“History has not dealt kindly with the aftermath of protracted periods of low risk premiums” – Alan Greenspan

The ability to see beyond the observable and the probable is the most important and underappreciated characteristic of successful investors.

For example, visualize a single domino standing upright. With this limited perspective, one can establish what the domino is doing in the present and form expectations around what might happen if the domino falls. However, by expanding one’s viewpoint, you may discover the domino is just one in a long line of dominoes standing equidistance from each other. The potential chain of events caused by the first domino falling now offers a vastly different outcome. Many investors myopically focus on the trends of the day and fail to notice the line of dominoes, or what is technically known as multiple-order effects.

Since the Great Financial Crisis of 2008, maintaining animal spirits has been a primary goal of the world’s central banks. The crisis proved a brutal reminder that, in this new era of significant leverage, a loss of investor confidence can result in violent reactions that ripple throughout the financial markets and the global economy. By employing extraordinary policies and optimistic narratives, the central banks have persuaded the public to believe that all is well. They have successfully focused the investor on one domino.

As investors, we are negligent if we follow the Fed’s lead into this complacent stupor. By prodding economic growth with unproductive debt and reigniting asset bubbles, the central banks have simply done more of what created the spasms of 2008 in the first place. Despite the markets calm façade and historically low perception of risk, the vast chasm that lies between perceived risk and reality is troublesome.

Implied Volatility

Implied volatility is a well-followed measure of expected price change. The metric, derived from the prices of put and call options, can be thought of as the amount of risk that investors expect to occur between today and a specified expiration date. Bullish periods are most frequently categorized by low implied volatility, while bearish periods tend to have elevated levels of implied volatility.

Chris Cole of Artemis Capital has a broader definition of volatility – “(volatility) is the difference in the world as we imagine it to be and the world that actually exists.” Think about his quote carefully before reading on.

In the investment sphere, Cole’s statement can be boiled down to the contrast between the consensus mindset investors hold to explain the current state of economic activity, fundamentals, market valuations and implied risks versus the reality encapsulated by those metrics. While no one can quantify “the reality”, the wider one perceives the difference between implied volatility and reality, the greater the opportunity present in the market.

Since the 2008 crisis, and especially over the last three years, implied volatility has been abnormally low more often than not. In other words, investors believe the risks of a significant downdraft in stock prices is relatively minimal. This by no mean indicates that the actual risks investors face have decreased per se, just that the financial gauges constructed on investor positioning claim that to be the case.

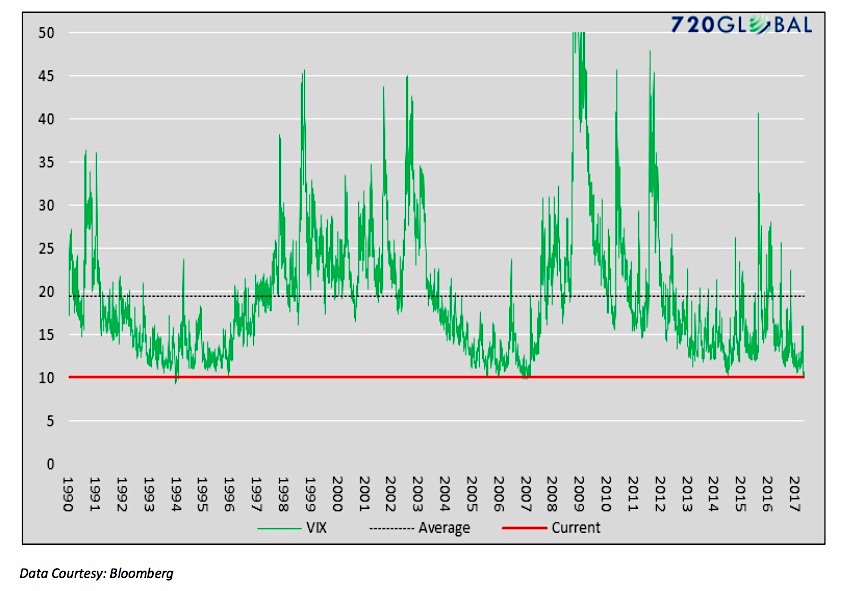

The graph below plots implied volatility via the VIX Volatility Index (INDEXCBOE:VIX) for the S&P 500 Index (INDEXSP:.INX) since 1990.

