The gradual reopening of the economy with little evidence of resurgence in the virus has bolstered investor confidence.

The popular averages gained more than 3.0% last week with the NASDAQ up 2.2%.

The April/May stock market performance was the strongest monthly back-to-back gains since 2009.

Projections for the U.S. Economy

Consensus estimates are that the economy will bottom in the second quarter leading to modest gains in the third and fourth quarters. Jobless claims exceeded two million last week to a total of forty million since February.

Some relief was found in the report that the number of new claims has gone down indicating that the unemployment rate may have peaked in May.

The Reuters/University of Michigan Survey in May showed a small uptick in confidence, suggesting consumer sentiment has stabilized. There has also been a notable rise in the consumer savings rate. This represents fuel for future spending and investing.

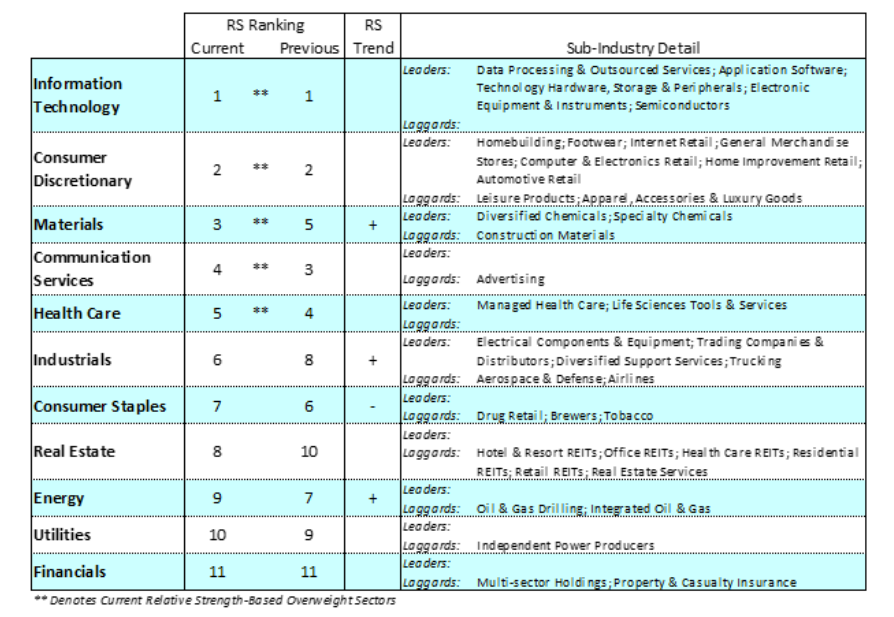

Stock Market Sectors

The past two weeks the stock market rally has broadened out to include small- and mid-cap stocks and cyclical sectors including financials and materials. The financial sector gained 6.5% last week versus 3.2% gain for the S&P 500 Index.

This is important for two reasons. Narrow based rallies are rarely sustainable and cyclical stocks, which are more closely tied to the economy, tend to lead the market higher because they react to positive trends in economic growth.

While we believe cyclicals will lead the market during this economic recovery, healthcare sectors and technology sectors should continue to be good defensive bets. In just a few weeks, companies all over the country converted to working from home and that trend is likely to continue. Businesses are transitioning their data and their communications to new cloud infrastructures. Tele-medicine will transform our healthcare system.

Stock Market Technicals

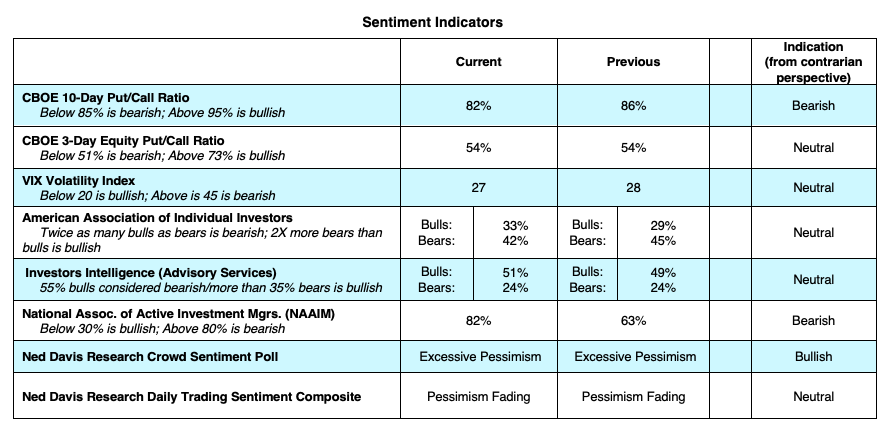

The S&P 500 broke through the key resistance level of 3000 last week. This is an important technical signal in that it is widely followed by stock market participants. The level usually serves as support for future gains. Based on the recent surge in the stock market, we expect to see a consolidation around this level until we see more positive developments on virus treatments.

The Bottom Line

It’s hard to believe that we are coming out of a full shut down in business and the stock market is approaching all-time highs. Investors may not be taking into account that the economy and corporate profits are going to be smaller and that the road to recovery may be long. There are concerns which could create volatility going forward – U.S. tensions with China, economic bad news, social unrest and a second wave of the virus.

However, when the Fed lowers interest rates to zero and injects massive amounts of money into the economy, the money looks for assets in which to invest. The Federal Reserve has indicated it will continue to stimulate the economy until such time as the economy returns to a healthy level of activity.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.