This article reviews the data from the latest weekly sentiment survey I conduct over on Twitter.

The survey measures respondents’ equity and bond positioning/view – differentiating between whether the view is bullish or bearish for technical or fundamental reasoning.

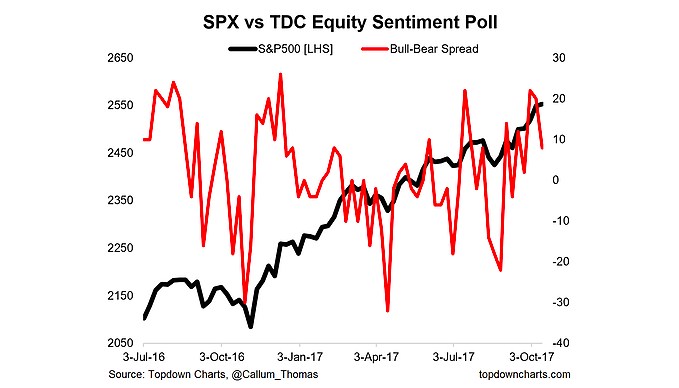

The latest results showed a further decline in net bullishness on the equity survey, driven by an increase in technical bears (+7pts) and drop in technical bulls (-6pts), albeit the fundamentals bull-bear spread ticked up. At a highest level it shows a divergence between price and sentiment… a bearish divergence.

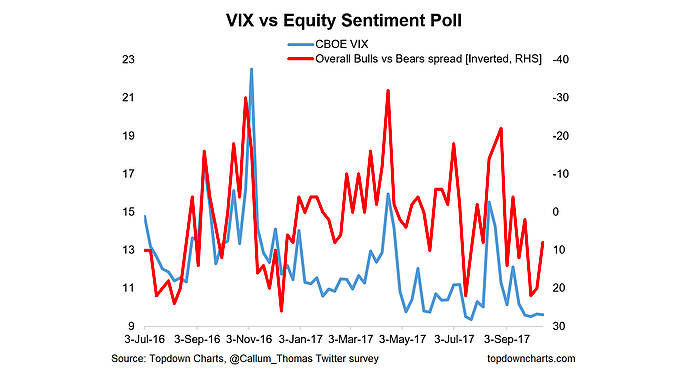

The first two charts show how sentiment is rolling over vs price, which has in the past flagged an impending selloff for the S&P 500 (INDEXSP:.INX). Likewise the sentiment vs the VIX Volatility Index (INDEXCBOE:VIX) chart shows a gap opening up. This gap seems to be implying an expected VIX level of at least 13-14 vs the current 9-10. This lines up with the commentary in the latest Weekly S&P500 #ChartStorm (“Overbought and Overhyped”).

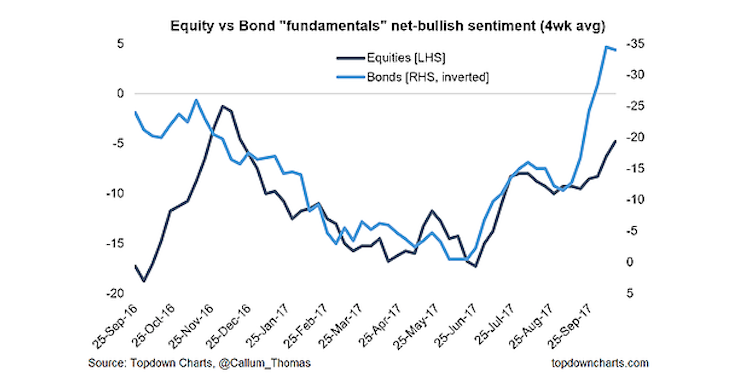

Finally, the last chart shows how “fundamentals” sentiment has been tracking in the equity and bond surveys, and how there has actually been a big improvement here. So taking this all together I would say there is a reasonable chance of a sell-off, but if the improved fundamentals sentiment is anything to go by such a selloff would probably be short-lived.

The overall bulls vs bears spread has rolled over. This contrasts with higher prices and has in the past been a red flag for markets.

On a similar note, the bull/bear spread (shown in the graph below, inverted or upside down), has opened up a gap vs the CBOE Volatility Index, and is suggesting a higher VIX from here.

Finally, the “fundamentals” sentiment picture is still looking pretty good, with the upturn in equity fundamentals bullishness confirmed by that observed in the bond market.

Thanks for reading.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.