Currently implied volatility is at a level that has only been experienced 0.22% of the time since 1990 and is almost half of its longer term average.

Some of the primary reasons for this abnormally low level of implied volatility are:

Monetary Policy and the Federal Reserve (FED): The FED’s recent monetary policies, including a near zero percent Federal Funds rate, have resulted in increased financial leverage and increased demand for securities. This occurred as the Fed removed $3.5 billion of U.S. Treasury securities from the market through Quantitative Easing (QE), further affecting supply-demand curves. As a consequence, the prices of many fixed income securities have risen sharply and yields and yield spreads hover near all-time lows.

It is worth mentioning that, at times when the stock market has dipped, the Fed has been vocal about their ability to take more aggressive action. As a result, investors believe the Fed will “not allow” the equity market to decline by much. The “buy the dip” strategy reflects this mindset.

Share Buybacks: Since 2012, 94% of S&P 500 companies participated in buybacks while all U.S. corporations spent over $2 trillion in precious cash over that time period. Meanwhile, total U.S. corporate profits over the same time frame rose only $14 billion. Reinforcing the “buy-the-dip” mentality, corporations tend to increase their pace of repurchases during periods when the market pulls back. An additional benefit of share repurchases is the purely optical effect on valuation measures like price-to-earnings. Although nothing material about a company’s long-term growth prospects change (indeed, prospects are arguably hurt by imprudent use of cash), buybacks afford the cosmetic appearance of improved operating performance which triggers additional demand or eases investor concerns.

Volatility Trading: Through VIX futures contracts and a multitude of long and short volatility ETF’s, the popularity of volatility as an asset class has increased dramatically in recent years. VIX traders are emboldened that volatility has risen for short periods of time but regresses toward or below its mean. This predictable behavior has made shorting volatility an attractive trade, especially during market drawdowns when VIX spikes higher. Again, such action strengthens the buy the dip reflex. Contributing to lower than average VIX levels is the upward sloping term structure of forward VIX futures contracts (known as contango). Trades which take advantage of this upward slope have made shorting volatility profitable even when the VIX is not elevated. An important dynamic in VIX trading is that as volatility falls, profit-seeking traders must increase the size of their positions to generate the same income as they did when the VIX was at a higher level. Doing so, however, clearly raises the potential risk of loss for these positions.

Passive Mentality: Historically-low fixed income yields have tempted investors to take on more risk. In part, this so-called “chase for yield” has led to a herding mentality. Investors have been flocking to securities, industries and indices that exhibit strong momentum, not necessarily commensurate fundamentals. Also growing is the popularity of passive investment styles. As we discussed in Passive Negligence and Passive Negligence II, the overwhelming demand for passive index funds has led many investors to eschew appropriate security evaluation. As a result, investors have bid up prices of some stocks to valuations that are well above historical norms.

Noted value investor Seth Klarman described it this way in his recent letter to clients: “One of the perverse effects of increased indexing and ETF activity is that it tends to ‘lock in’ today’s relative valuations between securities. Thus today’s high-multiple companies are likely to also be tomorrow’s, regardless of merit, with less capital in the hands of active managers to potentially correct any mispricing’s.”

The factors listed above, coupled with cheerleading from the media, Wall Street and the Fed, have led to a behavioral state best labeled as “animal spirits.” The term, introduced by John Maynard Keynes, is a way to say that human emotions have resulted in greed. When animal spirits run rampant, confidence trumps fundamentals, historical valuations, and poor risk/reward profiles. Janet Yellen’s husband, George Akerlof, literally wrote the book on animal spirits. Along with fellow author Robert Shiller, he wrote Animal Spirits to document how important human psychology is in driving desired market and economic results. In Fed Up, by Danielle DiMartino Booth, the Dallas Fed insider stated the following: “and yet here was the Fed, with Yellen as its biggest cheerleader, once again trying to build an economic recovery on the back of frenetic animal spirits.” Our review of Danielle’s book can be found here (link).

The four broad factors discussed above coupled with low but stable economic growth have temporarily sated investors’ desire for economic stability and, in turn, market confidence. While this may appear well and good, we must consider what lies underneath the cloak of stability.

continue reading on the next page…