Tuesday is being dubbed interesting stock market chart day.

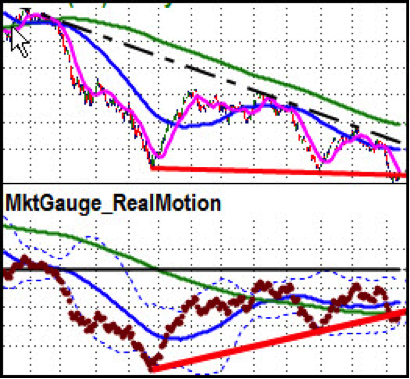

This chart is one that we use to in our Alpha Rotation trading strategy to assess the conditions of the market.

It has an interesting, but complicated tendency to lead or confirm stock market swings.

As a result, it’s current pattern is particularly interesting.

It’s a chart of the WOOD ETF NASDAQ: WOOD

It’s down 23% from its peak in June of 2018, but it may be time to pick a bottom.

It has a very big divergence in our Real Motion indicators, and if there is any reprieve of the global recession fears it could surprise traders to the upside.

The reason it’s so interesting is that if it were to bottom here, I would see it as a bullish sign for stocks.

It’s an early call for a “bottom”, but well worth keeping on your watch list.

Stock Market ETF Levels:

S&P 500 (SPY) Support at Monday’s low area, 287. Big support area is 280 to 277.70 (the 200 DMA). Resistance at today’s high, 291.14.

Russell 2000 (IWM) Support at today’s low area, 147.67. Next big support is 145.30. Resistance at 50 DMA 153.40

Dow (DIA) Support at Monday’s low area, 258.56. Next support levels are 252.50 and 247.Resistance around 264.50.

Nasdaq (QQQ) Support at Monday’s low area, 183.50. Swing low is at a trendline from the December 2018 low. Resistance at 190.70.

KRE (Regional Banks) Support around 50, then at swing low, 49.40 and 49.00. Big resistance at 51.70, then at 52 then 50 DMA around 53.

SMH (Semiconductors) Support at today’s low area, 109.30, then 108. Resistance at today’s high114.19, then 116.

IYT (Transportation) Needs to hold 179.25. Resistance at 186 then 191.

IBB (Biotechnology) Support at 104 which has been pivotal since April. Looks interesting if it can close over 107.

XRT (Retail) Next big support area is Dec. 2018 low at 38 area. Major resistance around 41.50.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.