The financial press and related blogs are packed with tales of worry about the record low VIX Volatility Index (INDEXCBOE:VIX) levels.

With the move below 10 last week, it prompted no less than five full length articles on the Wall Street Journal. Writers worried that we should “Fear the Stock Market’s Lack of Fear” while others argued that we should “Fear not the Fear of Complacency in the Markets”.

But I believe that several major news outlets struggled to explain the low VIX. While it makes sense that a market with low actual volatility would have low implied volatility (which drives the options premium in SPX puts that the VIX reflects), some are wondering whether investors are using other means to hedge downside risk, such as getting long Treasuries, an asset class traditionally negatively correlated to equities. But most writers are worried that, with the increase in volatility ETPs, the short volatility trade is an accident waiting to happen.

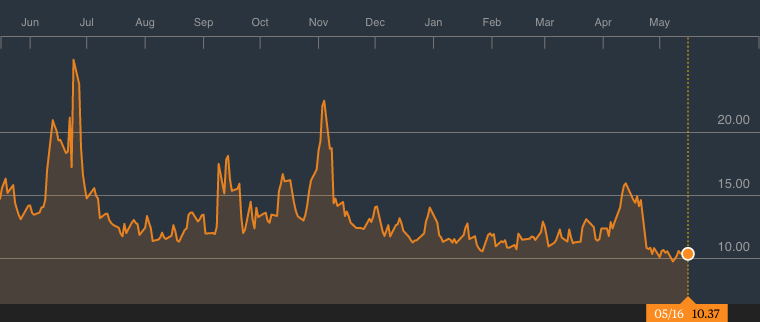

VIX Volatility Index (VIX) Chart

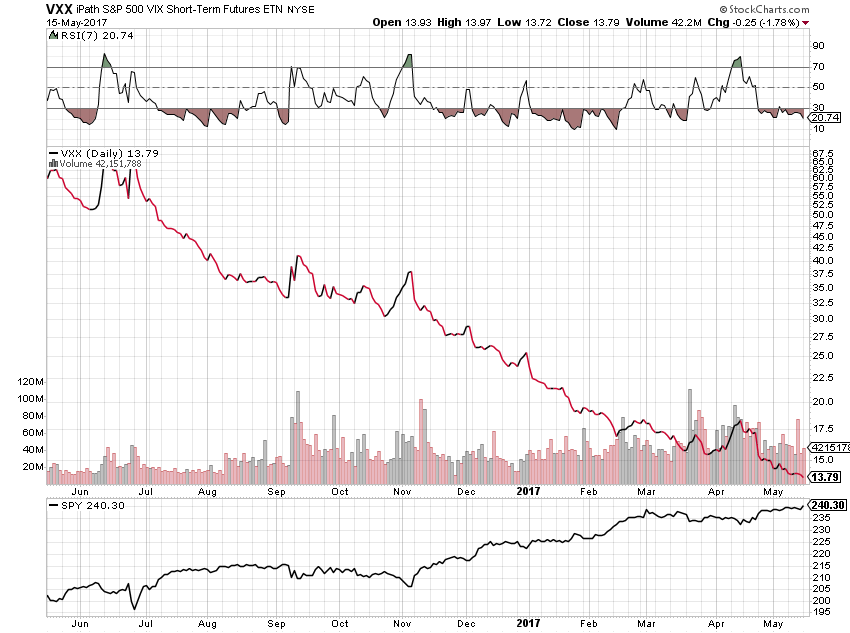

While these articles are all interesting forays into market structure and trader psychology, none of them touch on the most important aspect of a short volatility trade (or any trade for that matter) – no one holds these trades indefinitely. Everyone who takes a trade should have a clear rationale for entering the trade and a trigger to exit the trade. Perhaps you use a momentum measure or an RSI reading to go long the SPY (SPDR S&P 500) when the VXX (NYSEARCA:VXX) spikes and then recedes. Maybe you use the VIX futures curve or the CBOE skew measurement to determine when to sell out of the money VXX call spreads.

Regardless of your method of managing a short volatility trade, it is likely that you have a method to determine when it is time to get out of a short vol trade or even reverse and go net long volatility. By simply being short volatility at all times, your P+L will suffer immense drawdowns. But that doesn’t make short volatility an inherently bad or dangerous trade. It just requires care and attention, like any other position in your book.

Thanks for reading!

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

This post was updated at 6:07 pm removing the parentheses from title.