Stocks fell for the third week in a row last week with the S&P 500 Index INDEXSP: .INX, Dow Jones Industrial Average INDEXDJX: .DJI and NASDAQ INDEXNASDAQ: .IXIC losing about 1.00%.

The increase in market volatility has been fueled by trade concerns and collapsing bond yields that raised concerns the slowdown in the global economy is accelerating.

Further, the volatility that erupted in August is likely to continue as we move deeper into the third quarter with September looming historically as the least friendly month of the year for stocks.

Although the trade confrontation with China captures the headlines, investors are also challenged by prospects that the global slowdown in manufacturing has spread to our shores. The July ISM Manufacturing Index fell 0.5 percentage points from the June reading, its fourth straight decline, to 51.2, the lowest level since August 2016, as nationwide factory activity continued to lose momentum.

Given the weakness in the manufacturing sector, much rides on the consumer continuing to pick up the slack. Fortunately, there is little evidence that the consumer is retreating.

Retail sales jumped 0.7% in July, the most in four months, and more than double the consensus of 0.3%. But counting on the consumer is not without risk.

The preliminary Reuters/University of Michigan Consumer Sentiment Index fell in August to its lowest level since January and the second-lowest level since October 2016. Should consumers become too cautious, then spending and investing could slow and cause the economy to contract but until such time a healthy labor market and steady wage growth should continue to support the economy and the markets.

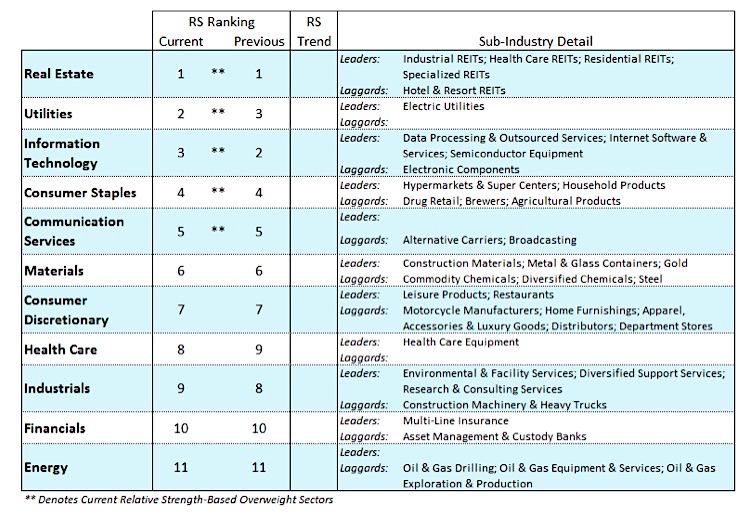

Since early this spring investors have been flocking to (and have been rewarded by) the typical safe havens in the market – the defensive areas of utilities and real estate investment trusts and consumer staples, U.S. Treasury notes, high quality corporate bonds, and gold.

At this juncture, with volatility expected to continue and with investors worried about recession, the investment landscape becomes more challenging. Large capitalized companies with healthy balance sheets and strong cash flows tend to perform better in times of uncertainty and in the later stages of an economic cycle.

While gold has been a strong performer, we think this will continue if risk aversion continues. Morningstar recently upgraded the Gold-rated Baird Aggregate Bond Fund and the Baird Short Term Bond Fund. With the Federal Reserve set to lower the fed funds rate at least one more time this year, there remains opportunity in fixed income investments and actively managed funds.

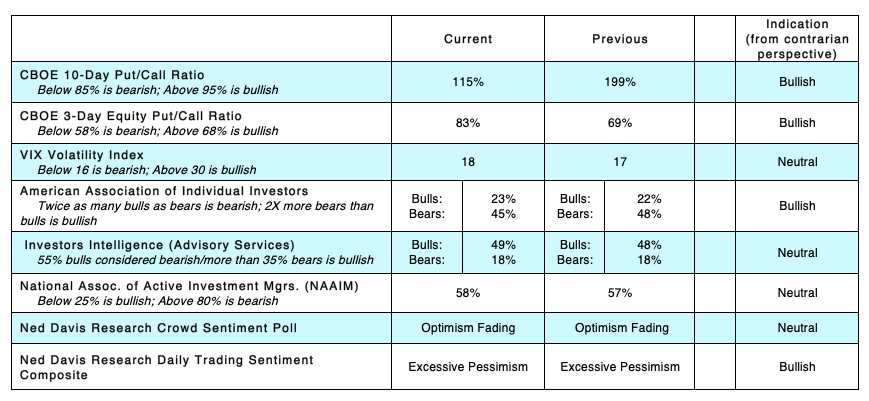

The technical indicators are mixed. Measures of investor sentiment show investors have become more fearful. This is found in the dramatic rise in the demand for put options (puts are purchased in anticipation of stock prices moving lower) and the jump in the CBOE Volatility Index to levels that indicate fear has entered the building.

We also have seen unusual pessimism in the latest survey from the American Association of Individual Investors and from the Ned Davis Daily Sentiment Composite. From a contrary opinion perspective, rising levels of investor fear are considered bullish. The bullish sentiment data, however, is offset by weak market breadth, where only a limited number of indices and stocks are hitting new highs. The negative divergences are concerning given that in a healthy bull market, most areas are in gear with the primary trend. In the current example, new highs by the Dow Industrials and S&P 500 have not been confirmed by new highs in the Russell 2000, Dow Transports, Value Line indices.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.