Today, I’m going to take an extended look at treasuries, as I think we are getting closer to another major turn to the downside.

I’ll primarily focus on the 20+ Year Treasury Bond ETF (NASDAQ:TLT), but will also reference the 10-Year Treasury Bond Yield (INDEXCBOE:TNX). See charts below for reference.

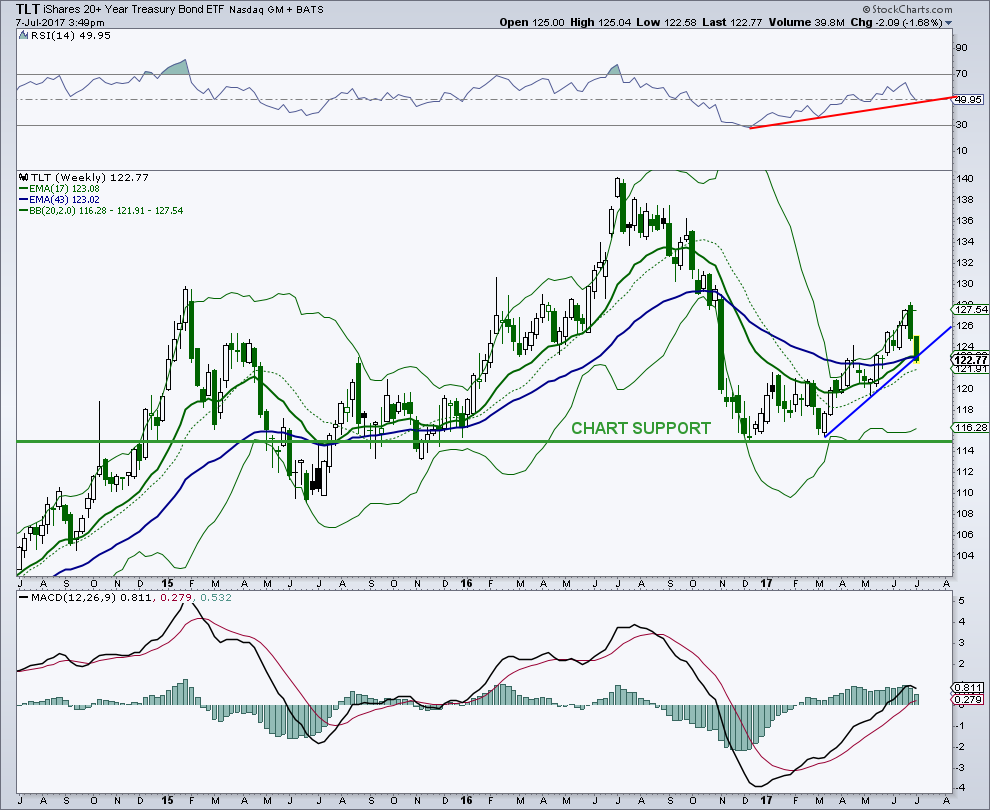

The TLT has filled a big open gap from November and has retraced 50% of the decline from July to December 2016. This has occurred in a 3-wave or ABC rally, which is counter trend in nature.

On the weekly chart, TLT has already fallen to trendline support off the lows since March near 123, as well as both the 17-week and 43-week exponential moving averages, which are both potential supports.

On the daily chart, the Treasury Bonds ETF (TLT) has declined to near its 50-day average as well as an area of chart support also near 123. If the second half 2016 decline in TLT was the first wave lower in a bear market, then the recent rally was a wave 2 higher (counter trend) and the next wave 3 should take TLT way under the recent lows near 115. Looking at a long-term chart of the 10-year yield (TNX), this next wave lower in price could finally send yields above 3%+ and break out of the down sloping channel that has been in place since 1981 and end the 30+ year bull market in bonds.

Besides the current chart read as well as Elliott Wave analysis, are there other reasons to be concerned about treasury bonds? Yes, the COT data and market sentiment. Commercial hedgers (smart money) are about as bearish on the 10-year and 30-year as they have been in the past 10 years.

Market sentiment is extremely bullish on the 10-year and 30-year, and all this adds up to trouble looking out into 2017 and into 2018.

I’m hoping for one last rally in the TLT, before issuing a short so stay tuned.

ALSO READ: Financial Sector (XLF) Testing Breakout Resistance

Feel free to reach out to me at arbetermark@gmail.com for inquiries about my newsletter “On The Mark”. Thanks for reading.

Twitter: @MarkArbeter

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.