U.S. Financial Market Highlights:

Inflation may put pressure on the Federal Reserve.

Economic gains are being broadly distributed.

S&P 500 earnings expectations reset may not be complete just yet.

Equity funds are seeing inflows as optimism rises.

Seasonality is struggling to produce reliable forecasts / outcomes.

The list of stocks making new highs remains narrow.

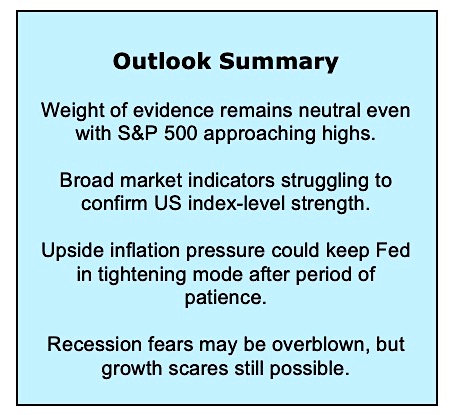

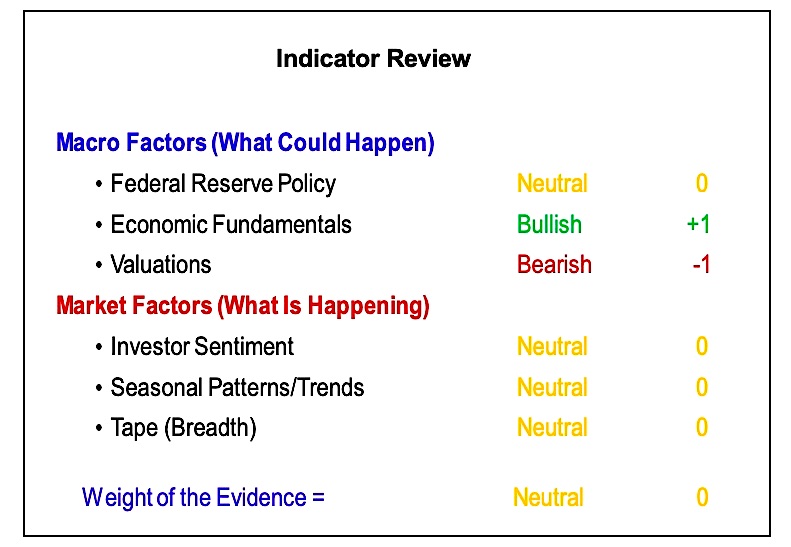

Rally raggedness has not yet been resolved. The move toward the September highs on the S&P 500 has been impressive in its own right, but at this point the weight of the evidence remains neutral.

Near term, a consolidation/pullback could help relieve the recent uptick in optimism and provide a chance for the broad market (both domestically and globally) to take more of a leadership position. Longer term, there is little evidence that the broad trading range of the past year-plus is yielding to a renewed up-trend. Breadth on the S&P 500 has shown some signs of improving, and the percentage of stocks trading above their 200-day average has surged in recent weeks and is back to where it was in September. The new high list, however, has not been able to break out of the range that has persisted for the past year.

Investor bullishness (in word and deed) has accompanied the latest rise in equity prices, and sentiment could be on the cusp of moving from elevated to excessive optimism.

From a macro perspective, recession fears are overblown and the global economy may soon be moving from getting worse to getting better. While the Fed may be on the sidelines right now we still think the next move will be higher not lower, particularly if inflation surprise to the upside.

