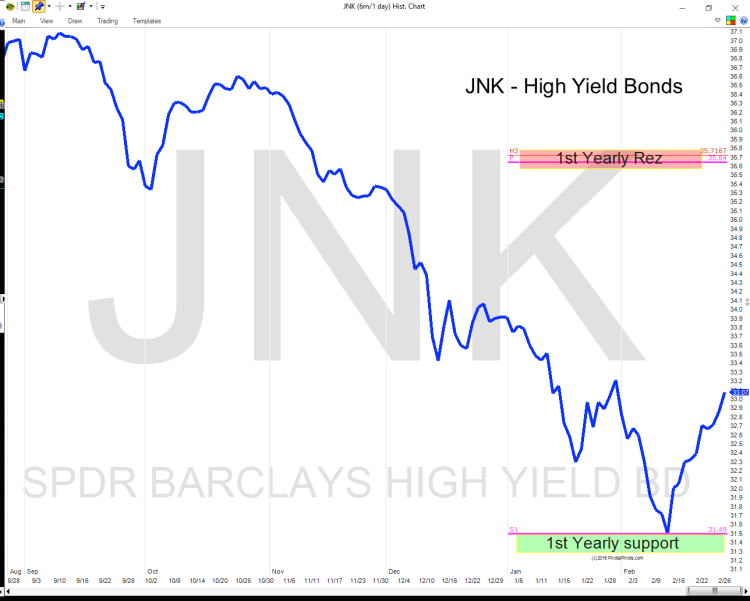

$JNK & $HYG high yield bonds both found strong support on the YearlyS1 pivots. I am looking for them to rally back up to the Yearly(P) Pivots in 2016.

Instead of guessing where to buy & sell, or where to cover your shorts, pivot points can show you with a higher degree of accuracy where market reversals occur. No need for moving averages, Fibonacci, RSI, MacD or any other lagging indicator. Pivot Points is the best “Forward” looking predictive indicator of where price will turn for stocks, stock market indices, commodities, currencies, and any/all markets.

To learn more about Pivots, please check out my webinar.

Best to your trading.

Twitter: @Pivotal_Pivots

The author does not have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.