If an inverted yield curve is a harbinger of a near-term recession, then a steeper yield curve must be good news, right? Not so fast.

Before unpacking that, let’s lay a bit of foundation just in case you don’t follow the shape of various yield curves very closely.

Yield curve basics in 100 words: The yield curve is a measurement of bond yields of various terms from a few months to many years. Most often it has a positive slope, meaning 10-year yields are higher than 2-year yields. Locking your money up for longer should be rewarded with a higher yield (called term premium). Sometimes the yield curve inverts, and short yields are higher than longer yields. This typically happens as short-term yields are more influenced by central bank overnight rates and longer yields by economic expectations. If the central bank is fighting inflation with higher rates and the economy starts to slow, it can invert.

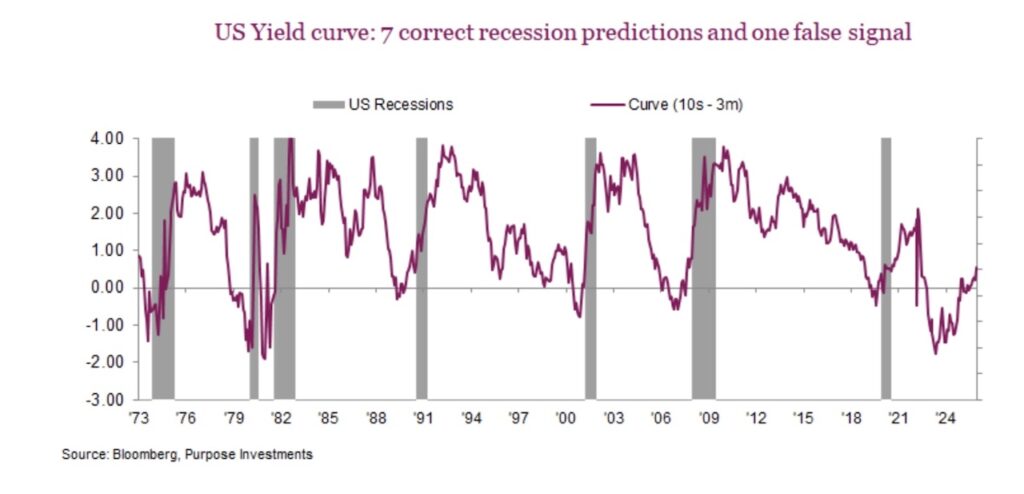

The U.S. yield curve used to have a perfect record signalling recessions, if it inverted, there was a recession coming soon. Seven times this happened, and seven times a recession manifested. It even got the COVID one right, and that was one unique recession. But then it inverted in 2023 and no recession, its only false signal in 50 years. Still, 7 out of 8 ain’t bad.

So clearly, an inverted yield curve is bad, even with that one false signal. Normally a steeper yield curve is good news as it implies higher economic growth expectations (higher longer yields) and/or lower inflation risk (lower short yields). As most countries’ yield curves followed the U.S. from being inverted in 2023, steepening to become flat in 2024 and positively sloped in 2025, this was because inflation risk was falling and economic growth prospects were improving. Yay!!!

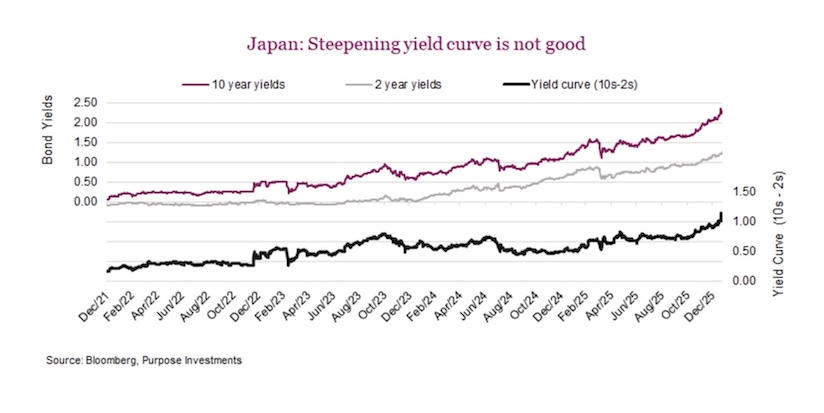

But it is not always good news. Japan’s longer yields moved significantly higher in recent weeks, accelerating a gradual trend that had been in place for a couple of years. The economic outlook for Japan has improved a bit but not enough to justify that move in longer yields. Instead yields moved higher on concerns over inflation and debt sustainability. Japan has been the outlier among central banks, consistently raising short-term interest rates to fight inflation while others are cutting. These higher yields increase the risk of servicing their debt, which is on the large size at 1.2 quadrillion yen or roughly 230% gross debt/GDP. This is bad steepening.

An added wrinkle is that Japan, which has enjoyed very low yields for many years previously, is one of the popular borrowing jurisdictions for the carry trade. Borrow where yields are lower and invest elsewhere. These rising yields make borrowing more expensive for the carry trade, which has been mitigated by a weaker yen. At some point though, these rising yields may cause some unwinding of carry trade positioning, which may hurt asset prices globally.

Diversifiers

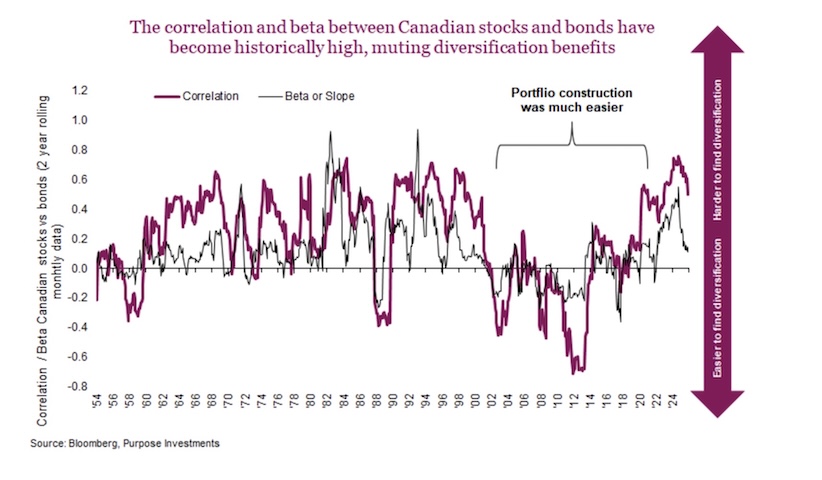

The other issue is from a portfolio construction perspective. If longer yields globally are rising because of fear of inflation or debt sustainability, as opposed to improving economic growth, bonds are not the portfolio stabilizer we all want them to be. Bonds still work really well as a portfolio diversifier if the market has an issue with slowing economic growth or rising recessionary risk. But if the market has an issue with inflation or debt sustainability, bonds probably won’t work well. This is one of the reasons equity/bond correlations have remained elevated over the past few years.

Final thoughts

We do believe inflation and debt sustainability will continue to garner more attention as a risk going forward, and this will likely mute the defensiveness of bonds in a portfolio. This will require different kinds of defence, whether it be holding more cash, commodities, or different diversification strategies. Bonds remain core for defence in case of an economic growth slowdown, but the need for more diversified defence has not been greater in recent history.

This report is authored by Craig Basinger, Chief Market Strategist at Purpose Investments Inc.

Sources: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.