Stock Market

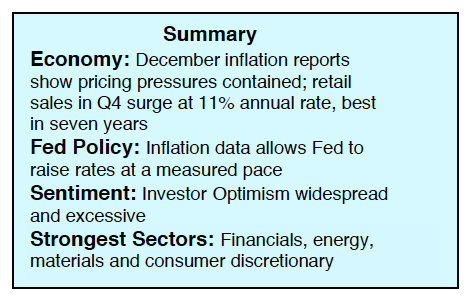

The popular stock market averages soared to new record highs last week, with the Dow Jones Industrials rising a remarkable 1000 points since the start of the year.

But stocks have tripped up to start the new week.

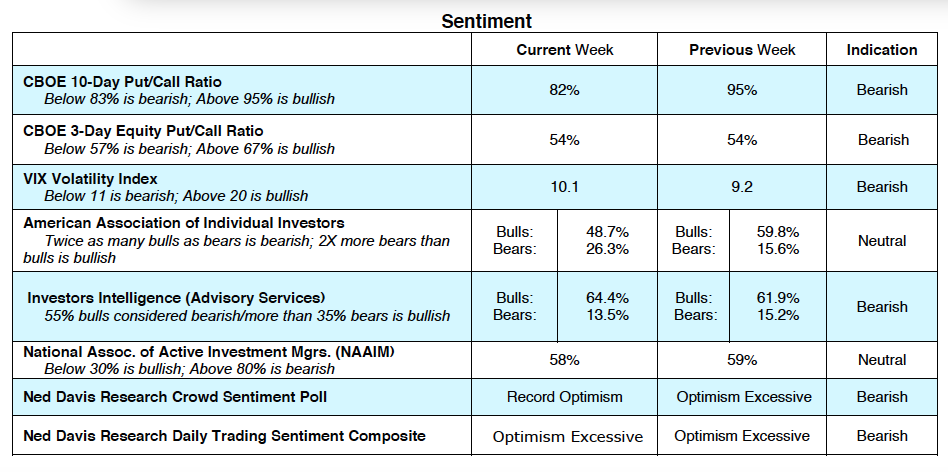

The stock markets are technically overbought with most sentiment indicators showing excessive investor optimism, a contrary indicator. This is seen in the Ned Davis Research Crowd Sentiment Index that reached a new record high last week. The cautionary message issued by the sentiment indicators, however, is offset by the fact that negative divergences that often precede a market decline are largely absent.

Barring today’s move lower, the current rally has been broad based with nearly all areas in harmony with the primary trend. Typically at an important peak in the market the leadership begins to grow thin, which is opposite of what we are witnessing now. This argues that any weakness that could develop will be limited in time and price. But something to eye, nonetheless.

Investor optimism is surging in sync with the rapid expansion of the U.S. economy. This has encouraged corporate earnings estimates to be revised upward. Fourth-quarter corporate earnings reports begin to flow this week and consensus forecasts of analysts show S&P 500 earnings expanded 10% to 14%.

A flood of reports that business is raising wages and providing bonuses based on the reduction of corporate taxes from 35% to 21% has added to the newfound optimism on Main Street.

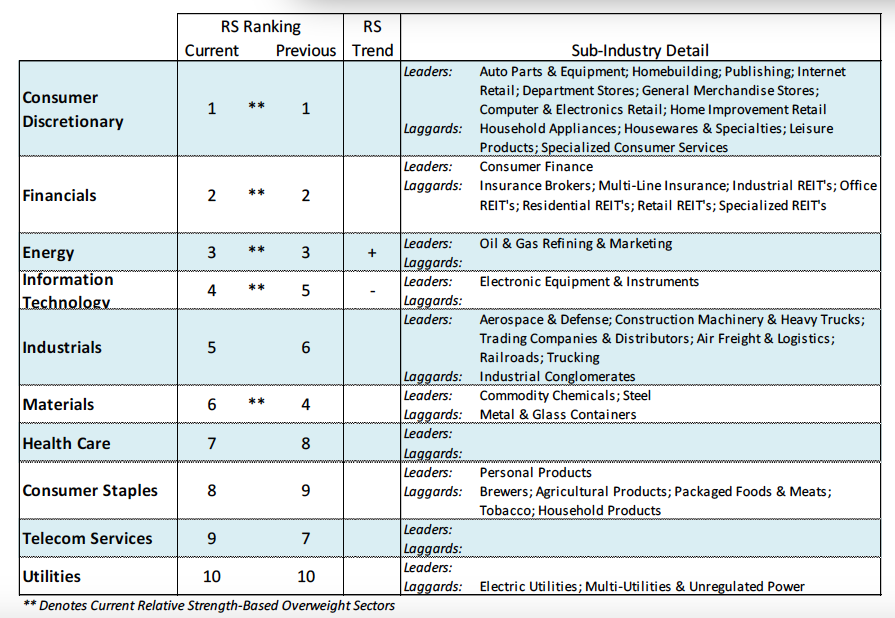

Any new funds should be directed to the strongest sectors. In our eyes, those are consumer discretionary, materials, energy and financials. Consumer stocks benefit from the combination of a lower corporate tax rate and increased disposable income provided by higher wages and the proliferation of worker bonuses in 2018. Commodity-related areas are benefiting from improving trends in the global economy. This would include the materials and energy sectors and precious metals stocks. The financials are benefiting from the rising rate theme that is anticipated to continue.

Economy, Inflation & Interest Rates

The U.S. economy is benefiting from a surge in consumer spending that has caused economists to raise fourth-quarter GDP estimates to 3.3%. The Citicorp Economic Surprise Index is hovering near the high for the cycle, which suggests that the momentum generated by the economy in 2017 will carry into 2018. As a result of the new tax legislation, business spending is expected to pick up the baton from the consumer in 2018.

Despite the improving economic trends, inflation by most measures has yet to break out to the upside. On a year-over-year basis CPI inflation moved down to 2.1% from 2.2%. Core inflation (less food and energy) moved up to 1.8% from 1.7%. The data shows inflation is presently contained providing the Fed no urgency to accelerate its move to normalize interest rates. At this juncture the markets are pricing in two and perhaps three rate hikes by the Fed this year. We do not anticipate the equity markets will be negatively impacted unless the Fed is forced to raise rates more than three times or the yield on the benchmark 10-year Treasury note rises above 3.00%.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.