Is softening Purchasing Manager’s Index (PMI) data signaling the end of the economic party after a decade-long expansion?

Or, do the numbers represent a temporary lull that will give way to continued growth?

While the debate is far from settled, at least one indicator suggests recent manufacturing weakness may simply reflect a pause as opposed to a full-fledged slowdown.

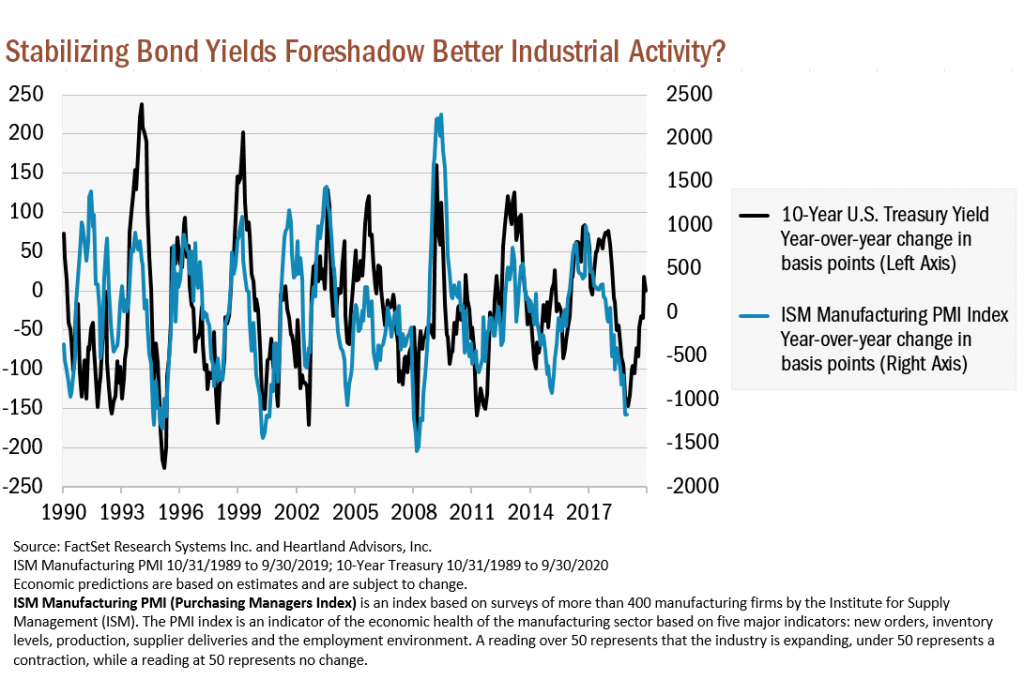

As the chart below illustrates, movements in the 10-Year Treasury Yield INDEXCBOE: TNX have been tightly correlated with domestic manufacturing activity.

With yields stabilizing, the market appears to be signaling brighter times ahead for manufacturers if historic PMI patterns persist.

A rebound could be particularly rewarding for attractively valued businesses in cyclical industrial areas of the market that already experienced a pullback when macro clouds gathered during the summer. As value-oriented investors who have found significant opportunities among manufacturing and industrial companies, we would welcome such a development.

This article was written by Troy McGlone, CFA and Portfolio Manager at Heartland Advisors.

Disclosure: Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal. There is no guarantee that a particular investment strategy will be successful. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change.

CFA® is a registered trademark owned by the CFA Institute.

Definitions:

Basis Point (bps) is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument. CyclicalStocks cover Basic Materials, Capital Goods, Communications, Consumer Cyclical, Energy, Financial, Technology, and Transportation which tend to react to a variety of market conditions that can send them up or down and often relate to business cycles. Treasury Yield is the effective rate of interest paid on a debt obligation issued by the U.S. Treasury for a specified term.

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.