Key Takeaway: Data out of the manufacturing sector has been encouraging; looking more like the industrial recession may have run its course. The relative price rally in the industrials sector since last summer suggests that even if the recovery is uneven, the bad news might already have been priced into stocks.

Has the “industrial recession” ended? Data out of the manufacturing sector has certainly turned more hopeful. Perhaps ironically and not at all coincidentally, the worse times for the sector may have been last summer as talk of weakness was crescendoing (climaxing in a well-publicized quote labeling the environment “an industrial recession”).

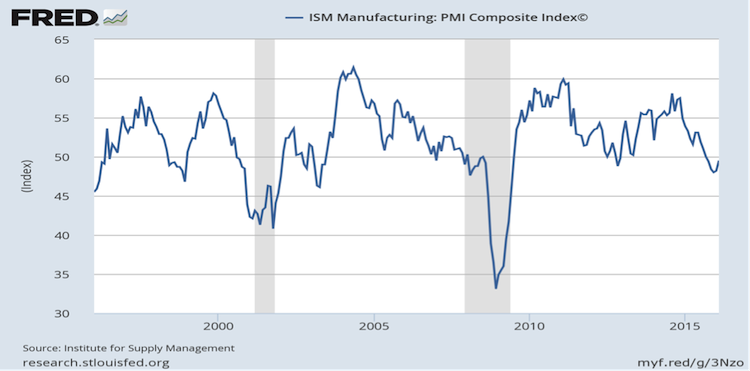

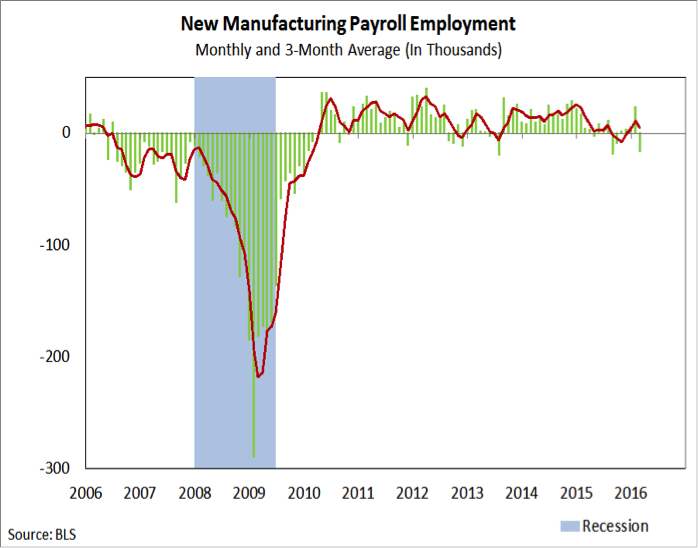

Over the course of the second and third quarters of last year, manufacturing payrolls actually contracted while the overall economy was adding jobs at a pace of 221,000 per month. The ISM Purchasing Managers Index reached a three-year high in November 2014, and proceeded to decline in 11 of the next 13 months. By December 2015 it had dropped to its lowest level since 2009.

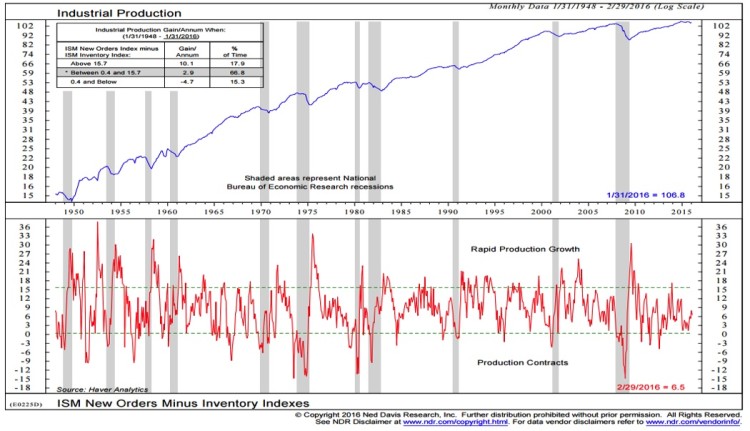

In February, it increased for the second month in a row and moved to its highest level since September. While the PMI is still below 50 (indicating a contraction in manufacturing activity), some of the details paint a more constructive picture. The New Orders and Production components have both been above 50 in the past two months. Both the production component and the spread between the new orders and inventories components suggest better manufacturing production growth going forward. We have seen pockets of improvement out of the regional manufacturing indexes, but perhaps most importantly, the industrials sector has been outperforming the S&P 500 Index since August of last year. This suggests that from the perspective of the stock market, the bad news for manufacturing may be fully priced in. And perhaps the industrial recession has run its course.

Manufacturing sector employment has been relatively weak for most of the recovery. But the little growth that was being seen stalled in 2015, and over the course of the second and third quarters, manufacturing employment actually declined. The trend improved somewhat as we moved into 2016, although following a strong gain in January, the manufacturing sector lost jobs again in February.

The overall ISM Purchasing Manager’s Index (shown on the first page) has ticked up over the last two months, but the components with the report seem to argue for a bit more strength than the headline number would suggest. The production component is back above 50 and the ratio between New Orders and Inventories (seen on the bottom panel of the chart below) appears to have bottomed during the fourth quarter of 2015 and is now rebounding. This is consistent with an expansion in overall industrial production at a solid, if not spectacular pace.

It would be pre-mature to definitively conclude that sustained growth is returning to the industrial economy – the evidence on that front remains circumstantial and the improvements seen in the national data could sour. However, we are also starting to see evidence of improvement among the regional business reports.

continue reading on the next page…