The two-month rally in the equity markets was interrupted last week as the Dow Industrials and S&P 500 Index (SPX) suffered declines of more than 2.0%.

Small-cap Russell 2000 Index (RUT) suffered more with the Russell 2000 index dropping more than 4.0%.

Concerns that the U.S./China trade negotiations had stalled and worries that developed economies around the world were decelerating triggered the decline.

Questions about the health of the U.S. economy grew louder with the February jobs report that included a big miss on the number of new jobs that were added last month. Anxiety over the employment data is likely overstated considering that the unemployment rate fell to 3.8% from 4.0% and wage gains accelerated at the fastest pace in 10 years last month.

The most recent economic data fits with our 2019 outlook that suggests economic growth is likely to slow this year but recession prospects remain very low. This reinforces the view that the Federal Reserve will continue with patience with regards to any future rate hikes until such time that underlying economic fundamentals show significant improvement.

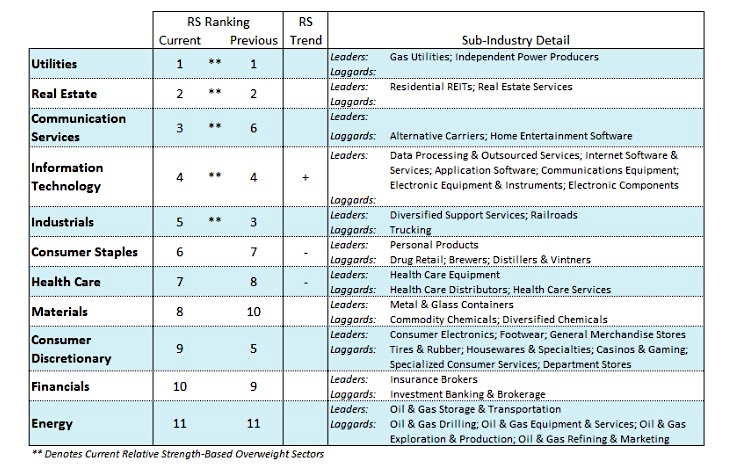

As a result, the current weakness in the equity markets should be viewed within the confines of a consolidation phase that is likely to continue until such time as a firm trade deal with China is drawn and the U.S. economy signals that the first-quarter weakness has run its course and we can anticipate renewed growth. Against this backdrop, investors should focus on sectors that are exhibiting the strongest relative strength. This would include utilities, REITs, industrials and communications services.

The technical indicators improved last week suggesting the current weakness should be viewed as a period of limited weakness following a near-record run in January and February. The drop in the popular averages last week and weakness in broader-based small-cap indices has partially helped relieve the extreme overbought condition entering last week.

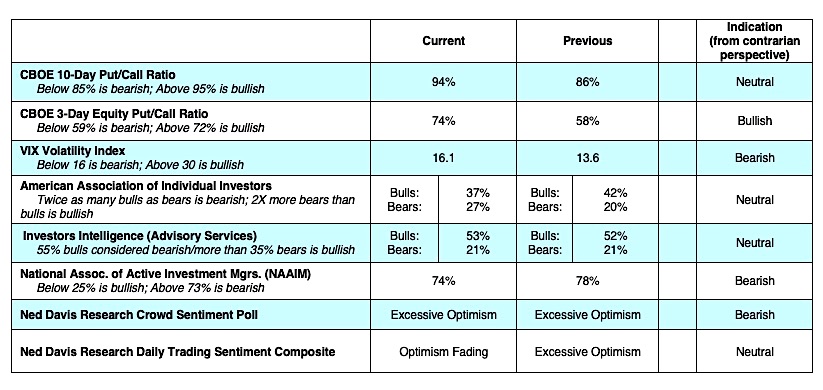

The percentage of S&P 500 issues trading above their 50-day moving average dropped to 75% from 92% the previous week. A move to 50% could suggest the consolidation phase has run its course. Investor optimism that was gaining steam at the start of the month receded last week and moved toward a neutral reading. This is seen in the aggressive return of put buyers last week as reported by the Chicago Board of Options Exchange (CBOE). Evidence that euphoria is being squeezed out is also seen in the Ned Davis Daily Trading Sentiment Poll that dropped out of the extreme optimism mode to neutral.

Although there has been a loss of momentum since the late-February highs, the fact that investor psychology has been so quick to move away from the extreme optimism found just a few weeks ago speaks to the current phase as a consolidation following a big rally as opposed to the start of a significant correction.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.