The world’s largest retailer Walmart (NYSE: WMT) traded 10% higher on Thursday morning, after posting earnings that beat analyst estimates.

The company reported earnings per share of $1.29 and total revenue of $128 billion, above Wall Street expectations of $1.22 and $126 billion.

Walmart also raised fiscal year guidance from $4.75-5.00 to $4.90-5.05, as well as estimates for total sales and same store sales. This news has the stock rallying Thursday.

“We had a great quarter with strong results across the business. We’re aggressively rolling out grocery pickup and delivery in the US, and recently announced omni-channel initiatives in China and Mexico,” explained CEO Doug McMillon.

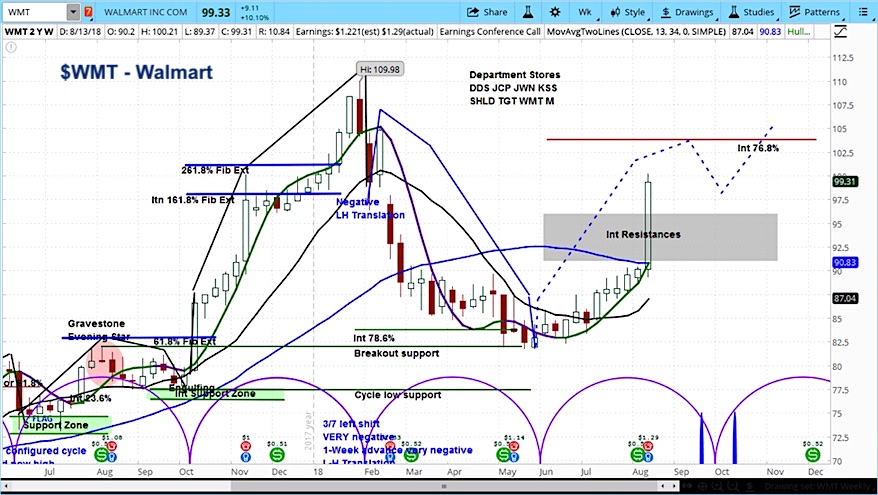

In analyzing the market cycles for WMT, we can see that it is still in the rising phase of its current cycle.

Walmart’s stock price gapped through our intermediate resistance, and now looks much healthier, after the previous cycle turned out somewhat bearish. Our near-term projection is $104, which is marked by the 76.8% Fibonacci retracement.

Walmart (WMT) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.