Micron NASDAQ: MU Weekly Chart Grid

On Wednesday, UBS analyst Timothy Arcuri upgraded Micron’s stock (MU) from neutral to buy.

He also raised his price target from $47 to $75.

The analyst cited a DRAM upswing, which should last deep into 2021. Micron derives approximately 60% of its revenue from DRAM.

UBS believes that Micron deserves to trade at a higher multiple given the company’s competitive positioning and through-cycle financial performance. Let’s see what the charts tell us.

At askSlim.com we use technical analysis to evaluate price charts of stocks, futures, and ETF’s. We use a combination of cycle, trend and momentum chart studies, on multiple timeframes, to present a “sum of the evidence” directional outlook in time and price.

askSlim Technical Briefing

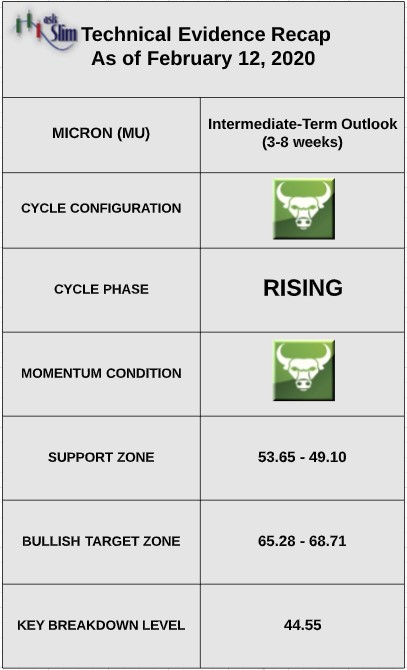

The weekly cycle analysis suggests that Micron is in a very positive intermediate-term pattern. Weekly momentum is positive.

On the upside, there is an intermediate-term Fibonacci projection/target zone from 65.28 – 68.71. On the downside, there is a rising intermediate-term Fibonacci support at 56.46 followed by another zone of support from 53.65 – 49.10. For the bears to regain control of the intermediate-term, we would likely need to see a weekly close below cycle low support at 44.55.

askSlim Sum of the Evidence

Micron is in a very bullish weekly cycle pattern with positive weekly momentum. Given these conditions, we would expect sell-offs to be contained to the rising intermediate-term Fibonacci supports beginning at 56.46 until the next intermediate-term low forms.

The next projected intermediate-term low is due between the end of April and the end of May. Once the next intermediate-term low forms, there is a likelihood the stock tests 65 by July.

Interested in askSlim?

Get professional grade technical analysis, trader education and trade planning tools at askSlim.com. Write to matt@askslim.com and mention See It Market in your email for special askSlim membership trial offers!

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.