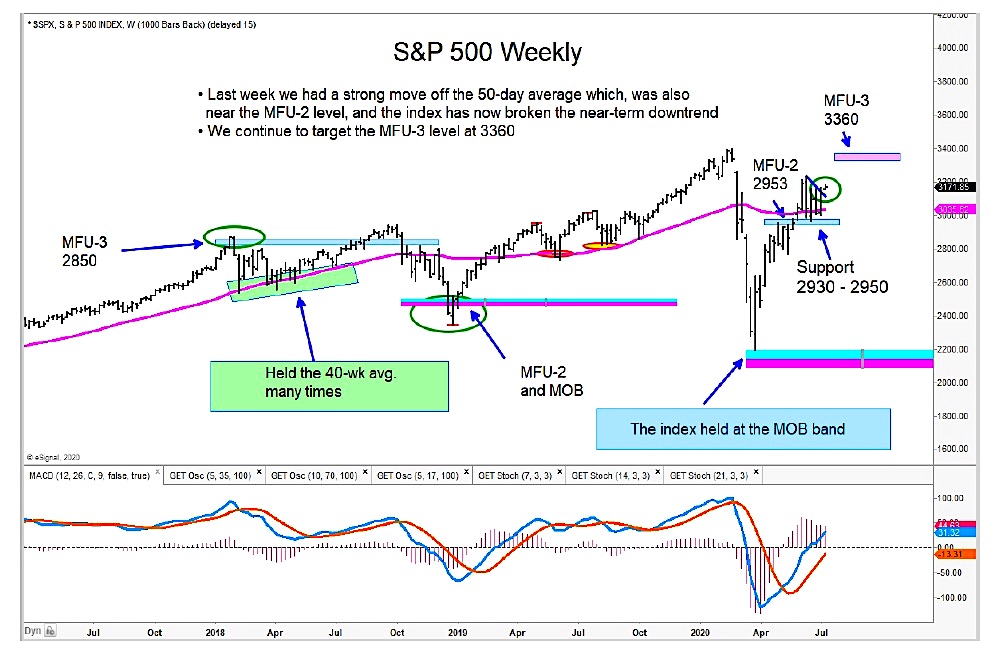

Last week, both the S&P 500 and Nasdaq Composite had a strong rally off support.

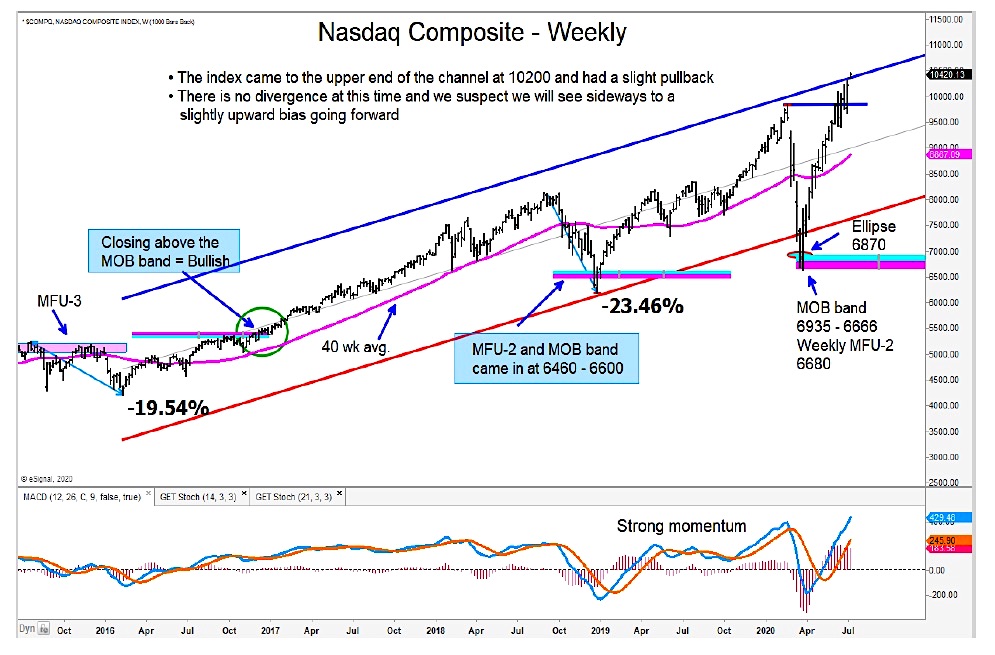

This week, the Nasdaq is finally approaching into the upper end of its channel and MOB target zone.

We don’t have any divergence at this time, so all we can say is that this is a zone for a pause for the Nasdaq.

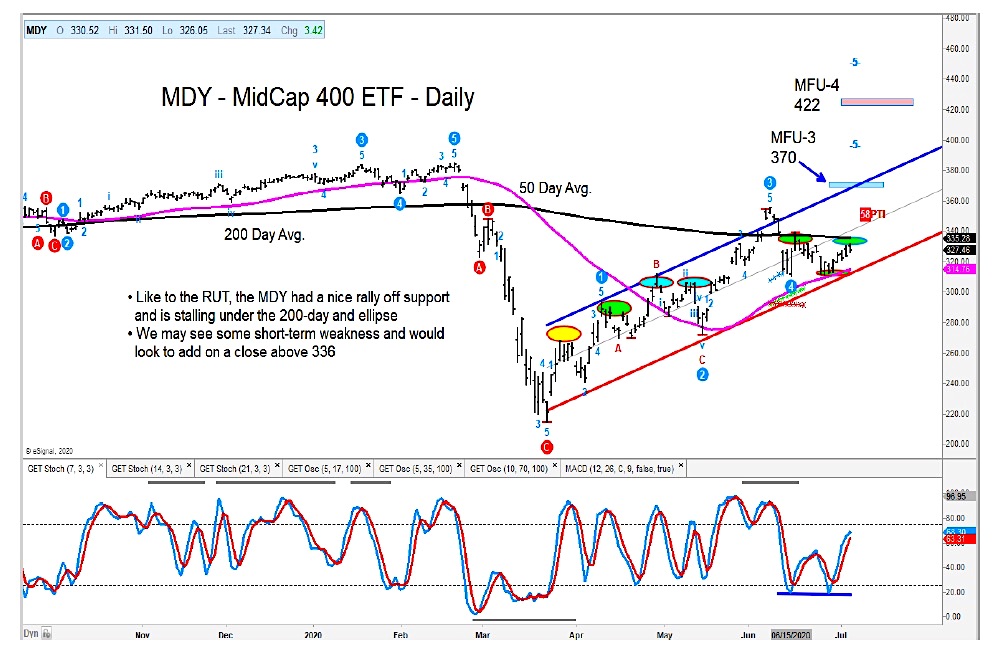

Both the Russell 2000 (RUT) and Mid-Cap (MDY) Indices had three consecutive days where the index closed on the lower end of the daily range giving a sense of struggle to push higher.

These two indices may have a short-term pause here before moving higher.

I would continue to avoid the Utilities as that group continues to trade in a weak position.

The ratio chart of the Momentum Factor ETF (MTUM) relative to the S&P 500 Low Volatility ETF (SPLV) has pushed above the June high, and I believe there is more to go.

I’d also like to highlight the U.S. Dollar Index (DXY), which is in a weak position and poised to move lower. On the other side of the ledger, we have the Euro poised to move higher.

The author may have position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.