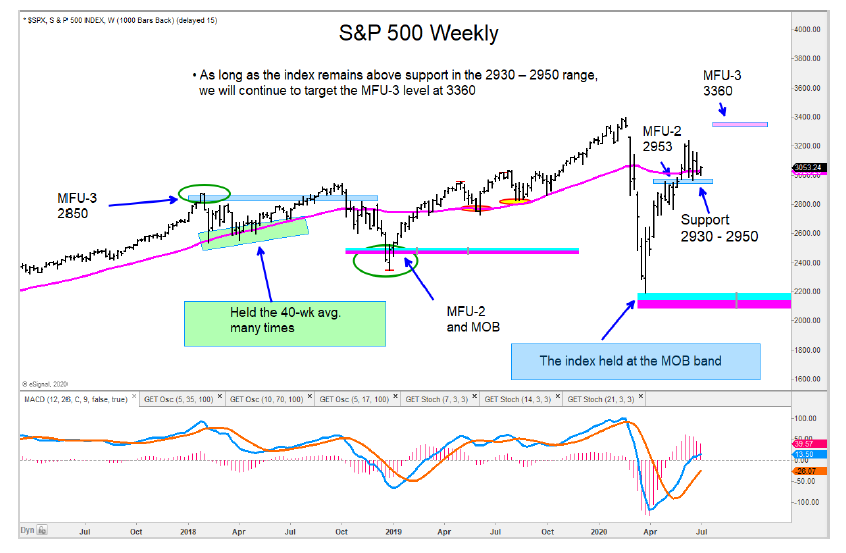

Last week’s orderly pullback had the S&P 500, Nasdaq Composite, Mid-Cap MDY, Russell 2000 and the Dow Transports turned up from support areas which are highlighted on the charts.

The Dow Utilities is notable, and remains in a weak position.

We would pay close attention to the small and mid-caps as we believe they will play catchup to the large caps should another rally play out.

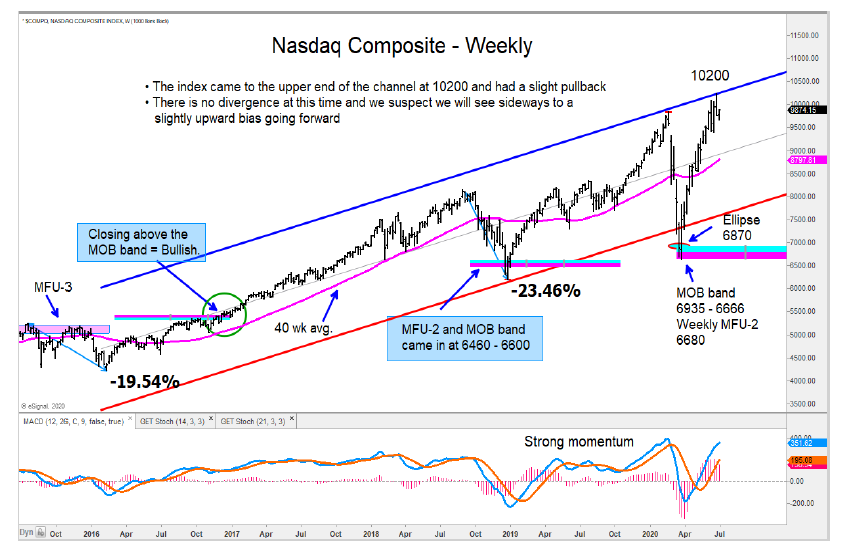

There is no momentum divergence for the Nasdaq Composite, and it has turned slightly down after hitting the upper end of the regression trend channel we have been highlighting.

We suspect we will see sideways price action and an eventual move higher.

