Last Monday Ted Cruz walked away the Republican winner of the Iowa caucuses, which was mildly surprising to some considering Senator Cruz’s well-documented opposition to the Renewable Fuel Standard.

The Renewable Fuel Standard (RFS), which was adopted by Congress in 2005 and expanded in 2007, created mandatory blend levels for renewable fuels including ethanol derived from corn starch (referred to as “conventional biofuels”).

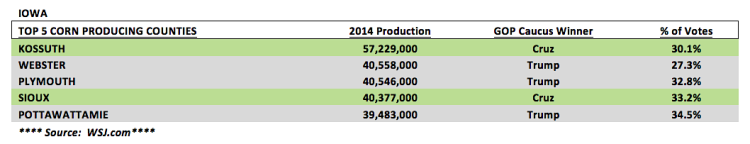

This law has been largely responsible for the massive buildout of new corn-based ethanol facilities across the Midwest and specifically Iowa over the last 8 to 10-years. Given Iowa’s standing as the largest state producer of both corn and ethanol in the country (representing approximately 25% or 3.8 billion gallons of total industry capacity) and Mr. Cruz’s desire to do away with the RFS, (which in theory eliminates a major backstop for guaranteed minimum levels of mandated ethanol consumption) Monday’s results confounded many. In fact even Kossuth County, the largest corn producing county in the state, was won by Cruz who garnered just over 30% of the vote. Donald Trump came in a distant 2nd at 23.7%. Trump did manage to edge out Cruz in both Webster and Plymouth counties, the 2nd and 3rd largest county corn producers; however the end result that evening was a still decisive win for Cruz, a U.S. Senator from Texas, claiming victory right in ethanol’s backyard. Corn prices are already at levels of concern.

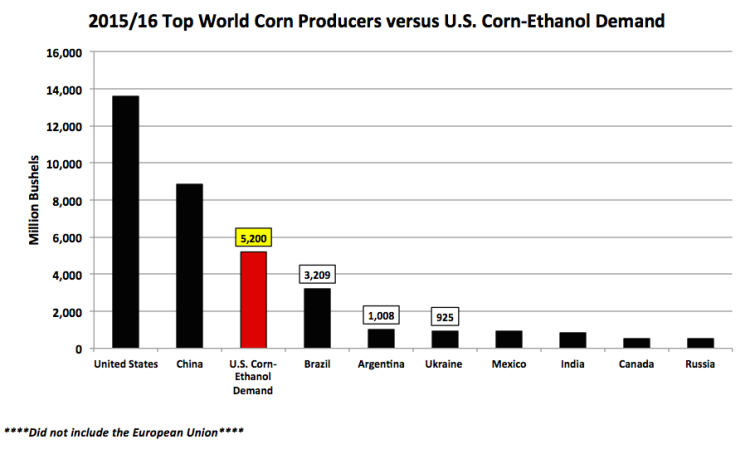

That said with the election spotlight momentarily focusing its attention on ethanol, it did offer a preview of some of the potential political challenges the industry faces over the next 6 years. The Renewable Fuel Standard is set to expire at the end of 2022. As of the January 2016 WASDE report the USDA was forecasting 2015/16 corn-ethanol use of 5,200 million bushels (38% of total U.S. corn demand), which equates to crop-year ethanol production of approximately 14.7 billion gallons (954,000 bpd) versus the conventional biofuels mandate for 2016 of just 14.5 billion gallons. What then are the realities of the existing RFS for both U.S. ethanol and corn producers?

- The U.S. corn-based ethanol industry is already capable of producing at a rate in excess of 15.0 billion gallons, which is the high-water mark for conventional biofuels under the current Renewable Fuel Standard through 2022. On the week ending 11/20/2015 the EIA reported record weekly ethanol production of 1.008 MMbpd, an annualized production rate of 15.5 billion gallons. Therefore this essentially means the Renewable Fuel Standard no longer necessitates any mandated growth in corn-based ethanol capacity beyond the existing footprint in the United States.

- Why is this a concern for U.S. ethanol and corn producers? As I mentioned above, corn-ethanol use now accounts for nearly 40% of total U.S. corn demand. 10 years ago that percentage was less than 20%. Therefore ethanol plants provide an extremely large, diverse, and consistent market for farmers. A number of these same corn producers are also investors in the ethanol plants they deliver corn to. However, under the existing RFS there is currently no secure incentive for this industry to expand (which would require a conventional biofuels mandate above 15.5 billion gallons). Furthermore if the Renewable Fuel Standard was eliminated there would also be no assurance of a floor in mandated ethanol consumption. Clearly on the surface this would then seem to raise a considerable amount of new uncertainty regarding the future demand for both the corn and ethanol produced in hundreds of rural communities across the Midwest.

