Financial Markets Backdrop:

The major stock market indexes rallied for the fourth straight week with the S&P 500 Index and NASDAQ Composite gaining more than 3.0% last week.

The rally broadened out to include a strong performance by the industrial and banking sectors. Small- and mid-cap averages trailed gaining one and two percent, respectively.

Despite the new high in the S&P 500, most companies in the index remain below their February peaks.

Risks to the Economy and the Stock Market:

The rate of consumer spending slowed in July which is due in part to the expiration of the $600/week pandemic unemployment assistance and also a spike in some areas of the U.S. of the covid-19 virus. However, the pace of infections is falling in Florida, California and Texas and the overall pace of the outbreaks in the U.S. for the past two weeks has fallen.

Additional risks include geopolitical issues with China and Iran, a disruptive presidential election, state and local financial issues, commercial real estate wreckage and possible return of inflation.

The CARES Act unemployment subsidy expired on July 31 and while the President, by executive order, replaced it with $300/week, most areas have not started the program and Congress is still debating the amount of the subsidy. Initial jobless claims continue to track above one million per week as some of the temporary layoffs are turning permanent.

Offsets to the Risks:

The last three months have provided mostly positive economic data and GDP forecasts for the third quarter are projected to be in the vicinity of 25% up from an annualized decline of 32% in the second quarter. Home purchases and refinance applications have exceeded pre-pandemic levels. Low mortgage rates and buyers looking for larger spaces to work from home have spurred the housing rebound.

Retail sales is near its January high. Industrial production has improved for three consecutive months but still below its peak. Applications for small business employer identification numbers are increasing and support the economic recovery. There is an overall decline in the rate of virus outbreaks, hospitalizations and mortalities.

Federal Reserve Chairman Powell announced last week a new policy that will seek inflation that averages 2%, meaning rates will stay lower for longer to support the economy and the jobs market. He reiterated their stance on doing whatever they can to restore opportunities for those who have been displaced.

The Path Forward:

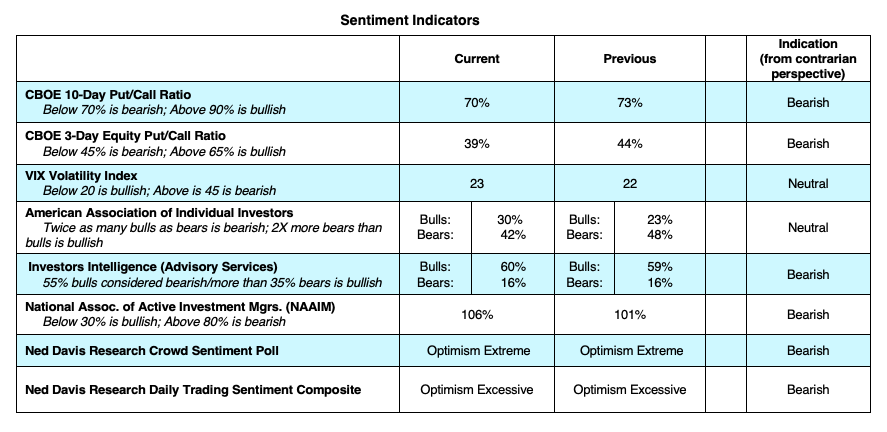

The technical indicators continue to move deeper into the excessive optimism zone. According to Ned Davis Research, both domestic and global equity mutual funds have never been more fully invested that they are today. The median P/E ratio of NYSE stocks is at record highs. Margin debt is at a new 12-month high. Wall Street letter writers are 60% bullish, the highest since January 2018. CBOE options data shows another drop in demand for puts, a new low. Highs in the market are often made during periods of excessive optimism.

The remarkable recovery in the economy and the stock market is due to the Federal Reserve’s liquidity stimulus that brought more money to the financial markets. Additionally, the federal government’s strong financial aid response to individuals and small businesses has played an important factor. The continuing recovery will be dependent upon the passage of a new fiscal aid package and also the slowing of the spread of the virus.

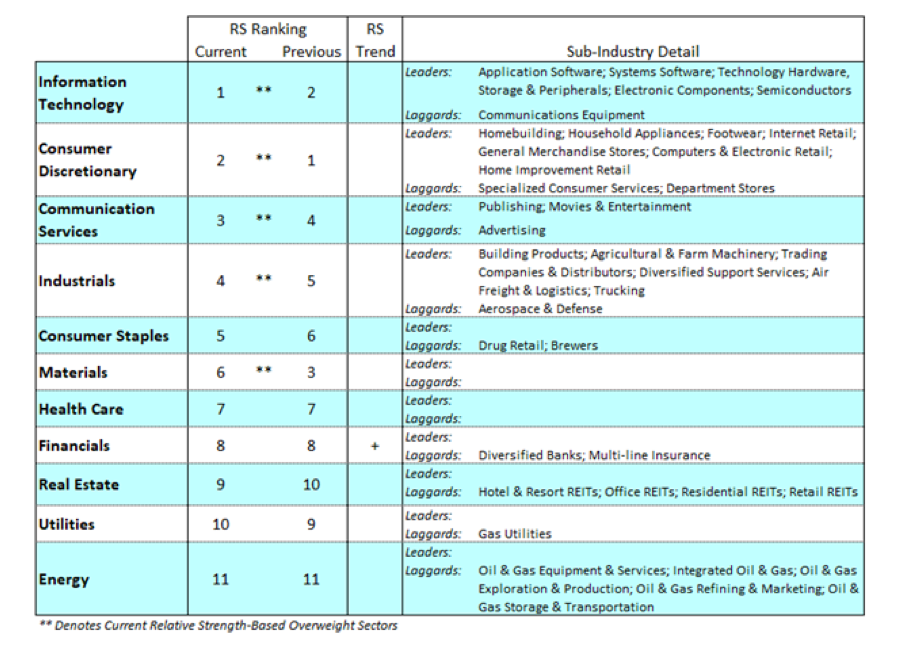

The expectation is that with pent-up demand being relieved to a certain extent and with apparent moderation of fiscal stimulus, the pace of recovery will be slower.We have recently seen a broadening out in the rally in stocks. The percentage of industry groups in uptrends continues to expand. The strongest areas of the market are currently technology, communication services, consumer staples, consumer discretionary, industrials and materials. Against the backdrop of a slower pace of economic recovery, uncertainty regarding the virus and federal stimulus, China, politics and technical indicators, we expect to see increased volatility in the stock market. But with the most accommodative Federal Reserve in history and with the economy steadily improving, we believe market pullbacks will be limited in both time and price.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.