The stock market experienced a pullback last Thursday and Friday as many of the largest-capitalized stocks underwent an expected correction.

The tech-heavy NASDAQ was down 3.3% for the week while the S&P 500 dropped 2.3% and the Dow Jones Industrial Average dropped 1.8%. Amazon, Microsoft, Apple, Facebook and Google comprise over 25% of the market capitalization of the S&P 500 Index.

Apple alone accounts for roughly 6% of the S&P 500. When these five stocks correct, it pulls the entire market down.

The reason for the pullback is likely a combination of factors.

Congress has failed to agree on a much-needed stimulus relief package. Dr. Fauci suggested a COVID 19 vaccine may not be available until later than expected – the end of the year or early next year. The political polls have recently suggested that we may have a too close to call unresolved presidential election on November 3 causing unrest at home and a lack of confidence in the U.S. from foreign investors. High valuations in the mega-cap stocks are stretched far beyond historical levels.

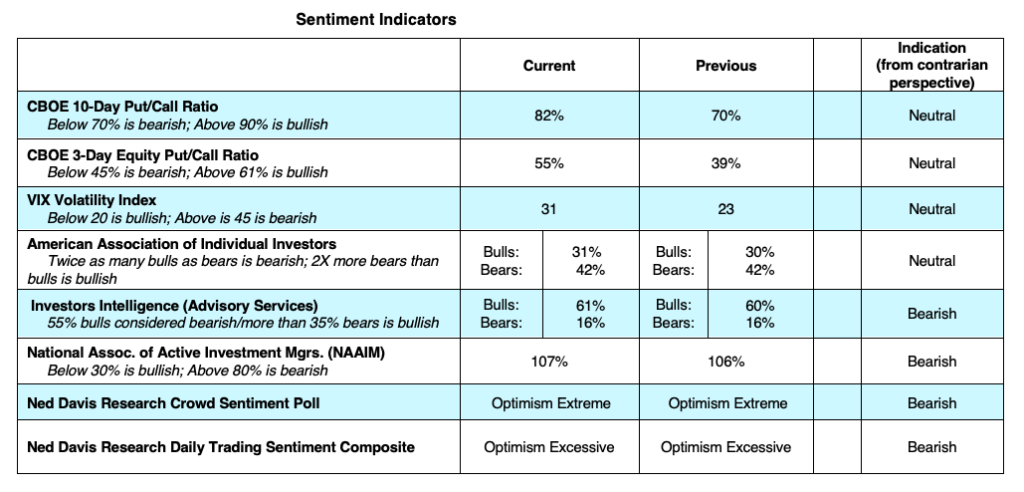

The technical indicators – high margin debt, fully invested mutual funds, CBOE options data showing record call volume, Wall Street letter writers at bullish levels — pointed to excessive optimism in the market which often suggests a consolidation/correction phase is likely.

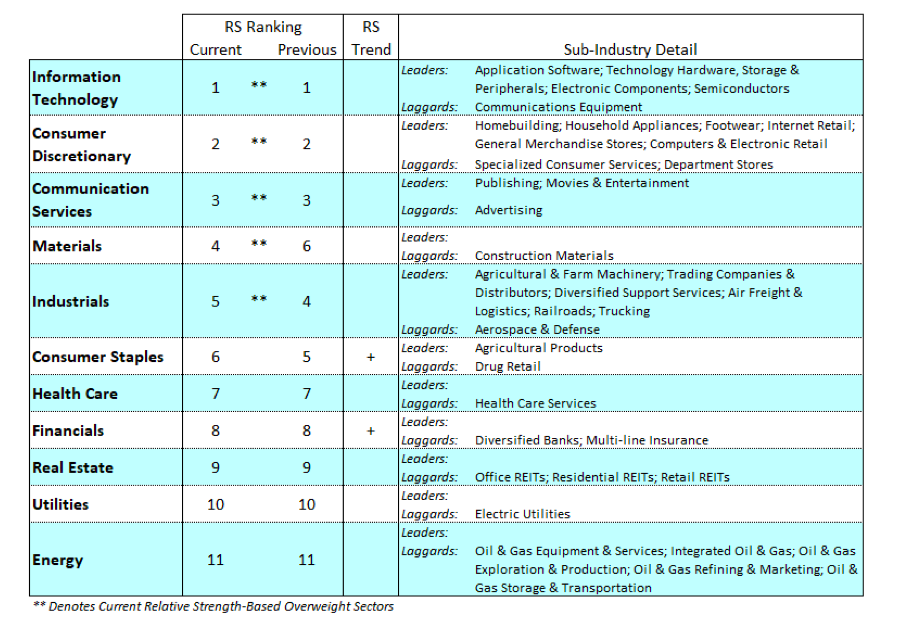

The above conditions still exist even after the recent pullback and we can expect to see further consolidation, but the good news is that there has been a broadening of the stock market outside of the tech sector. As the economy shows signs of improvement, the economically sensitive cyclical sector is exhibiting strength and the market may be beginning to see a rotation out of the large-cap growth stocks into stocks with cheaper valuations such as the mid-caps.

The strongest sectors of the market are information technology, consumer discretionary, communications, materials and industrials. The industrials sector hit a new recovery high last week and the materials sector climbed to a two-year high.

Last week we received a solid jobs report with employers adding 1.27 million jobs in August, and also a drop in the unemployment rate to 8.74%, down from 10.2% in July. GDP for the third quarter is expected to come in around 25% as a result of the fiscal and monetary stimulus and the resulting comeback in jobs. The Federal Reserve has pledged to keep rates low and monetary policy accommodative and Congress is negotiating a relief package which we could see by the end of September.

If we get the additional aid package from Congress and with over $3 trillion parked in money market funds and with low interest rates and a vaccine on the way, we can expect to see consumer and business confidence improve, which translates to a growing economy and a strong stock market. However, the stock market in the short run is expected to continue to be volatile as sentiment remains excessive and valuations for the mega-cap stocks are stretched.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.