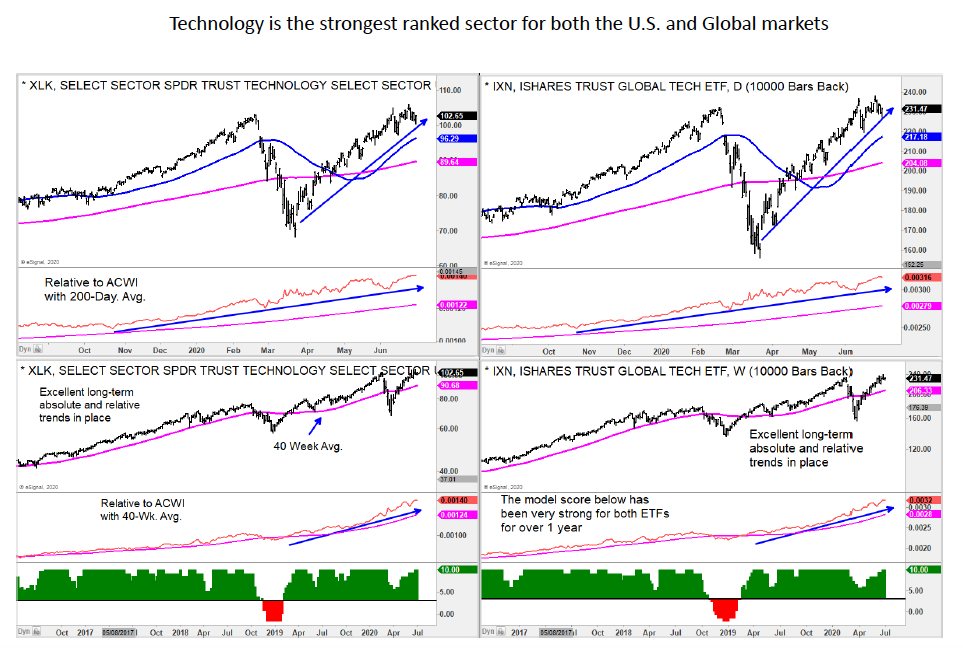

We highlight the SPDR Technology ETF (XLK) and the iShares Global ETF (IXN) as the strongest scoring sector. Both have solid absolute and relative trends in place.

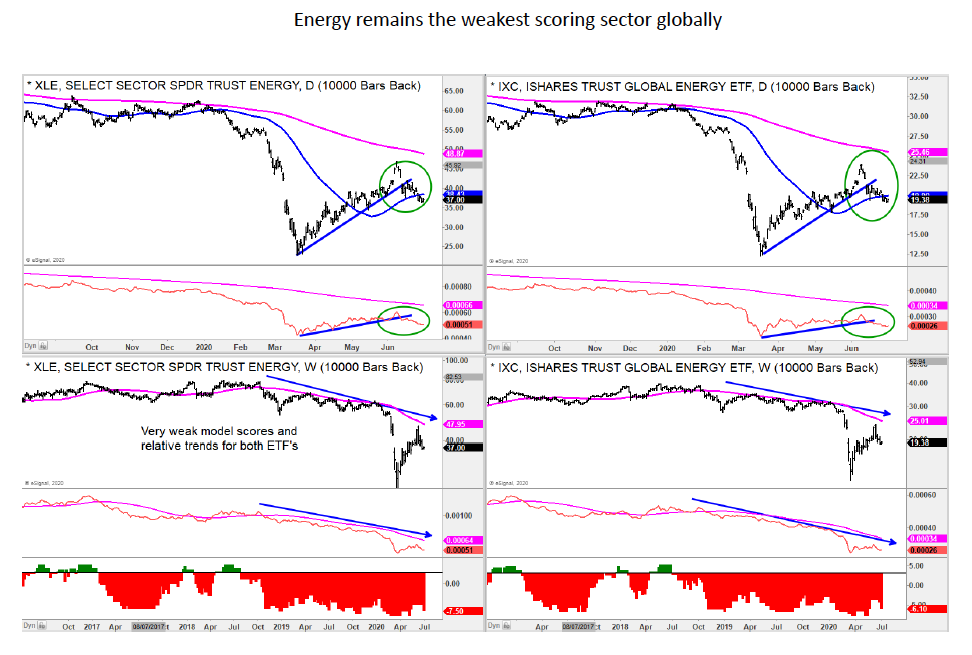

Energy ranks as the weakest sector globally.

The author may have position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.