How much is a business worth? Well, basically what you are willing to pay for it. Fortunately, there are some straightforward ways to assist you to determine the value; these are the Asset Valuation Method, Discounted Cash Flow Method and the Dividend Valuation Model. Over my next few articles we’ll look at each in turn, pointing out the obvious problems. For illustrative purposes, we’ll look at Caterpillar’s (CAT) balance sheet. I do not have a position in CAT.

How much is a business worth? Well, basically what you are willing to pay for it. Fortunately, there are some straightforward ways to assist you to determine the value; these are the Asset Valuation Method, Discounted Cash Flow Method and the Dividend Valuation Model. Over my next few articles we’ll look at each in turn, pointing out the obvious problems. For illustrative purposes, we’ll look at Caterpillar’s (CAT) balance sheet. I do not have a position in CAT.

Asset Valuation Method

There are a couple of advantages to the asset valuation method: the valuation is easily calculated and is a good starting point for negotiations as the minimum value can be determined. On the downside, the balance sheet depends on accounting conventions which may give values very different to a market valuation, and, most crucially, any future profits are not included in the valuation. Another obvious flaw in this method is that intangible assets are not always considered; therefore the valuation will be low. In this regard, this method is more useful for capital intensive rather than service industries.

It is also worth remembering that you may be purchasing the equity or the assets and liabilities. If it is the former, deduct borrowings.

The Methods

The first alternative option is to look at book value. The obvious problem with this method is that there can be inconsistencies in depreciation policies, some assets may be included in the balance sheet at well above their real value and there may also have been inconsistencies in asset replacement or the way in which they have been written down. Essentially, this method is of very little use.

Secondly, we can look at replacement value. Can’t give an indication of what this would be for CAT but it is apparent that this method may be considerably more realistic than book value and will be of value if you were taking the business on as a going concern.

The third option under asset valuation is to look at the break-up value. This method is probably best for the sellers as it would be a good indication of a minimum value of the enterprise. Arriving at a definitive value may be difficult in practice though as other factors such as the timescale to sell the assets and the market for the assets would have a material impact.

We’ll now consider CAT:

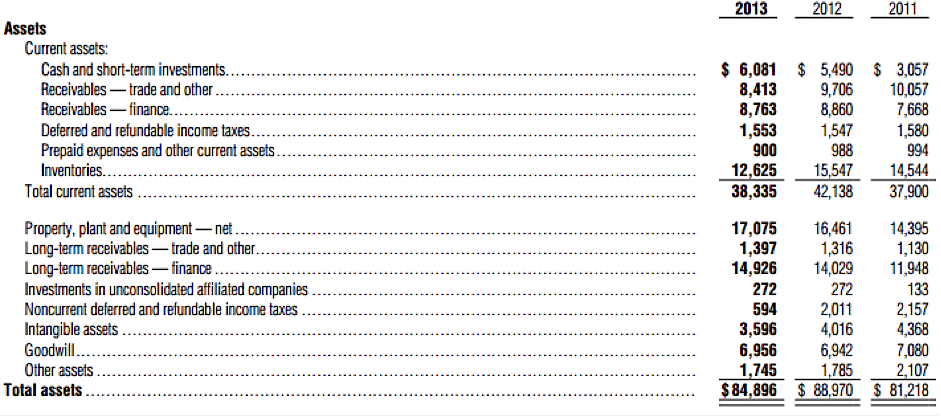

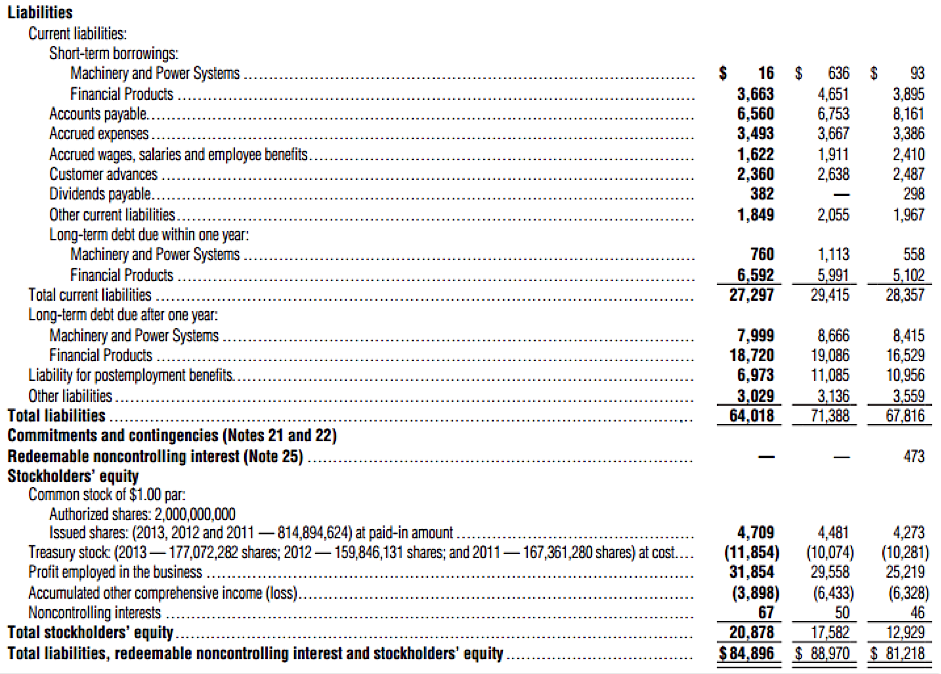

Figure1: Caterpillar – proxy statements

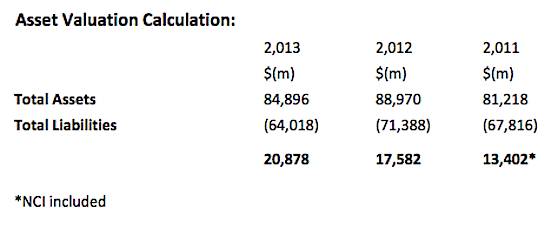

Figure1: Caterpillar – proxy statements  As you would expect, the asset value equals stockholders’ equity.

As you would expect, the asset value equals stockholders’ equity.

The Market Cap on June 3, 2014 was $65,340.35m, illustrating how the Asset Valuation Method provides a much lower value and indicates to us that the assets on the balance sheet are only one aspect of a company’s worth and that this method is not particularly suitable.

Having calculated an asset valuation for CAT, in my next article we’ll look at ways in which we can calculate the intangible value (CAT valued theirs on their balance sheet) and then move onto the other methods, which may provide a more realistic view.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.