Why have some ethanol proponents still chosen to support Cruz? Across Iowa Cruz’s opposition to government mandates and subsidies (such as the Renewable Fuel Standard) was well publicized prior to the caucuses on February 1st. However, it was also widely known that he disagreed equally with the current market restrictions for achieving higher level ethanol blends due to the E10 Blend Wall. This is where he started to win over a number of ethanol producers and Iowa corn growers simultaneously. I’ve read the post-caucus reaction from a number of the major news outlets suggesting that the Cruz victory in Iowa was a knockout blow to the ethanol industry. I couldn’t disagree more with that assessment. The reality is for the ethanol industry; and conventional biofuels in particular, the approval of higher level ethanol blends such as E15 and E20 remains an absolute necessity to accommodate future growth and sustainability. Coincidentally higher level ethanol blends would also create the need for increased corn production to be used as the primary feedstock to produce those gallons. Therefore did Iowans really issue a referendum against ethanol last Monday night by virtue of a vote for Ted Cruz? I don’t believe so.

Overall, my purpose for analyzing the Iowa caucuses was not to endorse any particular candidate, nor do I presume to know exactly what any of the candidates on either side of the isle would actually do regarding the Renewable Fuel Standard or conventional biofuels if elected President. Clearly everyone involved is currently posturing for as many votes as possible. However I do believe strongly the most critical takeaway from Monday’s vote was that it illuminated the impact the next President could have on the ethanol industry over the next 3 to 5-years, which in turn will also have a tremendous ripple effect on corn and soybean prices in the U.S. and the entire World (both futures and basis values). As a point of context as to the significance of corn-based ethanol demand, the top 3 world corn producers outside of the United States and China are Brazil, Argentina, and Ukraine. Collectively those 3 countries are forecasted to PRODUCE 5,141 million bushels of corn in 2015/16. That combined total is LESS THAN the 5,200 million bushels the United States uses to produce conventional biofuels in one crop year. Furthermore even with this massive demand base for corn in the U.S., World corn stocks for 2015/16 are still at a record high of 208.94 MMT and U.S. corn prices are the lowest they have been since 2009 and 2007. Therefore while the merits of clean energy and conventional biofuels are certainly up for debate in this election cycle; what’s not in my opinion is its significance and singular influence on the future direction of corn and soybean prices.

CURRENT MARCH CORN PRICE CONSIDERATIONS: March corn futures traded down 6 ¼-cents per bushel week-on-week, finishing on Friday at $3.65 ¾. It was not a good week for Corn Bulls with March corn closing back under the 50-day moving average of $3.673, despite 5 prior consecutive closes above that key support level. The other major disappointment was corn’s inability to rally despite a major downward correction in the Dollar Index, which ended the week below the 100-day moving average while also trading at close to a 3-month low. Other resistance factors for corn prices included:

- There were reports early in the week referencing a dramatic rise in domestic corn prices in Brazil due to a combination of market forces including the continued devaluation of the Brazilian real, as well as, strong corn exports. Both offer several potential negative consequences to the U.S. market. The most obvious is continued competition to U.S. corn export sales, which are already running 25% behind a year ago as of the week ending 1/28/2016. The second is the influence higher Brazilian corn prices could have on the amount of safrinha corn acreage planted in February. The incentive of record to near record corn prices could lead to not only more corn acres but also an increased willingness by producers to spend on input costs, looking to optimize production potential. Brazil is currently the world’s second largest corn exporter, trailing only the United States.

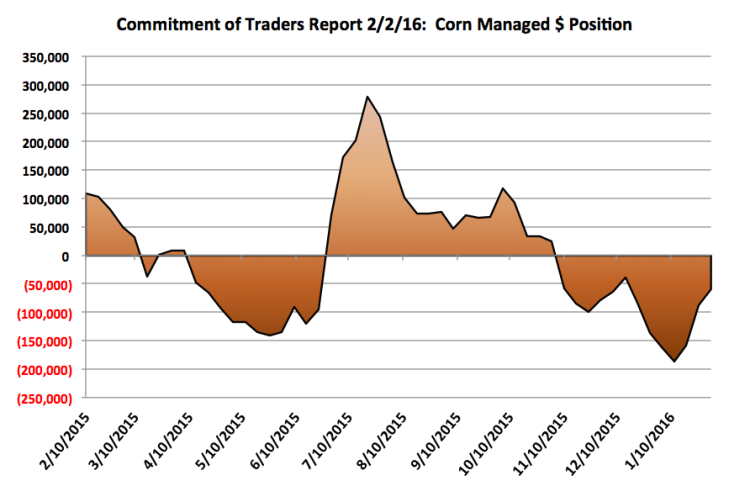

- Friday’s Commitment of Traders report showed the Managed Money net short position in corn continuing to shrink, decreasing to -59,479 contracts total (as of the close on February 2nd). Money managers were buyers week-on-week of nearly 28k corn contracts. In fact since January 12th they have now purchased an incredible 127,352 contracts. What has March corn done over that time period? From the CH6 close on 1/12 of $3.56 ¾ through the close on 2/2 of $3.72 ½ March corn futures have rallied 15 ¾-cents per bushel. That’s not good…no Series 3 license required to make that determination. This is once again a clear indication of the tremendous amount of topside commercial sell paper still weighing on the market (via farmers looking to price old-crop corn on even 5 and 10-cent rallies).

Overall, I still believe it’s far too soon to do any panic selling regardless of the overwhelmingly negative fundamental landscape. Last year Corn Bulls had to wait until mid-July for new-crop (December) corn futures to trade over $4.50 per bushel under an equally Bearish S&D scenario. Patience is a virtue… albeit not an easy one, especially when it comes to trading.

Thanks for reading.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service