“I have ways of making money you know nothing about.” – John D. Rockefeller

Contradiction

Noun : con·tra·dic·tion \ ˌkän-trə-ˈdik-shən \

A situation in which inherent factors, actions, or propositions are inconsistent or contrary to one another – Merriam-Webster’s Dictionary

Investors and the media can’t seem to get enough of Warren Buffett. They hang on his every word as if he was sent from the heavens offering divine words of wisdom. Unfortunately, Buffett is a mere mortal, and like the rest of us, I believe he tends to promote ideals that benefit his self-interests over yours.

The purpose of this article is not to degrade Buffett, as I have a tremendous amount of respect for his success and knowledge.

In this article I look at a few recent statements and actions of Buffett’s to highlight some contradictions that lie in their wake.

My conclusion is that it is far better for investors to watch what “The Oracle” does as an investor rather than hang on his words.

This article also serves as a reminder that the most successful investors think and act for themselves. These investors are not easily persuaded to take action from others, even from the best of the best.

Buffett on Stock Buybacks

Warren Buffett has, for a long time stated that corporate stock buybacks should only occur when the following two conditions are met:

“First, the company has available funds— cash plus sensible borrowing capacity — beyond the near-term needs of the business and, second, finds its stock selling in the market below its intrinsic value, conservatively calculated.”

The quote above was from nearly 20 years ago, however based on more recent quotes his thoughts about buybacks remain the same. The following comes from a recent CNBC article:

At the 2016 meeting, Buffett said that buyback plans were getting “a life of their own, and it’s gotten quite common to buy back stock at very high prices that really don’t do the shareholders any good at all.”

“Can you imagine somebody going out and saying, we’re going to buy a business and we don’t care what the price is? You know, we’re going to spend $5 billion this year buying a business, we don’t care what the price is. But that’s what companies do when they don’t attach some kind of a metric to what they’re doing on their buybacks.”

Buffett added: “You will not find a lot of press releases about buybacks that say a word about valuation,” but he clearly believes they should.

Knowing his opinion of buybacks, let’s explore his own firm, Berkshire Hathaway (BRK/A). It turns out BRK/A is now “seriously considering” buying back their own stock. Given their cash and cash equivalent hoard of over $320 billion, such an action would seem to fit right in line with Buffett’s first qualification noted above. Unfortunately, the stock is far from cheap and fails his second test. Currently BRK/A trades at a price to book value of 145% and at a price to earnings of 28 (28 is considered a very high multiple for a company that has consistently grown earnings at a 4% clip over the last 8 years). Altering the firm’s buyback policy would require relaxing or eliminating Buffet’s price-to-book value requirement of “below 120%”.

“When stock can be bought below a business’s value, it is probably the best use of cash.”

The bottom line: Buying back BRK/A at a price to book value of 145% and P/E of 28 is clearly not the “best use of cash”, and the market certainly is not valuing BRK/A at “below intrinsic value.” To counter his contradiction, it would be nice if he either came out and said he has changed his opinion about the optimal factors promoting buybacks, or stated that BRK/A does not have reasonable opportunities to grow earnings and returning cash to shareholders is the best option.

In the end, Buffett is unreliable on this topic, and BRK/A does not make a habit of returning cash to shareholders. In the long history of the firm, they have only conducted a few very small share buybacks and only once issued a dividend of $0.10 in 1967. It seems to us he is feeding the buyback frenzy occurring in the market today and will likely avoid meaningful buybacks in BRK/A.

