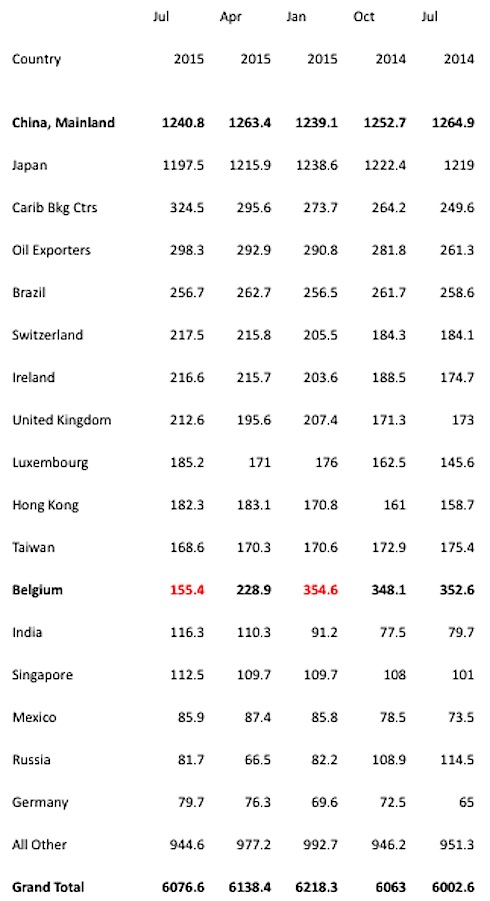

The chart below is one piece of data that helps inform my current investment decisions. At the beginning of the year, Belgium was the 3rd largest holder of U.S. Treasury bonds. This puzzling piece of news is explained by the presence of Euroclear Bank SA, a clearinghouse for U.S. Treasuries that is based in Belgium. Central banks are often secretive, and China was buying treasury bonds through Belgium for many years to disguise their purchases. As you can see, they have sold $200 billion of U.S. Treasuries since the beginning of the year.

I believe this makes U.S. Treasuries very attractive, even though they might continue to experience short-term downward pressure. The reason China is selling is because their currency is overvalued and their corporations are no longer generating enough cash flow to cover dollar-denominated debt obligations. So Treasuries will see downward pressure in the short term, but ultimately China’s slowdown will likely get worse, either through a debt crisis or further devaluation or both. This is bearish for global risk assets – stocks –and bullish for global safety assets – U.S. Treasury bonds.

Foreign Treasury Holdings – in billions

Foretelling the direction of markets is a famously difficult task, so I continue to position portfolios based on long-term diversification strategies, and the needs of each individual client. However, this data does influence which risk assets I choose to buy, and which safety assets. For example, a further yuan devaluation would likely lead to further commodity declines, so I do not yet think it is a good time to buy oil company stocks or emerging market stocks with generally high commodity exposure.

Thanks for reading.

This material was prepared by Greg Naylor, and all views within are expressly his. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index. The information is based on sources believed to be reliable, but its accuracy is not guaranteed.

Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Listed entities are not affiliated.

Data Sources:

- www.standardandpoors.com – S&P 500 information

- www.msci.com – MSCI EAFE information

- www.barcap.com – Barclays Aggregate Bond information

- www.bloomberg.com – U.S. Dollar & commodities performance

- www.realtor.org – Housing market data

- www.bea.gov – GDP numbers

- www.bls.gov – CPI and unemployment numbers

- www.commerce.gov – Consumer spending data

- www.napm.org – PMI numbers

- www.bigcharts.com – NYMEX crude prices, gold and other commodities

- https://www.bloomberg.com/news/articles/2014-07-27/china-hides-treasury-buys-in-belgium-chart-of-the-day – Article referencing Euroclear Bank SA

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.