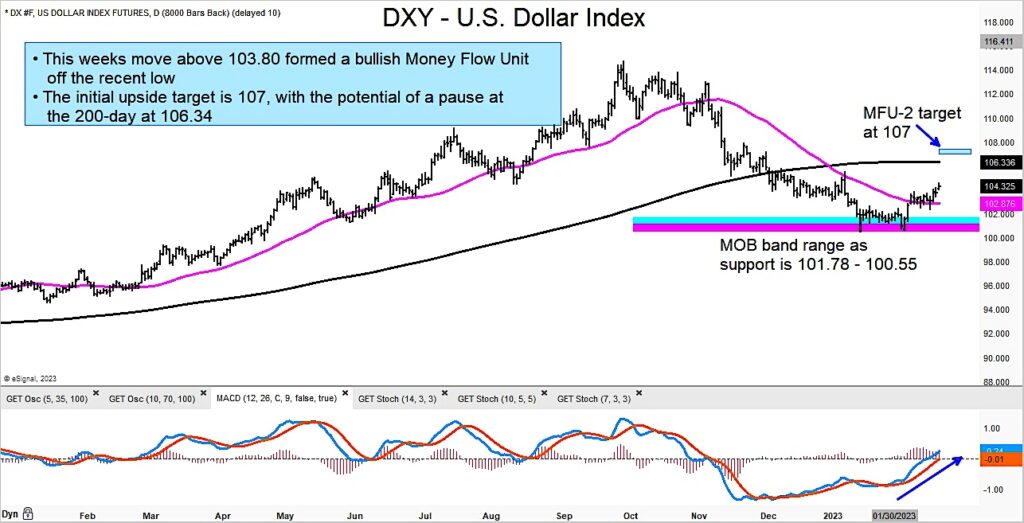

Since the start of the new year we have shared a couple updates on the US Dollar and 10-Year US Treasury Bond Yield… both bullish price reversals from a trading standpoint.

For the US Dollar Index, it could simply be a counter-trend trade. We’ll need more time to see…

That said, the US Dollar Index created an MFU-2 target at 107 with its move over 103.80 this week. Note that the 200-day moving average is just below that mark so that area will be resistance.

Looking at the 10-Year Treasury Bond Yield, it appears that this move could be the start of another big wave higher. We highlighted this reversal last week and today is simply an update. A recent breakout of the downtrend line has bond yields (interest rates) eyeing a new upside target of 5.5%. Yikes!

US Dollar Index and 10-Year Treasury Bond Yield Charts

Twitter: @GuyCerundolo

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.