For the week ending October 23, 2015 December corn futures closed up 3-cents per bushel at $3.79 ¾ versus the finish on 10/16. This compares to last year’s December futures close on 10/23/14 of $3.59 ¾. November soybeans futures closed down 2 ¾-cents per bushel week-on-week at $8.95 ½ versus last year’s 10/23/14 SX close of $9.93 ¼.

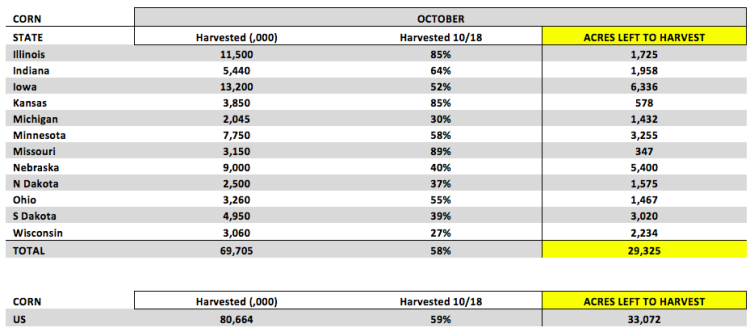

US HARVEST UPDATE: The US corn harvest improved to 59% complete as of October 18th versus just 30% a year ago and the 5-year average of 54%. This would suggest that nationally approximately 33.1 million acres are still in the process of being harvested (see table below).

Illinois, Kansas, and Missouri are quickly approaching the finish line with IL and KS both 85% harvested and MO at 89%. Minnesota and Iowa both experienced big week-on-week gains with MN now 58% harvested and IA at 52%. From a crop condition standpoint, the US corn good-to-excellent rating held steady at 68% versus 74% a year ago.

For the month of October Illinois’s good-to-excellent rating remains unchanged at 56%. Indiana and Ohio have both experienced 1% improvements, increasing to 49% and 51% respectively. In my opinion this continues to suggest that a tangible, downward trending US corn yield surprise in the November WASDE report is highly unlikely. The October US corn yield estimate was 168 bushels per acre versus 171 bpa in 2014/15 and 158.1 bpa in 2013/14.

In soybeans, the US soybean harvest increased to 77% versus 51% in 2014 and the 5-year average of 68%. Illinois, Indiana, Iowa, Minnesota, North and South Dakota, and Ohio are all over 80% harvested in soybeans. The vast majority of harvest yield results in soybeans remain better than or “as good as” expected. I’ve seen nothing to suggest that the US soybean yield estimate in the October Crop report of 47.2 bushels per acre will be lowered in November. A consecutive downward adjustment to harvested acreage is certainly possible; however after the 1.1 million acre reduction in October, a substantial decrease is unlikely. Total US soybean production potential remains exceptional.

Weekly US Corn Export Sales: US weekly export sales in corn totaled just 9.8 million bushels for the week ending 10/15/2015, which was 57% below the prior 4-week average. Japan was the primary buyer accounting for 4.1 million bushels. Year-to-date US corn sales for the 2015/16 marketing year are now 251 million bushels behind a year ago (-35%). Despite the slow start, the USDA (as of the October Crop report) was still forecasting 2015/16 US corn exports of 1,850 million bushels versus 1,864 million a year ago and the 5-year average of 1,577 million bushels (low-to-high range of 731 million bushels in 2012/13 to 1,921 million bushels in 2013/14). It seems possible the USDA will lower its current export forecast in the November 10, 2015 WASDE report.

#NoFilter: PRICE FORECAST

December Corn Futures: The corn market did manage a higher weekly close; however I’m hard pressed to find anything remotely bullish that would lead to a sustainable rally back over $4.00 to $4.10 CZ5 over the next 2 to 3 weeks (and possibly longer).

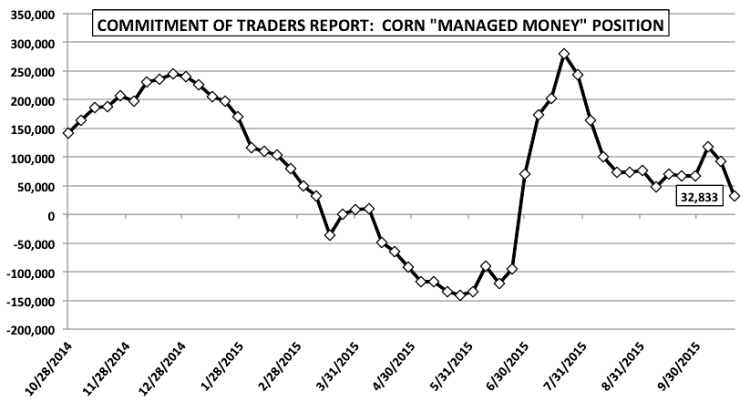

Friday’s Commitment of Traders report showed the managed money net long in corn dipping to just 32,833 contracts as of Tuesday’s close on 10/20. That’s down nearly 60,000 contracts from the previous week and also represents the smallest long position money managers have carried since June. I’m not suggesting they’ll actually start accruing a net short position in corn futures at current price levels; but rather a position that reflects an attitude of indifference.

From a supply and demand perspective given the weak performance of the US corn export market and no indication of a market moving yield decrease pending in the November Crop report, I don’t see US corn ending stocks moving under 1,500 million bushels at this time. Furthermore there have also been reports suggesting that Brazil will increase its safrinha corn acreage (winter crop) in 2016. Brazil is the world’s 2nd largest corn exporter (trailing only the US) with 2015/16 exports estimated at 25 MMT or 984 million bushels. That said have December corn futures bottomed? As a point of reference, in 2013 corn futures continued trending lower into mid-to-last half November due to a sufficient US corn carryout and a US corn yield pushing over 160 bpa. The current market setup is very similar. Therefore a retest of the current CZ5 contract low at $3.57 ½ per bushel from August 12 remains a possibility. Strong overhead resistance in corn futures begins at the 100-day moving average of $3.893. Right now I’d put the CZ5 price range at $3.60 to $4.00.

December Corn Futures Chart

continue reading on the next page…