Buffett on Valuations : Market Cap to GDP

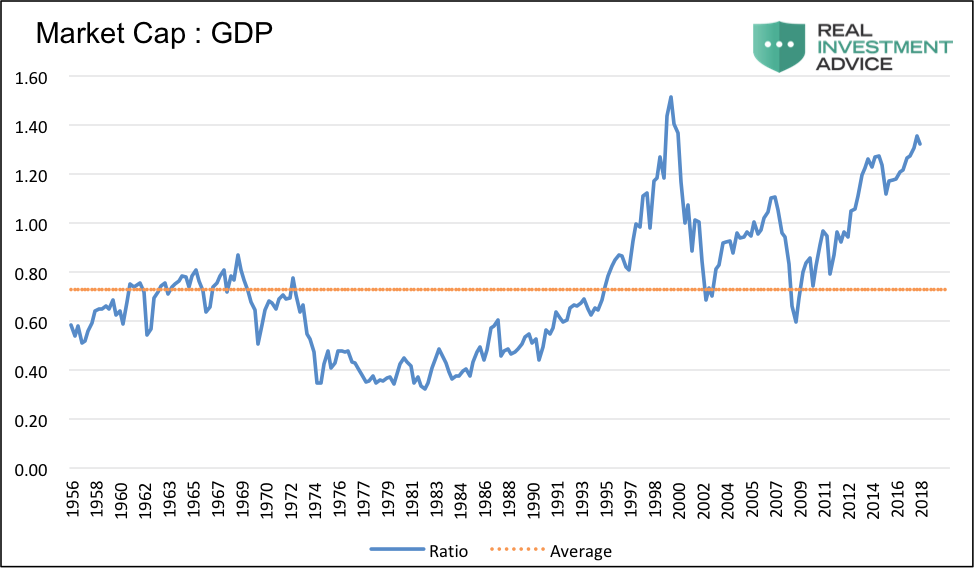

One of the most widely followed equity valuation gauges is what is commonly referred to as the Buffett Indicator. The indicator, Buffett’s self-professed favorite, is the ratio of the total market capitalization to GDP. Currently, as shown below, the indicator stands at 132% and dwarfs all prior experiences except the final throes of the Tech boom in the late 1990’s.

The following section highlighted in orange is from a recent article entitled Would You Rather with Warren Buffett by Eric Cinnamond:

Question to Warren Buffett: “One of the things you look at is the total value of the stock market compared to GDP. If you look at that graph it’s at a high point, the highest it’s been since the tech crash back in the late 90’s. Does that mean we’re overextended? Is it a better time to be fearful rather than greedy?”

Eric Cinnamond (EC): What a great question, I thought. I couldn’t wait for his answer. Let him have it Warren! It’s your favorite valuation metric flashing red – tell everyone how expensive stocks have become! I was very excited to hear his response. Buffett replied,

Warren Buffett (WB): “I’m buying stocks.”

EC: But in 1999 when this valuation was actually less than today he said this…

WB: “Let me summarize what I’ve been saying about the stock market: I think it’s very hard to come up with a persuasive case that equities will over the next 17 years perform anything like–anything like–they’ve performed in the past 17. If I had to pick the most probable return, from appreciation and dividends combined, that investors in aggregate–repeat, aggregate–would earn in a world of constant interest rates, 2% inflation, and those ever hurtful frictional costs, it would be 6%. If you strip out the inflation component from this nominal return (which you would need to do however inflation fluctuates), that’s 4% in real terms. And if 4% is wrong, I believe that the percentage is just as likely to be less as more.”

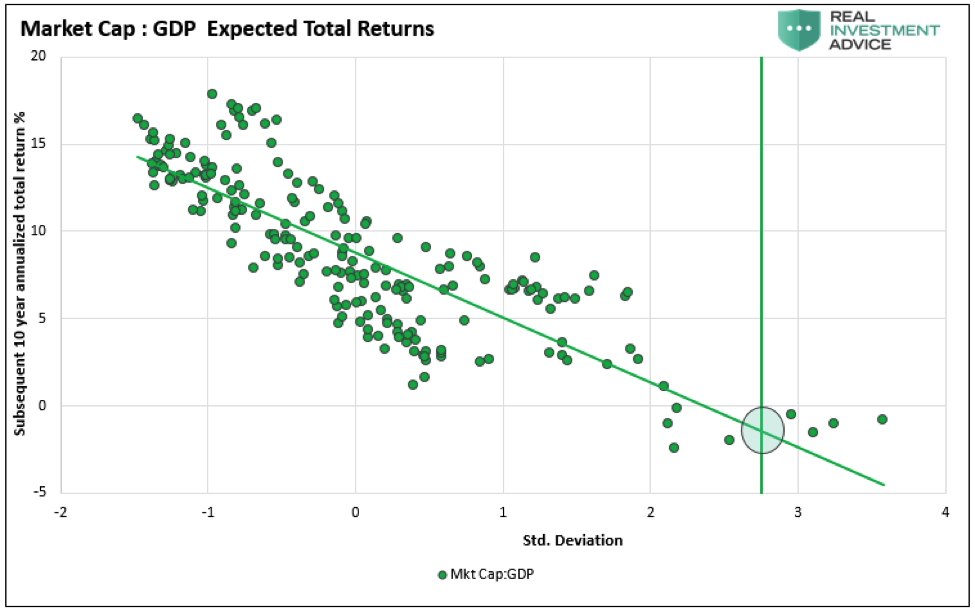

My take: Stocks are far from cheap. Based on Buffett’s preferred valuation model and historical data, as depicted in the scatter graph below, return expectations for the next ten years are as likely to be negative as they were for the ten-year period following the late ‘90’s. To read more about this graph click on the following link –Allocating on Blind Faith.

The article provides a glimpse of the value added in our new service RIA Pro.

The more compelling question for Mr. Buffett is not whether or not he generallylikes stocks but whichstocks he likes. As a value investor, he ardently discriminates on price within the context of which companies operate with unique pricing power. This characteristic, more than any other, best defines Buffett’s investment preferences.

continue reading on the next page…