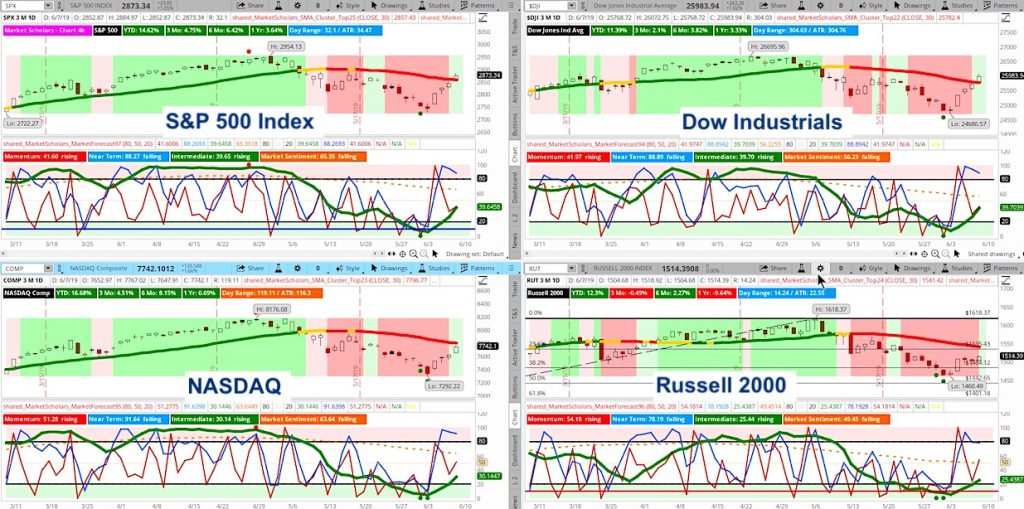

The S&P 500 Index ETF (NYSEARCA: SPY) followed up on last week’s extreme oversold signals found in multiple timeframes that were cited in last week’s Market Outlook video with a strong bounce in short-term sentiment this week.

The momentum line (red) and near-term line (blue) both show patterns that suggest the intermediate line (green) will make a run towards the top end of the chart.

Also, the weekly chart still shows a strong bullish posture with this week’s bounce off its rising 30-week moving average and improved short-term sentiment lines.

The S&P 500’s pullback reached the point where its 38% Fibonacci retracement level crossed with the 50% Fibonacci Fan of the Dec 24 – May 1 rally and bounced back above key 2,800 level that was formerly a strong support level.

After closing below its 40-week EMA, the S&P 500 filled the gap and closed back above its 10-week EMA this week. This is actually a common occurrence after “golden crosses”.

The strong winning streak including a 2% gain and 1% this week without a strong drop mixed in is another sign we have formed the intermediate low.

Interestingly, after not showing strong moves during the decline, this week’s range exceeded the weekly average by double even with only hitting average volume levels.

Most likely due to unexpected weekend news potential, the $VIX Volatility Index (INDEXCBOE: VIX) remained higher than its May 22 closing level despite closing at a higher price.

Get market insights, stock trading ideas, and educational instruction over at the Market Scholars website.

Stock Market Video – For the Week of June 8, 2019

Summary: There are multiple indicators showing improvement in the S&P 500’s trend, but the new intermediate trend hasn’t been established yet. There may be some near-term weakness early next week but indicators suggest a new trend may develop soon – especially with the breakdown in the U.S. Dollar.

Twitter: @davidsettle42 and @Market_Scholars

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.