The Purchasing Managers Index (PMI) release came out today giving insight into the economy’s health as the market ramps up with increased consumer sales and all time highs for hiring.

Additionally, the our favorite economically sensitive ETFs got another positive boost from Oxford and AstraZenica’s vaccine.

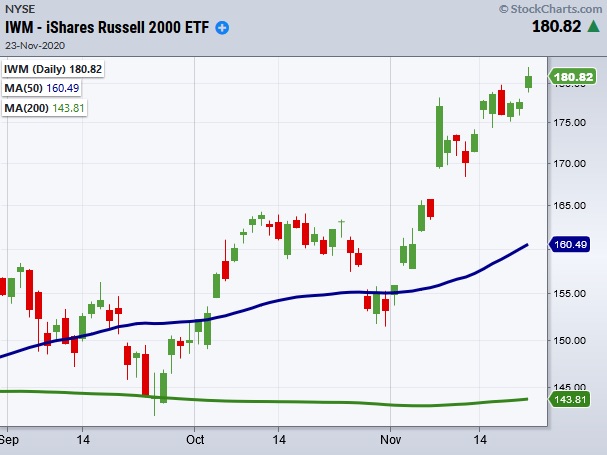

The Russell 2000 ETF (IWM) closed the strongest of the major stock market indices making new all time highs.

Comparatively, the S&P 500 (SPY), Nasdaq 100 (QQQ), and Dow Jones (DIA) are bound to their prior week’s range proving that the small cap companies are still a major focus among investors.

The biggest winner of the day was the Retail Sector ETF (XRT).

On another new all-time high, XRT is happy right now. Consumers are now expected to spend more during the holiday season.

However, the good news brings to mind the end of the famous quote by John Templeton…”bullish markets end in euphoria.”

Consumers might spend more, but 65% surveyed said they have not set any money aside for holiday shopping.

That means they will be charging this season. And if you haven’t noticed, the highest rates exist with credit card fees.

The $100 billion drop in credit card debt earlier this year due to deceased spending in travel and leisure, could go right back up.

Without stimulus, and no guarantee enough stimulus will come given the gridlock it looks like the government is heading into, that debt could come back to bite the market later.

Plus, costs are rising-everywhere with a bottleneck of goods sitting on anchored vessels.

Even Amazon today warned that folks should pick up orders as deliveries could be delayed.

That is the supply chain disruption along with rising prices that could bring the rally to a screeching halt.

And now with Janet Yellen slated as the new Treasury Secretary, many feel she will keep the money printing regardless of what a red Senate might not let through.

So we are back to looking at inflation coming soon.

But for now, enjoy the ride in the best sectors we know and love-Semiconductors, Transports, Retail and Small Caps!

S&P 500 (SPY) Needs to clear 364.38. Currently flirting with the 10-DMA at 357.21.

Russell 2000 (IWM) New all time highs.

Dow (DIA) 300 key to clear with support 289.19.

Nasdaq (QQQ) Another Close on the 10-DMA with major support from the 50-DMA at 281.57. 300 key to clear.

KRE (Regional Banks) 49.60 to clear. Support at 45.16.

SMH (Semiconductors) New all time highs!

IYT (Transportation) Still holding over the 10-DMA as support at 215.70 222.90 is the high to clear.

IBB (Biotechnology) 137.10 support the 50-DMA and 143.36 Resistance.

XRT (Retail) New all time highs.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.