Corn news and market analysis for the week of October 21, 2019.

Here’s a look at recent corn data and news highlights, along with my analysis and outlook for Corn futures prices.

Last Tuesday, the USDA released its weekly Crop Progress report which showed 73% of the U.S. corn crop “mature” and therefore no longer in danger of being adversely impacted by freezing temperatures (as of October 13).

That said several key corn producing states in the Western Corn Belt including North Dakota, South Dakota, and Minnesota reported “mature” percentages still well behind a year ago. North Dakota’s corn crop was just 42% mature versus 96% in 2018, South Dakota 52% versus 92%, and Minnesota 66% versus 97%.

Following last weekend’s snowstorm and below freezing temperatures, which primarily centered on North Dakota however also affected sections of South Dakota, Minnesota, Iowa, and Wisconsin, trade analysts have estimated that approximately 100 to 200 million bushels of 2019 corn production were potentially forfeited.

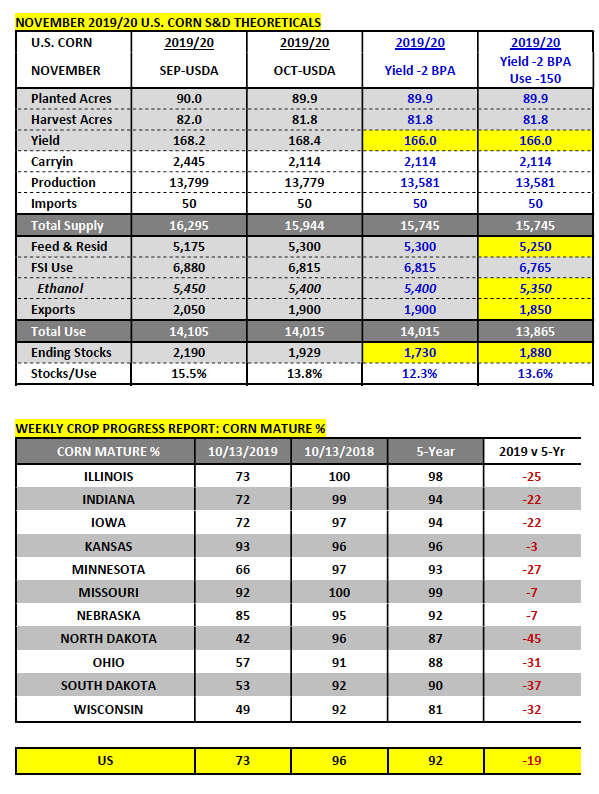

This in turn would suggest that as the market shifts its attention to the November 2019 WASDE report (released on 11/8/2019) a 2019/20 U.S. corn yield reduction of 1.2 to 2.4 bpa versus October is likely in play (range of 166.0 to 167.2 bpa versus the October forecast of 168.4 bpa).

How “Bullish” are the crop losses in the Western Corn Belt?

I would argue they’ll continue to act more as an underlying price support at or below $3.85 in December corn futures versus being the potential catalyst in rallying prices back over $4.05 per bushel.

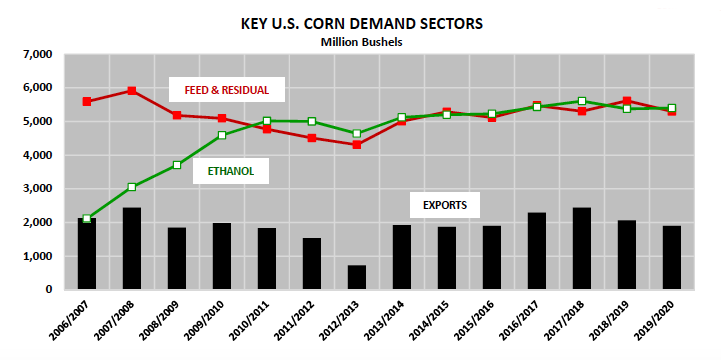

The reality is with 2019/20 U.S. corn ending stocks currently estimated at 1.929 billion bushels there is some cushion to accommodate minor production losses. Furthermore U.S. corn demand continues to disappoint in both the ethanol and export sectors. Thursday’s weekly EIA report showed U.S. ethanol production averaging 971,000 barrels per day for the week ending October 11, 2019.

This marked the fourth consecutive week U.S. ethanol production has failed to exceed 1.0 million barrels per day. The last time that occurred was over a 4-week period in April 2017. It’s becoming more and more apparent that the U.S. ethanol industry isn’t simply going to ramp back up to full production capacity even with margins improving substantially in the front-end over the last two weeks. The EIA’s most recent 4-week average run-rate of 959,000 barrels per day was down 67,000 bpd from the previous year, which is the daily production equivalent (2.814 million gallons) of ten 100-million gallon ethanol facilities not producing any ethanol.

