The week is starting off with some modest US Dollar Index (DXC) weakness, but nothing that was unexpected. However, I have adjusted the wave count to account for this.

I am comfortable remaining long in USD/SGD as it is performing better while the US Dollar Index has been selling off. The same goes for USD/JPY and USD/CHF – pairs we will need to keep an eye on for possible longs when DXC completes the correction.

US Dollar Index (DX) Chart

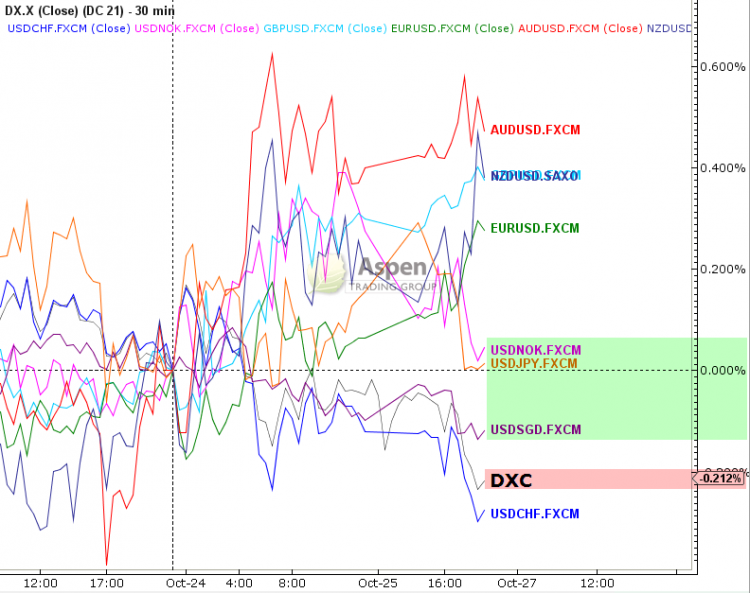

As the FX Strength Meter below shows, DXC is off .21% from the recent high while USD/SGD, USD/CHF and USD/JPY are off less. It is reasonable then to assume that when DXC resumes the uptrend that these pairs should pop nicely higher.

Using this simple compative measure allows traders to position themseleves in the pairs that are most likely to respond when trends resume. Stay patient and remain focused.

FX Strength Meter Chart

Follow Dave on Twitter: @aspentrading10

Author holds a position in USD/SGD at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.