The S&P 500 Index and the Dow Jones Industrials Average relinquished all the January gains last week as concerns escalated regarding the impact of the coronavirus on global growth.

It would be a futile exercise at this point in time to predict how this outbreak will impact the markets and the global economy. More importantly, we do not want to ignore the human tragedy that is taking place.

There is no doubt that China’s economy will be severely impacted.

Large numbers of stores have closed, transportation in certain regions has shut down and over 50 million people quarantined. Companies reliant upon supply chains in Asia have scaled back.

However, past history of viral outbreaks has not had sustainable long-term impacts on the global economy or financial markets.

There were other forces in play last week besides the coronavirus.

The Chicago Business Barometer, which measures economic activity in that region, posted the worst showing in four years. Additionally, there had not been a sell-off in the stock market in months and add the fact that the yield curve inverted (due to the recent flight to safe havens).

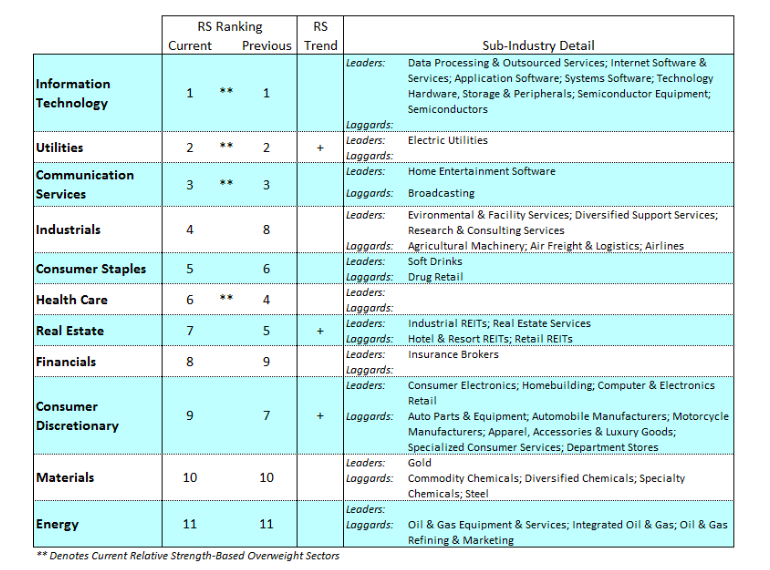

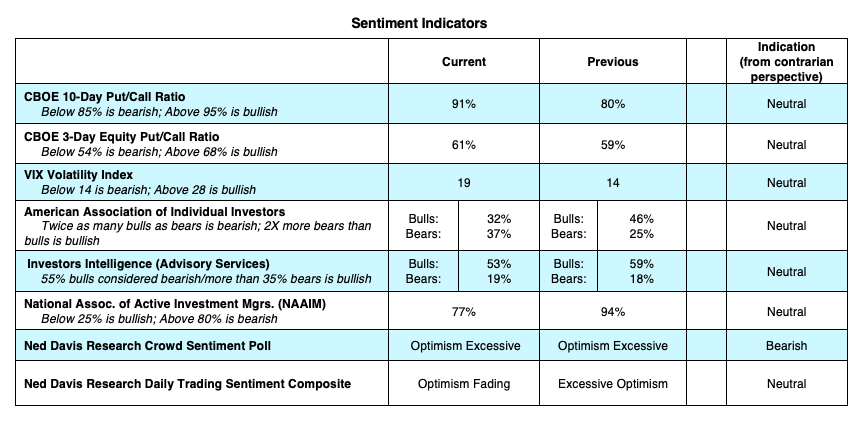

Valuations have been stretched and investor sentiment has been high. Consequently, the reaction from the stock and bond markets to the coronavirus uncertainty and the economic data has been what you would expect – responding last week with a broad-based decline. Only the communications sector and consumer discretionary sectors moved higher.

An exceptionally strong fourth quarter and positive economic and trade data had sent investor optimism soaring in early January. This was seen in the CBOE Volatility Index (VIX) which hovered near 12 for more than two months suggesting widespread complacency. On Friday, however, the VIX reached 19, an indication that the increase in volatility from last week caused investors to feel uncertain about the market, and from a contrarian standpoint, is a positive.

Additionally, last week’s steep decline erased the overbought condition that existed in January. On Friday the number of S&P 500 companies closing above their 50-day moving average fell from 80% two weeks ago to just 45%. A buy signal using overbought/oversold indicators is issued when the percentage of stocks trading above their 50-day moving average drops below 30%.

While we may see more downside if this virus escalates, the markets should stabilize and grind higher encouraged by a strong U.S. economy and a consumer who is doing well. Last week at the Federal Reserve Open Market Committee Meeting, Fed Chairman Powell reiterated that the U.S. economy will expand at a moderate pace and reassured investors that rates will remain on hold but that the Fed will be accommodative if the economy deteriorates.

Additionally, the fact that this is an election year means that the President will do whatever he can to ensure growth in the economy and the markets.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.