Ethanol values have rallied; however with an approximate 10-cent per gallon inversion between prompt and next month prices, there remains little margin incentive to restart shuttered ethanol facilities based on the forward margin curve still hoovering undecidedly at cash positive EBITDA. Strong corn basis levels and the inability to source new-crop corn supplies due to continued weather-related harvest delays has also been a significant prohibitive factor.

As far as U.S. corn exports are concerned, Friday’s export sales summary showed weekly U.S. corn export sales of just 14.5 million bushels. Crop year-to-date sales increased to 408.0 million bushels versus 830.2 million a year ago, a deficit of 422.2 million bushels (or -51%). This is a HUGE problem for supply-side Corn Bulls. Historically U.S. corn export sales are front-end loaded in the marketing year, which as it relates to the current crop year runs from September 1, 2019 through August 31, 2020.

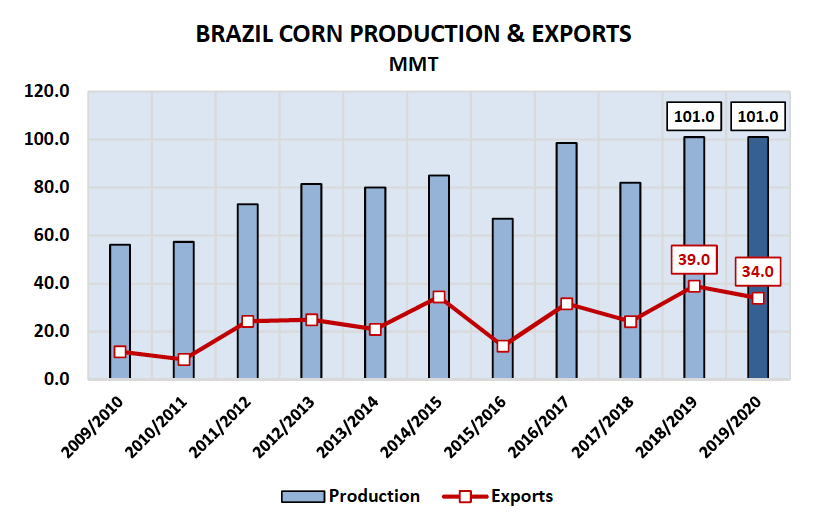

Corn export competition from South America accelerates February forward with Brazil harvesting its full-season corn in Feb/Mar with its “safrinha” corn harvest to follow during Jun/Jul/Aug. Brazil corn exports will invariably start to displace U.S. corn exports during Q1 – Q2 2020 making it very difficult for the U.S. to “catch up” late in the marketing year. As of the October 2019 WASDE report the USDA was projecting 2019/20 cumulative Brazil/Argentina corn exports of 67.5 MMT versus 75 MMT in 2018/19, a difference of -7.5 MMT or -295 million bushels. Therefore it’s possible the U.S. export situation performs better than it did a year ago Q2 2020 forward; however I’m not overly optimistic.

Two narratives in corn continue play out, leading to an elevated; however narrow trading range ($3.80 by $4.02) with Specs and End-users alike unwilling to add longs or shorts at the extremes of the range.

Why no one is ready to buy CZ19 above $4.02?

As I referenced above, both U.S. corn ethanol and export demand remains extremely sluggish, leaving the impression that even if the USDA lowers the U.S. corn yield as much as 2.4 BPA in the November Crop report, the USDA might be able to find a near equal demand offset. This means U.S. corn ending stocks likely won’t drift much below 1.85 billion bushels.

From a seasonal price perspective, this isn’t the time for extended rallies in December corn futures. With harvest progress likely to accelerate, Commercial hedge/sell paper will neutralize the real impact of Spec/Managed Money corn buying. (Key Resistance = $4.01 ½; 200-Day Moving Average).

Why no one is ready to sell CZ19 below $3.80?

Believe it or not, traders are still wary of some unexpected downward U.S. corn production adjustment in the November WASDE report. The USDA helped stoke those fears by announcing on Thursday they will resurvey harvested acreage in North Dakota and Minnesota due to last weekend’s massive snowstorm. Those changes will be reflected in the November report.

Additionally, U.S. corn basis levels remain firm across the Corn Belt, offering a strong indication that U.S. corn supplies likely aren’t as robust at they appear on paper. This also implies that the U.S. corn harvest will be drawn-out. Therefore the market likely won’t feel/experience a “gut slot harvest” type sell-off. (Key Support = $3.77; 50-Day Moving Average).

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.