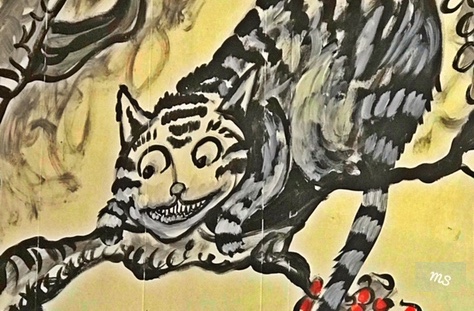

Allegedly, the Cheshire cat is named after a county in England that had an abundance of milk and cream.

Hence, the cats grinned in response to the abundance.

Then, Lewis Carrol used the Cheshire Cat in Alice in Wonderland.

He was depicted as a clever and mischievous cat, who helped Alice get in and out of trouble.

Furthermore, he could make his body disappear and appear at will, leaving visible, only his grin.

The Cheshire Cat describes both the bulls and the bears in this stock market.

The bears have been grinning in response to the abundance of selling.

They also make their bodies disappear at will, allowing the bulls to come back in, only to be left staring into the bear’s mischievous grin.

They also make their bodies disappear at will, allowing the bulls to come back in, only to be left staring into the bear’s mischievous grin.

What will take to for the bulls to reverse places with the bearish cat, leaving the shorts with only a bullish mischievous grin to look at?

A couple of Modern Family notes first.

Last night I wrote, “As an extremely important factor in the U.S economic outlook, IYT, extremely oversold, might have some bounce if can hold over 169.45, the mid-November 2017 swing low.”

Today’s low was 169.15 and Transports (IYT) closed at 169.92. That helps.

I also featured Biotechnology Sector (IBB), as one of the most speculated sectors.

Early in the day, IBB failed to hold 100. I warned, that if that price level broke, “I’d prepare for another leg lower with next support at 97.90.”

Today’s low in IBB was 97.08. And it closed at 98.31.

If that price level can hold and this can actually clear and hold over 100, way better.

As far as the rest of the board, I am focused on NASDAQ and the Dow.

With SPY and IWM under their 23-month moving averages, QQQs are holding it as long as the price remains above 157.45.

In the Dow or DIA, that price is 236.41.

Two things have to happen to get the bulls grinning.

First, all the levels mentioned above in IYT, IBB, QQQ and DIA must not fail.

Secondly, SPY needs to close out December above 261.60-its 23-month MA.

Then, I think we should have enough fuel to spark a decent rally as we start the new year.

Both bulls and bears should never forget what the Cheshire Cat says, “I’m not crazy. My reality is just different from yours.” Lewis Carroll.

S&P 500 (SPY) – Made a new low from yesterday but closed above it. Anything can happen here. 252.92 February low. 261.50 point to clear

Russell 2000 (IWM) – A lot of support around 134.50-135. Let’s see if this can back above 140

Dow Jones Industrials (DIA) – 233.20 the 2018 low made in April. 246.25 is price resistance.

Nasdaq (QQQ) – 150.13 the 2018 low. That’s quite a distance away. Tell me, if holds 157.40 area, could see a move back to 164 first.

KRE (Regional Banks) – So weak. If this has anything, needs to clear 50.15 key resistance.

SMH (Semiconductors) – 90.00 is pivotal with 86.95 recent low.

IYT (Transportation) – 169.45 is pivotal.

IBB (Biotechnology) – 97.90 pivotal with 100 the holy grail.

XRT (Retail) – Broke the 80-month MA, first time since 2010. 42.38 is the point to clear back above.

Twitter: @marketminute

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.