The Federal Reserve is set on raising interest rates next week. The data dependent Fed has reduced their dependency to seemingly only two data points: employment and the S&P 500. As the market attempts to price in a rate increase, investors may soon shift gears to pricing in Federal Reserve guidance on interest rates in 2016.

Moreover, I believe that the real news will be about what they say regarding the projected pace of further interest rate increases. They have been hinting that raising rates in December will allow them to raise rates more slowly throughout 2016. So any Federal Reserve guidance on further rate hikes will likely cause the bond markets to move based on how soon they think the next rate increase will be.

I expect the markets to be more volatile than normal over the next few weeks as more information becomes available.

Underlying all this uncertainty, there is a huge debate going on in the financial media about whether the U.S. economy is “mid-cycle” or “late-cycle”. In other words, over time the economy cycles like a sine curve. Note that I wrote about the current market cycle earlier this fall.

It seems that the financial firms that are always bullish believe that we are mid-cycle and that the party will continue for several more years before we see a slowdown and/or enter into a recession. And it is possible that they are right. I said ‘possible’, not probable. I find it highly unlikely that we are still mid-cycle. This current expansion has already lasted considerably longer than other post-war expansions. We’ll see what the Fed thinks after we get a glimpse at the Federal Reserve guidance on rates from their statement (if they offer so much).

So what does all this mean for investors?

If you believe that the economy is mid-cycle (and are willing to risk your money on it) then it makes sense that you should continue to be heavily invested in stocks. I’ve heard that some large brokerage firms are still projecting growth of 3% next yeare And, if they are right, that should be very positive for stocks.

If you believe that the economy is late-cycle, then you probably want to reduce your exposure to stocks because they are likely to decline over the next 3-6 months as the U.S. economy slows and moves toward recession.

Personally, I am managing money based on the assumption that we are in a late-cycle environment and that there is significant potential for loss (akin to the 2000-2003 and 2008 environments). As you could probably guess, I am not heavily invested in stocks. I believe caution is warranted.

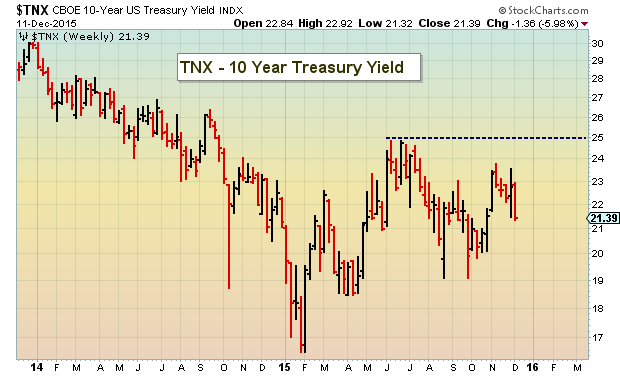

Here’s one final look at the 10 Year US Treasury Yield and the S&P 500 as we near what may be a historic Federal Reserve meeting.

10 Year US Treasury Note Yield

S&P 500 Index

Thanks for reading.

Further reading from Jeff: The Federal Reserve Conundrum: Will They Or Won’t They?

Twitter: @JeffVoudrie

Author holds various long positions in TLT and EDV at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.