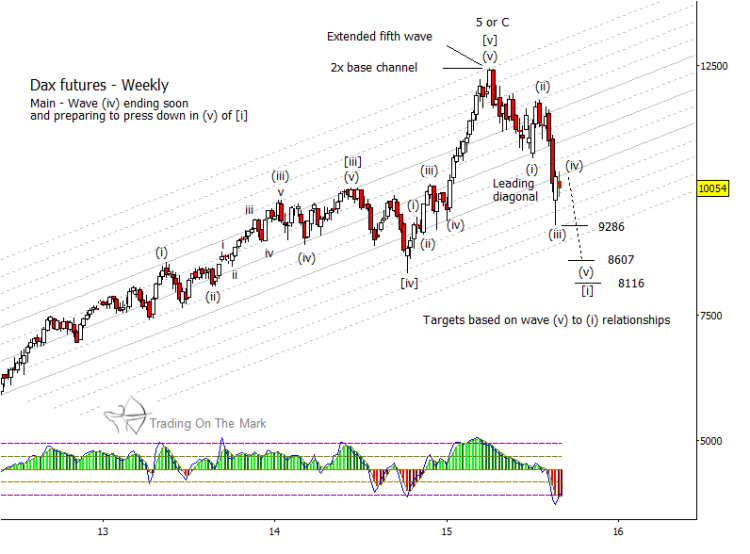

Fibonacci relationships with the candidate for downward wave (i) yield support targets for wave (v) near 9,286, 8,607 and 8,116, with the middle and lower targets being the most attractive.

As a technical note, close inspection of what we have labeled as wave [v] leading up to the market top shows that internal wave (iv) overlaps with internal wave (i). This is strictly a violation of Elliott wave rules for an impulsive move. However, the entirety of wave [v] displays the market sentiment one would expect with an impulsive wave, and the low of wave (iv) dipped only briefly into the territory of wave (i). Even so, we are mindful of the broken rule.

Stepping back again to consider the big picture, it is common for markets to follow a thrust out of a triangle with an eventual retest of the triangle’s apex, which is in the vicinity of 6,000 for the DAX. That prospect would entail the index losing half its value from last years high – something which might seem extreme but which we regard as likely.

Equity and bond markets are becoming quite interesting this season. Follow TOTM on Facebook and Twitter to get timely market updates and announcements of special subscription offers.

Twitter: @TradingOnMark

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.