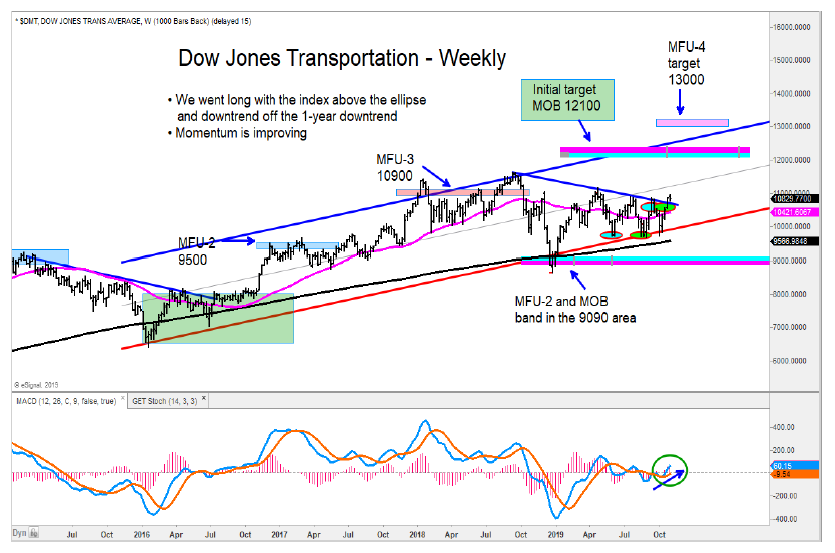

We reversed our short-term tactical sells for the S&P 500 Index INDEXSP: .INX and Dow Jones Transportation Index INDEXDJX: DJT as those indices have broken above their respective resistance zones.

Both the Russell 2000 and S&P Mid-Caps are on the cusp of doing the same.

The long-term trends remain intact, and we are looking for further upside in the weeks to come.

Below are my latest insights on the major U.S. Stock Market Indices:

U.S. Markets

– Our firm took off our tactical sells in the S&P 500, and the Dow Transports as those indices moved above their ellipse sell zones.

– The Russell 2000 and the Mid-Cap (MDY) are on the cusp of breaking above their resistance areas, which would turn these indices bullish.

– The long-term trends for these indices remain intact and bullish. We are navigating around the near-term swings to take advantage of an area to decrease or increase exposure.

– The S&P Regional Banking ETF (KRE) has formed a bullish Money Flow Unit. We would be buyers of the KRE and would be looking for individual stocks to get long as well.

– The SMH has rallied into a target zone from which we would expect a pause/pullback to occur. The long-term pattern is bullish, and we would be looking to be buyers on a pullback.

The author may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.