The stock market is moving higher again with the S&P 500 Index and NASDAQ Composite reaching further into record highs. INDEXSP: .INX INDEXNASDAQ: .IXIC

It has been a big news week for the economy and for the stock market compliments of the Federal Reserve, the U.S. China “Phase One” trade deal and the United States Mexico Canada Trade Agreement.

Federal Reserve

The Federal Reserve met last week and agreed to hold its target rate steady, unless there is a meaningful change in the economic outlook.

The majority of Federal Reserve policy makers project no changes to rates in 2020, one 25 basis point rate hike in 2021 and one 25 basis point hike in 2022.

Although the Federal Reserve is on hold as far as rate cuts are concerned, central banks, including the Federal Reserve, are aggressively expanding their balance sheets providing $90 to $100 billion a month of support through June (Ned Davis Research) which is forcing liquidity into the markets and helping to move asset prices higher.

U.S. China Phase One Trade Deal

It has been reported that a Phase One trade deal between the U.S. and China was finalized last Friday. While this is purported to be a “skinny deal” with many initiatives far from being resolved, it does serve the purpose of suggesting the U.S. and China are taking baby steps in the right direction, and this may have a positive impact on business investment and CEO confidence.

United State Mexico Canada Agreement

The United States Mexico Canada Agreement is set to be voted on by the U.S. House of Representatives on Thursday and is expected to pass. This agreement will create 200,000 new jobs and will benefit all 50 states from Wisconsin dairy farmers who will have access to Canadian markets to Detroit auto manufacturers where it will be required that 75% of auto parts be built in North America, preventing offshoring of our auto industry, and much more.

The Economy, The Stock Market, Sectors

The drivers of the stock market in 2020 will, in our opinion, continue to be the Federal Reserve, the consumer and trade. The Fed has committed to an accommodative stance, the consumer is going strong (supported by job gains and wage growth) and trade with China, Mexico, Canada, Japan and a host of others is looking optimistic. Business investment and manufacturing may continue to struggle due to issues with trade but the strong consumer should help to offset that.

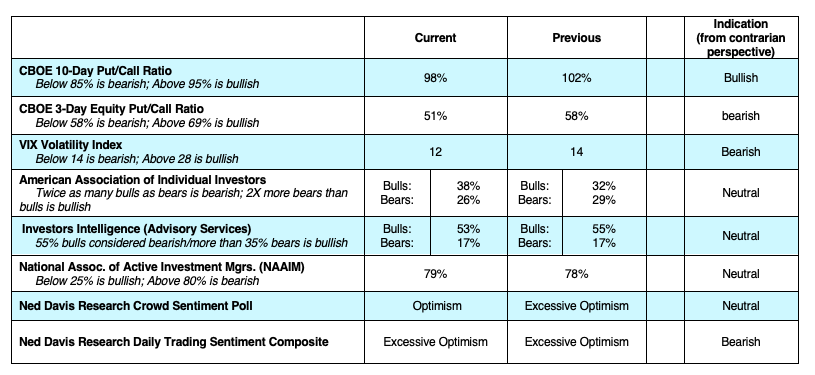

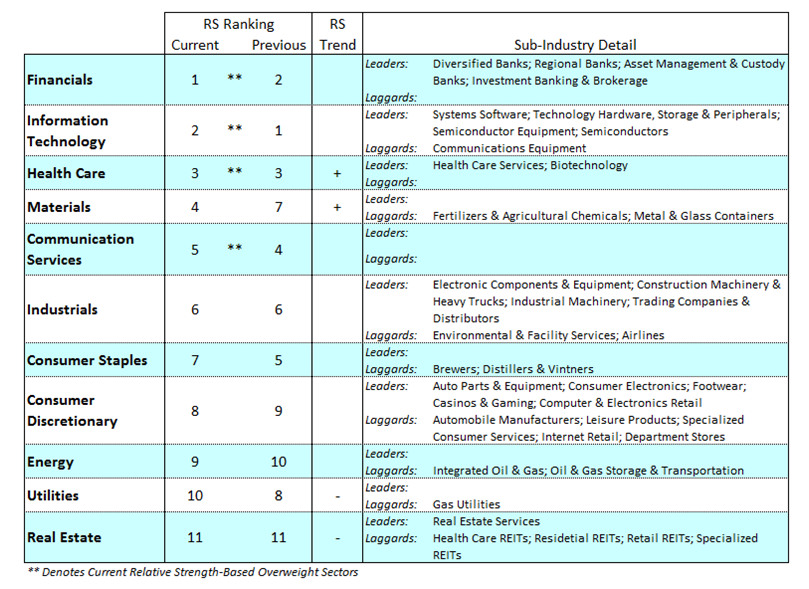

The markets are entering the 11th year of an economic cycle with slower growth expectations and investor sentiment optimistic (but not excessive). I think investors should stick with the strongest sectors in the stock market which are the industrials, technology and financials (all of which tell us the economy is getting better) and health care which is benefiting from the demographics of an aging population.

There may still be more room to buy investment grade bonds due to the fact that yields are negative across the globe and foreign investors are looking at our markets. Income-oriented investors may want to consider bond proxies, such as dividend-paying stocks.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.