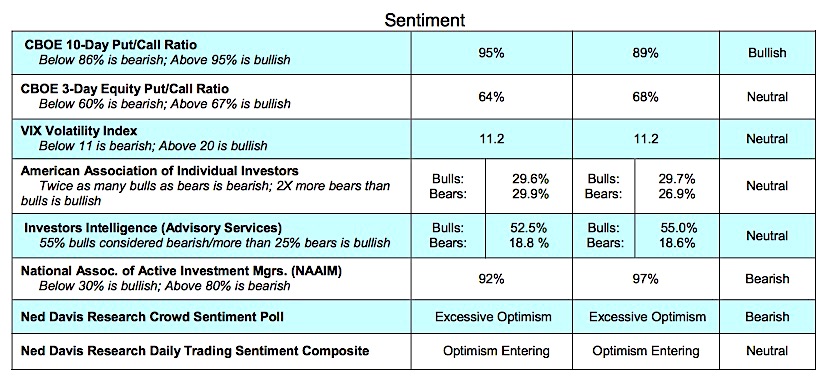

A rise in U.S. and European interest rates caused volatility in the equity markets to spike last week. This rise in stock market volatility could be seen in gyrations in price for the S&P 500 (INDEXSP:.INX), as well as the VIX Volatility Index (INDEXCBOE:VIX).

Yet despite the sudden change in the interest rate environment, the equity markets have managed to hold up pretty well, posting modest gains last week.

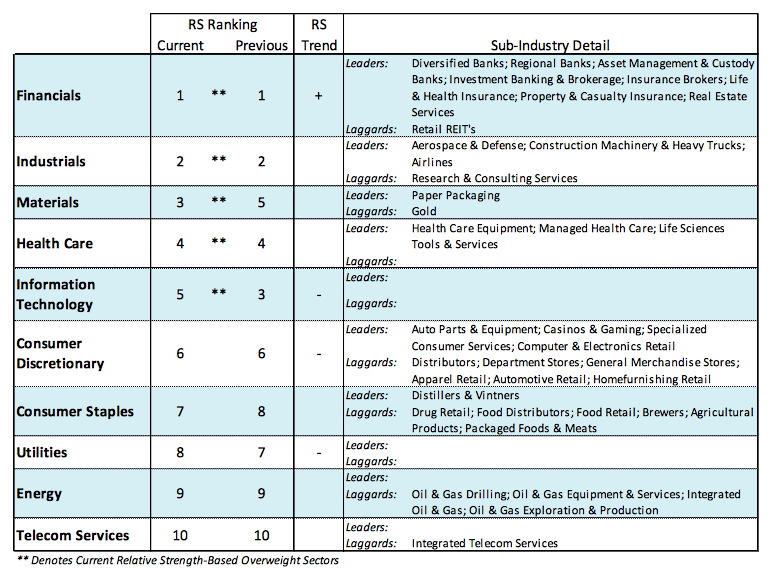

The yield on the benchmark 10-year Treasury note (INDEXCBOE:TNX) rose 25 basis points but a much larger shock occurred in Europe where the yield on the German 10-year bond doubled. At this juncture the rise in rates is a welcomed development signaling the global economy appears to have gained traction after years of operating on the edge of recession. Growth trends have improved around the world with nearly 90% of world economies showing positive and accelerating growth. Evidence of improving economic fundamentals in the U.S. is apparent in the employment numbers that show monthly job gains averaging 194,000 in the second quarter versus 166,000 in the first quarter.

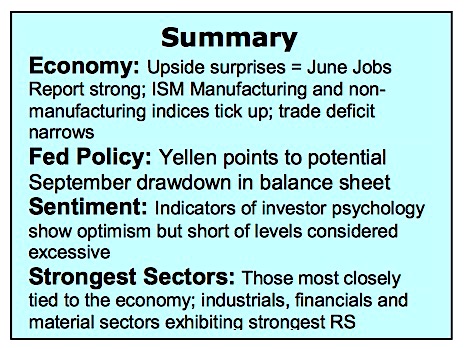

Near term, the risks of a correction are elevated in an environment of rising interest rates. The key factor is likely to be the Fed continuing to normalize policy at a gradual pace. Janet Yellen appears committed to one additional rate increase in 2017 and a reduction in the Fed’s balance sheet beginning in December. Should the Fed accelerate the process with a rate hike in September and balance sheet reduction beginning in October the odds of the first correction in more than a year would escalate. Although we anticipate a rise in stock market volatility, the modest uptick in interest rates at this juncture does not pose a threat to the long-term trend in stock prices.

Second-quarter earnings reports will be the focus this week over the stock market technicals that are little changed week- over-week. It is widely anticipated that profits expanded 8.00% in the second quarter. This could be a low bar number given that the economy grew at a faster clip in the past three months than in the first quarter.

A stronger labor market was anticipated to result in a rise in wages that could threaten profit margins. The June jobs data, however, showed wage gains stalled in the 2.50% range. Inflation is conspicuous by its absence in 2017 with the most recent CPI report showing prices actually declining. The steep drop in energy prices in the second quarter is a negative for oil-related companies but a pleasant reduction in costs for most other industries. The combination of a stronger economy, stagnant wage growth and lower energy costs suggests that second quarter earnings are likely to surprise on the upside. This will be important given that investor cash levels have been drawn down to record lows while margin debt is sitting on top of an all-time high.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.