Last week the U.S. registered an all-time high in new coronavirus cases as recent spikes have caused at least 11 states and some businesses to pause in their reopening.

This set off a broad selloff in the equity markets with the S&P 500 Index and Dow Jones Industrial Average losing about 3% while small-cap indices fell more than 4%.

Let’s review the latest investing themes and trends to watch.

Trends which are likely to drive markets as the U.S. economy transitions from a gradual reopening to a recovery:

1) An increase in infection rates of Covid-19 could slow the economic rebound.

However, deaths are declining or leveling off even though new cases are increasing. As long as the virus cases stay localized and new treatments continue to be developed, we will probably not experience a nationwide lockdown.

2) Aggressive fiscal and monetary stimulus to continue.

The commitment by the Federal Reserve to keep interest rates low and to do everything within their power to stabilize the economy promises to be an ongoing fundamental support for the markets.

A Phase Four Stimulus Package is on the table in Washington which places an emphasis on bringing American manufacturing jobs back home from overseas, incentives for domestic travel, support to consumers and businesses most vulnerable to this decline, and a payroll tax cut.

3) Recent data suggests an economic recovery is beginning to emerge.

Retail sales, housing demand, new business applications have all recently reported strong numbers. Claims for unemployment insurance have remained high but the pace of new claims has been steadily slowing. Hiring rose by a massive 2.5 million jobs added in May as opposed to an expected loss of 7.5 million.

On Friday the Bureau of Economic Analysis reported that consumer spending jumped 8.8% last month despite a continued lockdown in some areas and an enormous consumer savings rate. But Americans’ income fell 4.2% as government payouts declined.

Consumer spending makes up 70% of GDP and will be the key to the recovery. The Congressional Budget Office is predicting a surge in GDP of 23% in the third quarter and 20% in the fourth quarter. The economy will likely experience a strong rebound but it may take years to work through the disruptions caused by the covid-19 virus.

4) The second quarter of this year is expected to see a decline of 44% in corporate earnings for S&P 500 companies from a year ago. Debt defaults and bankruptcies will likely rise and many restaurants will go out of business because they will not be able to stay afloat at partial capacity. The collapse in earnings according to consensus estimates is expected to improve gradually through the end of this year and begin to recover next year.

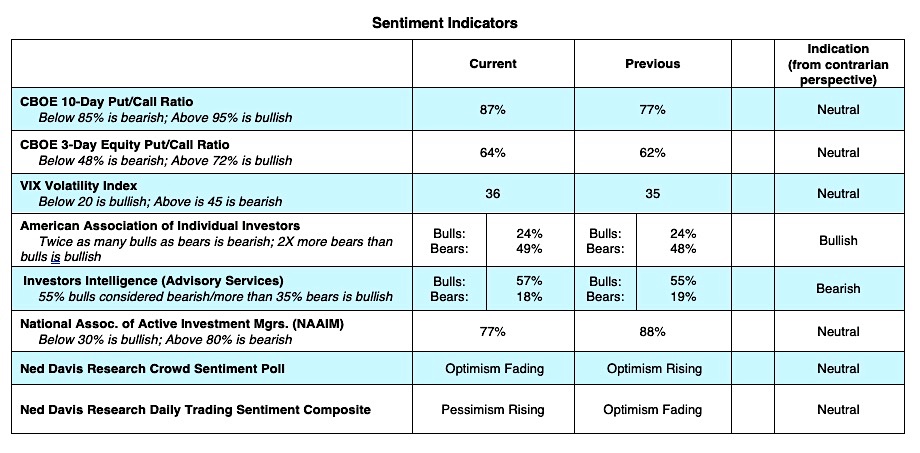

5) At the bottom of the market in March investors were excessively pessimistic. Sentiment has since steadily turned more optimistic verging on excessive optimism in early June. The recent pullback, however, has caused sentiment to begin to reverse moving toward pessimism the past two weeks. Should investor sentiment continue to deteriorate toward excessive pessimism, that would signal, from a contrarian stance, a potential buying opportunity.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.