Despite many promises, there has been no sustainable economic recovery. The United States, and the developed world for that matter, have made repetitive attempts over the last 16 years to return economic growth to the pace of years long past. These nations are stuck in a cycle in which hopes for economic “escape velocity” get crushed by economic recession and asset price collapse. Following each failure is an increasingly anemic pattern of economic growth accompanied by rising mountains of debt, which ultimately lead to another failure. The perpetual excuse from the central bankers is that not enough was done to foster “lift-off”. In their view, lower interest rates, more fiscal spending and additional quantitative easing will eventually provide the needed spark that will cause the economic engine to fire on all cylinders. In the profound words of Mark Twain, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

What follows in this article is evidence that current economic policy is not simply flawed in its logic and application but actually destructive. As should be evident to all by now, these experimental monetary and fiscal policies provide short term economic relief but only serve to exaggerate the problems they claim to solve. The elegant Virtuous Cycle that propelled western economies to prosperity has been quietly dismantled and replaced with an unproductive imitation. This new, Un-Virtuous Cycle euthanizes discipline and prudence in exchange for the immediate gratification of debt-fueled consumption.

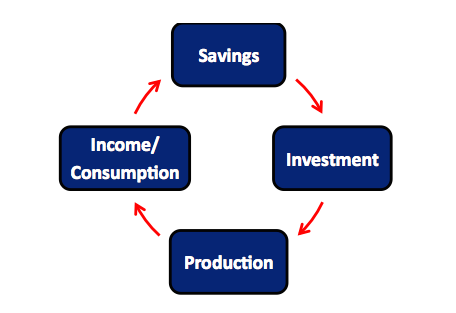

The Virtuous Cycle

One of the primary differentiating characteristics between rich and poor countries is the presence or absence of physical capital in the form of abundant sophisticated machinery and equipment. These productive assets are accumulated through savings (individual or institutional) which is converted to investment in physical capital. In the natural order, there is a sequence of events properly characterized as The Virtuous Cycle (illustrated below). It is an identity associated with sustainable productive output and growth.

Saving, or simply the discipline of consuming less than one earns, is a prerequisite for capital accumulation and the chief requirement in the Virtuous Cycle. The amount of saving determines how much investment will take place. Investment in new property, plant and equipment – better tools – fuels new and improved forms of production and leads to increased productivity and enhanced income. Higher incomes increase consumption and produce higher levels of savings, so economic prosperity continually grows. This cycle enables us to produce things of greater complexity than we otherwise could, and thus advance productivity, income and prosperity.

It is logical therefore that government and central bank policies should focus on promoting a healthy savings rate. However, over the last several decades we have seen the exact opposite. Central bank policy dismembers the Virtuous Cycle by punishing savers.

Two Primary Factors of Economic Growth

The impact of misguided economic policy is best understood through an evaluation of the two key components of economic growth.

1.) Demographics – the size of the working population

2.) Productivity – the amount of goods and services that can be produced in a unit of time

The working age population in the United States and most developed nations has become stagnant with the recent on-set of the baby boomers retiring. There is little a country can do to influence this variable outside of a dramatic relaxation of immigration policies, which clearly runs counter to the current trend. Productivity, on the other hand, is more readily influenced by policy. Economic policy however, has incentivized a preference for consumption fueled by debt instead of saving which feeds and encourages productivity. Productivity growth is experiencing a multi-year decline as a direct result of these policy errors. As demographic and productivity trends worsen, it should be no surprise that economic growth remains anemic and the outlook will deteriorate further.

Despite the fact that in the long run it is the primary determinant of a country’s future standard of living and affluence, the importance of productivity is not well understood by many outside the economics profession. As a clinical economic measure, productivity tells us how much an individual is able to produce in one hour of labor. If productivity is growing, then workers are incrementally able to produce more in an hour of work than they were previously. Although productivity can improve for a variety of reasons, it generally occurs because the tools employed make workers more efficient.

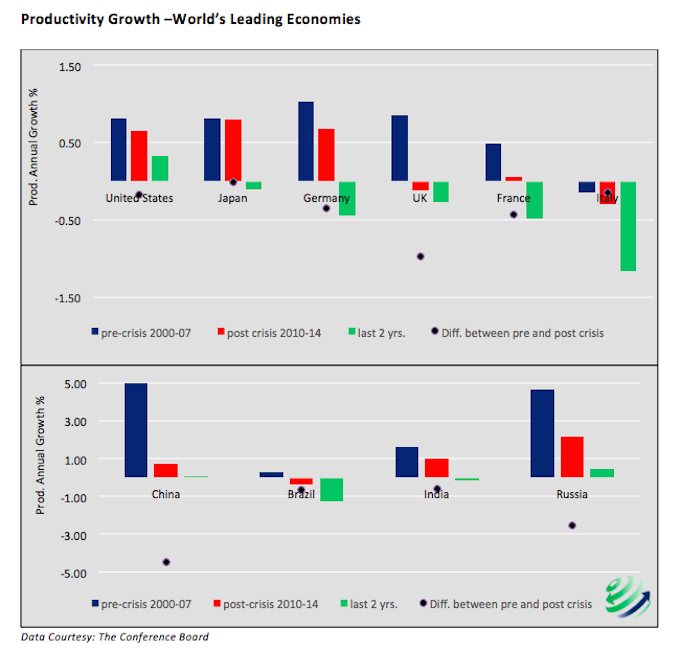

In the United States, we are currently experiencing a secular decline in productivity growth and this has troubling implications for the future. As shown below, productivity growth trends in the U.S. and 9 other leading economies are currently measured at their lowest levels since at least the year 2000.

While this fact may seem counter-intuitive given how much technological advancement there appears to have been, Total Factor Productivity and Labor Productivity data clearly point this out. Further supporting this analytical evidence is the consistently poor rate of economic growth, stagnant wage levels and the widening gap of wealth disparity.

read more on the next page…