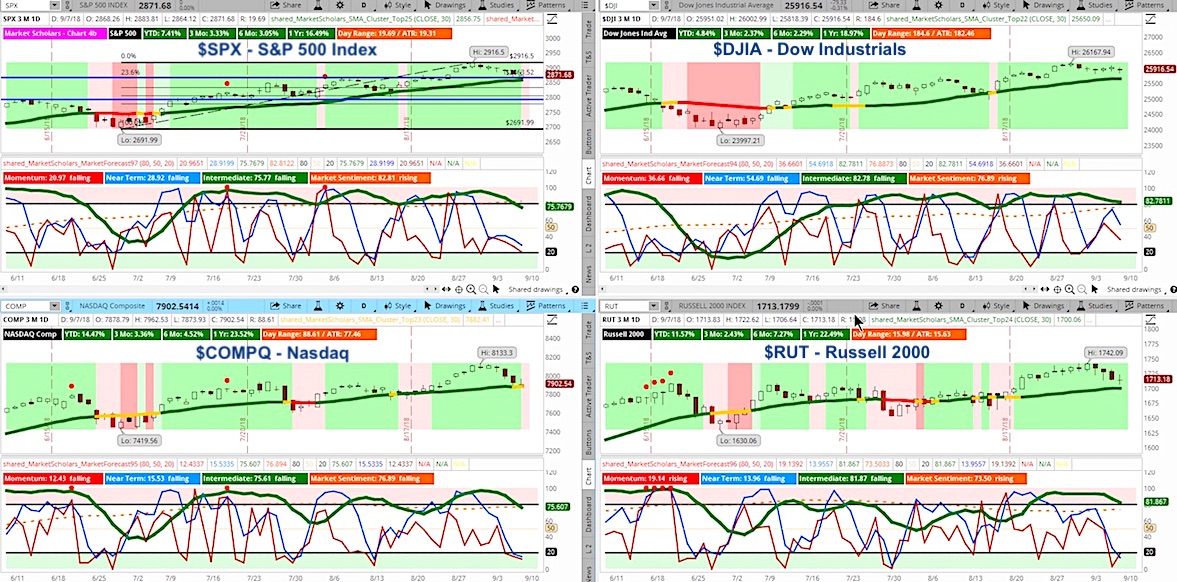

Market bears finally showed some teeth, taking the S&P 500 and Nasdaq lower on the week. We’ve now had six consecutive days with lower highs and lower lows with a close above the previous days lows.

In this week’s “Weekend Market Outlook” we will discuss current market weakness, September seasonality and current trading setups for key indices, sectors and stocks. Below is a summary of what’s in the video below.

Market Outlook Video (September 8):

– S&P 500 is pulling back with weak bearish intermediate posture into support at 23.6% Fibonacci retracement level that coincides with January peak. Bearish short-term sentiment is also weak.

– Long-term bearish divergence setting up on 50-day and 200-day MAs. Previous divergence took months to play out.

– MACD and Stochastic showing similar weakness to late July and mid-August setbacks

– New lows in Market Scholars 1000 hitting above 50. I show you the last two times that happened and what the S&P 500 did the week after.

– Volatility, trading ranges and volume still not to bearish levels to support more of an intermediate pullback.

– Weakness in Europe again instead of emerging markets limits the potential for contagion to spread to U.S. markets. Tariffs dominated investor sentiment after strong jobs report lifted rate hike expectations.

– Utilities and Real Estate overbought in 3-month period with potential for relative strength in Materials and Energy once the dollar starts to pullback.

Twitter: @davidsettle42 and @Market_Scholars

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.