Vinny-“The UTES are back!!” Judge- “Did you just say UTES??” Vinny-“ Oh excuse me, your Honor, Utilities”

Yes, Utilities are back with a vengeance alright, as the year that couldn’t get any stranger drags on, leaving investors underperforming and shaking their heads in disgust and regret.

This market remake of the popular line from the movie “My Cousin Vinny” is certainly apropos at a time when global bond yields are plummeting and the hunt for yield is on. World Government bond yield index hit a record low of 0.7539 % on Wednesday, based on the Citigroup index comprising 23 countries. Negative interest rates amidst plummeting long bond yields on growth concerns might not seem like the right environment for rate hikes, but they’re certainly advantageous to yield hungry investors who can capture yield through select utilities stocks and/or the sector.

Performance-wise, the Utilities sector through 6/9/16 had outperformed all other S&P 500 GICS Level 1 groups Year-to-Date, with returns of 16.27%, swamping the S&P 500’s (SPX) 3.5% return. On a 12-month basis Utilities are leaders as well, thumping the next best sector (Consumer Staples), by over 600 bp, at 19.66%. Who would have thought this group could outperform when SPX lies within <1% of All-time highs?

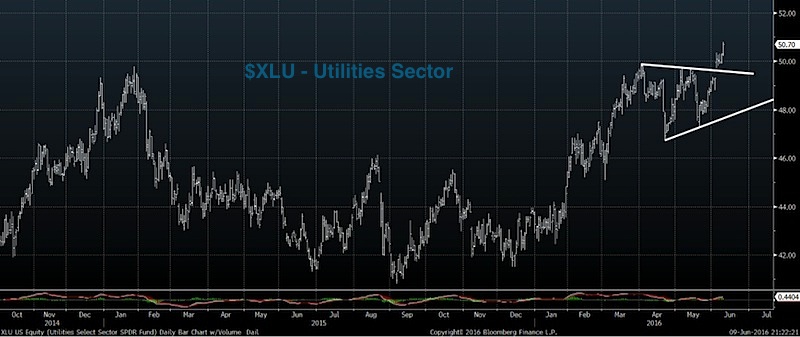

Technically speaking, this group remains one of the best Technical groups to own right now, and looks to continue higher in the weeks and months ahead. Daily XLU charts show prices having just broken back out to new high territory in the last week following nearly a 18-month base, which many technicians including myself would label a “Cup and Handle” pattern. Momentum is not all that overbought given the three-month consolidation near the highs, and given this week’s technical breakout above $50 in XLU, higher prices are likely, targeting $53.50-$54.

Many might be loathe to touch the Utilities sector given concerns about high valuation, or interest rate normalization just beginning, and some investors feel that yields on the long bond should go nowhere but higher. Yet precisely the opposite is happening, and at least technically, it looks like another few months of outperformance and above-average relative strength is likely out of this group.

The second chart below highlights the relative relationship of the XLU vs the SPX which has also just broken out, exceeding an intermediate-term RELATIVE downtrend that’s been in place since February. So despite a good likelihood of stocks moving back to new high territory, we’re faced with a market where defensive groups look quite good with stocks on the cusp of all-time highs. {And you thought the POLITICAL scene was a little strange this year?? J)

For now, despite the ongoing market resiliency, Utilities look like a group to consider owning, if not for yield reasons, then for safety reasons at a time when uncertainty is at the forefront during the six-month period for stocks that’s historically sub-par between May and October. An added bonus of course is that technically the group remains attractive, and might continue to offer above-average outperformance in the months ahead given the sharp global downtrend in place for Bond yields. Stocks to consider technically include PCG, WEC, CMS, NI, and NRG, the latter which has the unusual honor of going from worst to first, having underperformed all other 29 members which make up the XLU over the last 12 months with a -30.47% return, while OUTPERFORMING all other 29 XLU constituent members on a YTD basis, with returns of 40.95%. {And you thought the UTES were dull and boring?? }

Twitter: @MarkNewtonCMT

Author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.