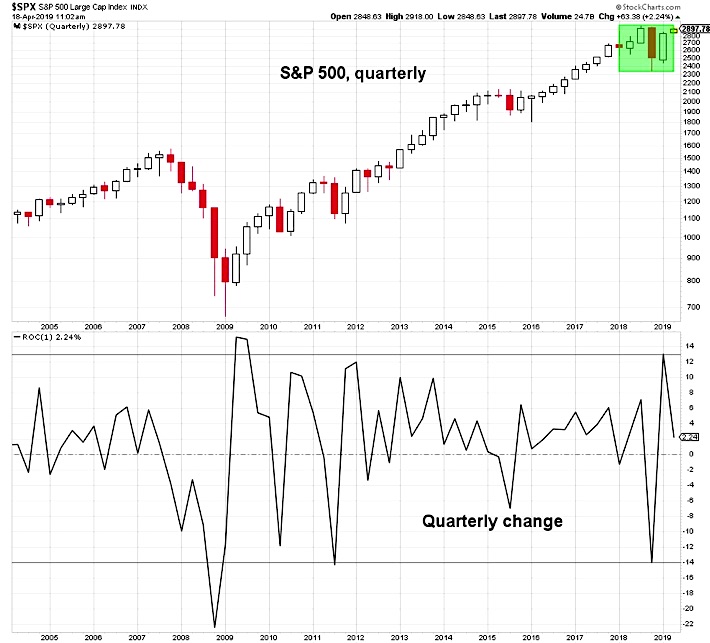

The last six months have been a tale of two quarters (apologies to Mr. Dickens): It (Q1 2019) was the best of times (since 2009), it (Q4 2018) was the worst of times (since 2011). In times such as these it makes sense to lengthen time horizons rather than shorten them .It pays to tune out the noise. From a longer-term perspective, the S&P 500 has traded in a broad range since approaching 2900 for the first time in January 2018. As the weight of the evidence table on the first page shows, the message from the indicators remains mixed. As the S&P 500 approaches its September price high, we would make the following point: new highs tend to be bullish, and a failure to do so, is not. A rally that stops just shy of a previous peak invites selling.

A breakout to new highs, especially if accompanied by improving breadth trends, would be strong evidence that a new cyclical bull market has indeed emerged.

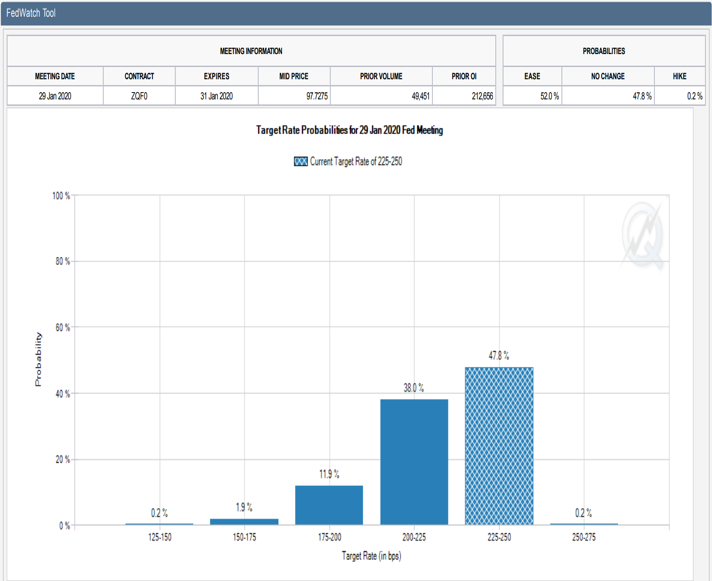

The Fed’s pivot (in terms of both speed and degree) was one of the more significant developments in the first quarter. Patience on the part of the Fed is a welcome development and fed funds futures suggest expectations for a near-term rate cut have ebbed. Still there remains a gulf between the Fed’s expectations of its future policy actions and what is currently expected by the market.

In public comments, current Fed officials have pushed back against the perceived need to lower interest rates, usually stressing that the outlook for the U.S. economy remains relatively firm. In terms of the market aligning with the Fed, it is encouraging to see the CME FedWatch tool move from seeing a 75% chance of at least one rate cut by January 2020 (as of March 26) to reflecting a nearly 50% chance of no change in rates.

While the Fed has been roundly praised for its pivot, it does not come without risk. An uptick in inflation could be closer than the majority on the Fed feel is likely. We have highlighted the median CPI (published by the Cleveland Fed) in the past. That index shows inflation rising at its fastest pace in a decade on both a 3-month and yearly basis.

Wage growth is also showing some signs of accelerating on both an hourly and weekly earnings basis. Market-based measures of inflation expectations are rising, though they do remain historically subdued. While the Fed is stressing it will be patient with respect to rates, this may be little more than quasi-assurance that there will be no move in rates at the next FOMC meeting. As a former Fed official commented recently, those talking about rate cuts now could soon be talking about the Fed being behind the curve.

We agree with the Fed that the economy remains on firm footing. Given this view, we were caught off guard by the degree to which the Fed has pivoted in 2019. The path toward patience did not, in our view, require such an abrupt shift. The rising trend in wage growth not only has potentially inflationary ramifications, it has positive implications for the economy as well. Wage growth is not just being fueled by gains at the top of the income distribution.

continue reading on the next page…