The Transportation stocks are an excellent measure of industrial and manufacturing strength and supply and demand.

In this video, I discuss the Transportation Sector ETF (IYT) – It is a good indicator of economic health as the movement of goods and services across the country is the economy’s lifeblood.

This relates to Charles Dow and his emphasis on tracking transportation to gauge the economy’s health.

We can use IYT to see if goods are moving or not. And in a strong economy, we don’t want to see supply outweighing demand.

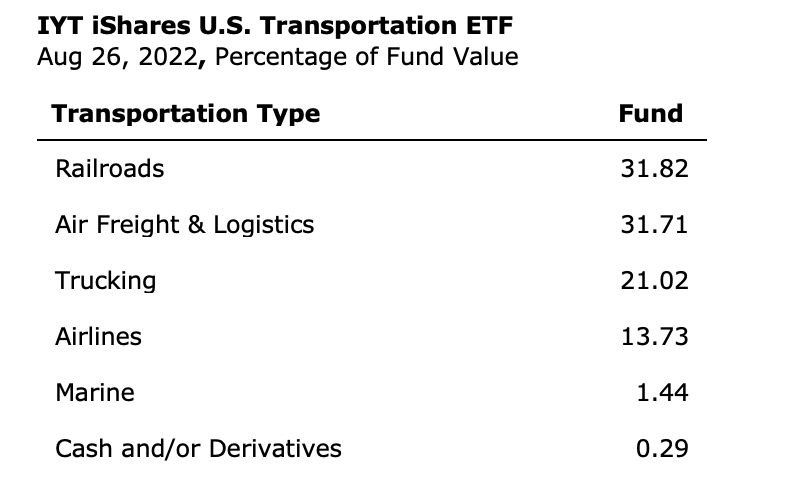

The ETF basket is broken down below:

Generally, transportation companies are busier when economic activity picks up, leading to strong demand for the movement of goods across many economic sectors.

When economic activity increases, transportation businesses are often busier, which fuels significant demand for more commodities across various economic sectors.

When the supply of goods outweighs the demand, that’s a sign that the economy is slowing down. But when demand outweighs supply, that signifies a strong economy.

IYT is a great way to measure that relationship and better understand where the U.S. economy is heading.

So if you want to learn more about how the Tran can be a good indicator of financial health, click the link below to watch my video recap.

Also be sure to watch today’s clip on Bloomberg TV!

Please let us know if you’re not a member and would like to learn more about investing into ETFs.

Stock Market ETFs Trading Analysis & Summary

S&P 500 (SPY) 399 major support 410 pivotal 417 resistance

Russell 2000 (IWM) 190 pivotal, 182 major support, 195 resistance

Dow Jones Industrials (DIA) 320 major support

Nasdaq (QQQ) 312.50 pivotal, 303 major support and 319 resistance-clutch hold of the 50-DMA

KRE (Regional Banks) 62.00 the 50-DMA

SMH (Semiconductors) Unconfirmed bear phase if cannot retake 223.50-215 next support

IYT (Transportation) 227 the 50 DMA. 234 area pivotal and 240 resistance

IBB (Biotechnology) Confirmed bear phase. 124 resistance 117 next support

XRT (Retail) 64.25 area the major 50-DMA support and 67 resistance

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.