Verizon has taken a beating lately having dropped from $54.80 down to $48.40, a decline of 11.7%. Verizon has long been a favorite for dividend hunters and this recent decline has seen the yield on the stock rise to 4.7%. That is sure to attract some interest shortly.

Dividends have long been proven to generate a large portion of total stock market returns and Verizon has been a buy and hold safe haven for years.

One analyst believes Verizon is “the very model of a stock you buy for income…. This means when the stock becomes oversold… you buy. Then you hold and enjoy the yield.”

Verizon recently reported earnings that disappointed the markets. Their Q4 EPS of $0.86 fell short of estimates by $0.03. However, the company did report a 1.9% growth in wireless retail connections.

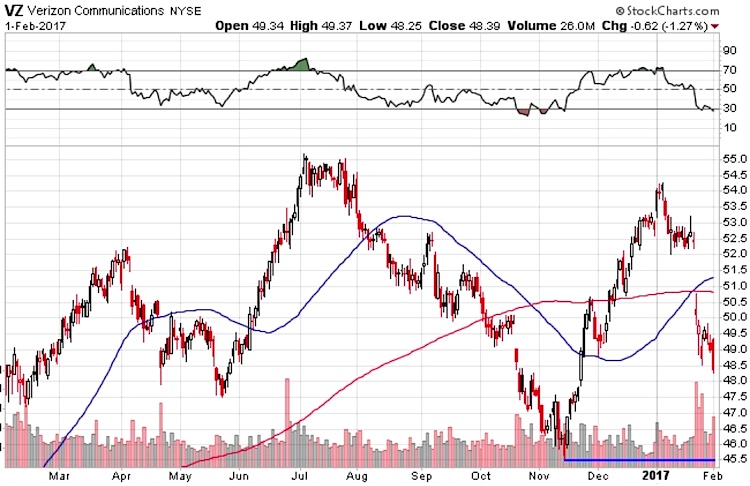

The chart of Verizon does not paint a pretty picture. The recent gap lower has seen the stock drop below the 200 day moving average. Generally this is a bad sign and something that may prevent money managers from investing in the stock.

There is a clear level of support at $45.50 so the stock should stay above that level in the short term.

Verizon Stock Chart (VZ)

Cautious investor may want to wait for the recent selloff to play out before jumping in.

One way to do this is by selling cash secured puts.

The April 21, 2017 $47 puts are currently trading for $1.06. Investors willing to buy Verizon for $47 can sell this put and only need to take ownership of the stock if it falls below $47 by April 21.

If Verizon closes above $47 on April 21, the investor keeps the premium and can sell another put, or move on to another opportunity. By keeping the $1.06, the investor would made a 2.26% return in less than 3 months which equates to 10.55% per annum.

If Verizon does drop below $47 and the investor is forced to purchase the stock, the effective purchase price is $45.94 thanks to the option premium received. This brings the effective yield to 4.95%, not paid in this era of low yields.

Options trading involves risk and is not suitable for some investors. Check with your financial advisor before making any investment decisions. Thanks for reading.

Twitter: @OptiontradinIQ

The author has a position in Verizon stock (VZ) at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.