The U.S. stock market is higher today, with small cap stocks (Russell 2000) leading the way and the S&P 500 Index nearing 3400.

The S&P 500 Index continues to pause at our MFU-3 target area.

With this in mind, we are on alert for either a push to new highs or a near-term pullback.

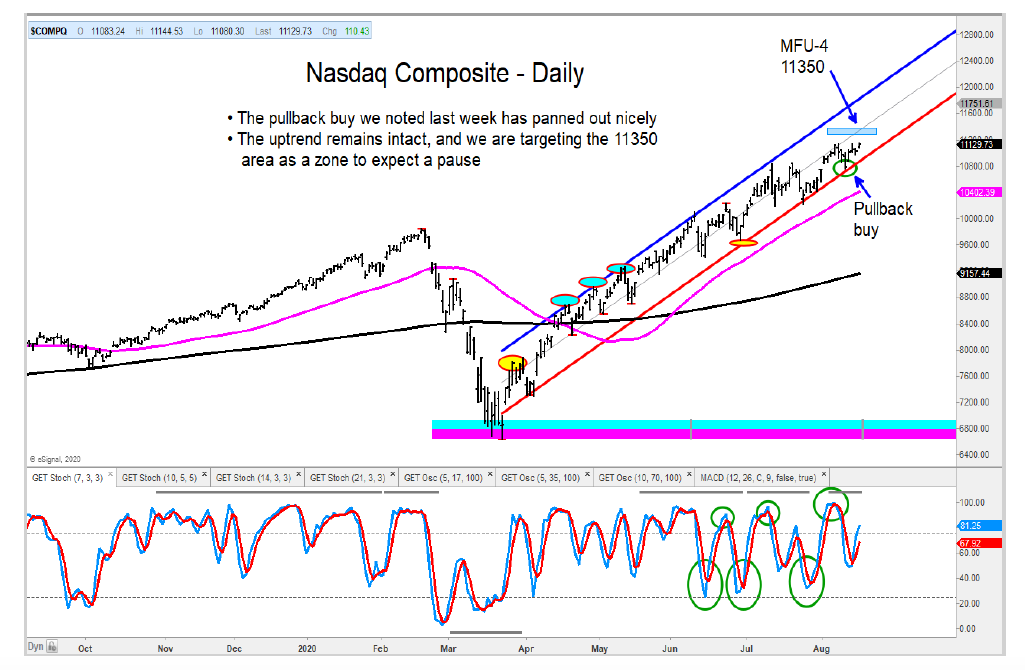

The pullback buy we noted last week for the Nasdaq Composite has worked out nicely. The tech index is nearing our MFU-4 target of 11350.

Both the Russell 2000 (IWM) and Mid-Cap (MDY) have had a shallow pullback and now look poised to move higher.

I would be reducing exposure to the Dow Transports. The index has stalled out at our MFU-3 target zone with momentum divergence. There is risk of a pullback from here.

Avoid Utilities

The MTUM relative to SPLV has hooked up sharply off the ellipse buy trigger we recently highlighted. We would be overweight MTUM.

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.